MasterCard launches in-app purchasing model, buys digital wallet C-SAM

While many eyes will be draw to shiny new devices being unveiled at Mobile World Congress, MasterCard is more concerned with how money is spent on the devices themselves.

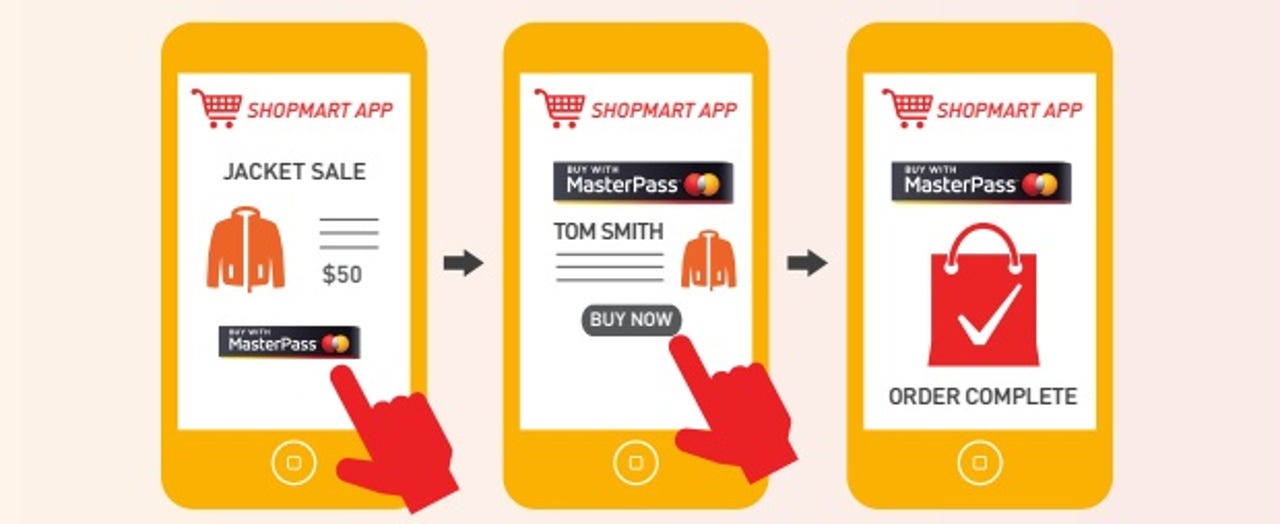

The global credit card brand has a few announcements to kick off the annual trade show in Barcelona this week, starting with a new in-app purchasing capability for the MasterPass platform, which up until now has been browser-based only.

Mobile world congress 2016

The latest iteration of MasterPass is designed to eliminate the need to store payment card credentials across numerous mobile apps, saving a lot of time and anguish on the part of consumers when having to retype long strings of numbers on a tiny touchscreen.

After an initial configuration, using MasterPass should be emulate a one-click (or one-touch) payments process across the entire device without having to leave an app at all.

As with anything related to digital payments, or even just credit cards, there are going to be security concerns -- especially about how this information might be filtered and shared between apps and their makers.

MasterCard assures that the checkout process is "supported by the highest levels of security and cryptology" as well as optimized for each individual user.

MasterCard has already signed on a number of app providers already supporting MasterPass, including MLB Advanced Media, Forbes Digital Commerce, and Starbucks Australia.

MasterPass in-app payments are scheduled to become available during the second quarter.

The American financial services corporation also appears to be still plugging away at the digital wallet path, one that has never been mapped quite right by anyone yet.

MasterCard is planning to acquire digital wallet provider C-SAM, which already powers commercial mobile payments pipelines worldwide, including ISIS in the United States. Although it is no longer part of the project as it once was, MasterCard was one of the original leading companies leading the ISIS project when it launched in 2011.

Regardless, MasterCard and C-SAM had also already forged a strategic partnership in 2012.

Without providing specifics, MasterCard chief emerging payments officer Ed McLaughlin explained in the announcement that C-SAM's resources will be integrated with MasterCard's mobile and virtual solutions, especially with the intention of boosting deals with merchants, government agencies, and telecommunications giants.

Expected to close by the end of the first quarter, financial terms of the deal have not been disclosed.

Image via MasterCard