SaaS: Pros, cons and leading vendors

Software as a Service (SaaS), the best-known branch of cloud computing, is a delivery model in which applications are hosted and managed in a service provider's datacenter, paid for on a subscription basis and accessed via a browser over an internet connection. As a mainstream business option it's often seen as dating from the launch, in 2000, of the hosted Salesforce.com customer relationship management (CRM) service, which has become the 'poster-child' for SaaS. However, its roots lie in earlier developments in virtualisation, service-oriented architecture (SOA) and utility/grid computing.

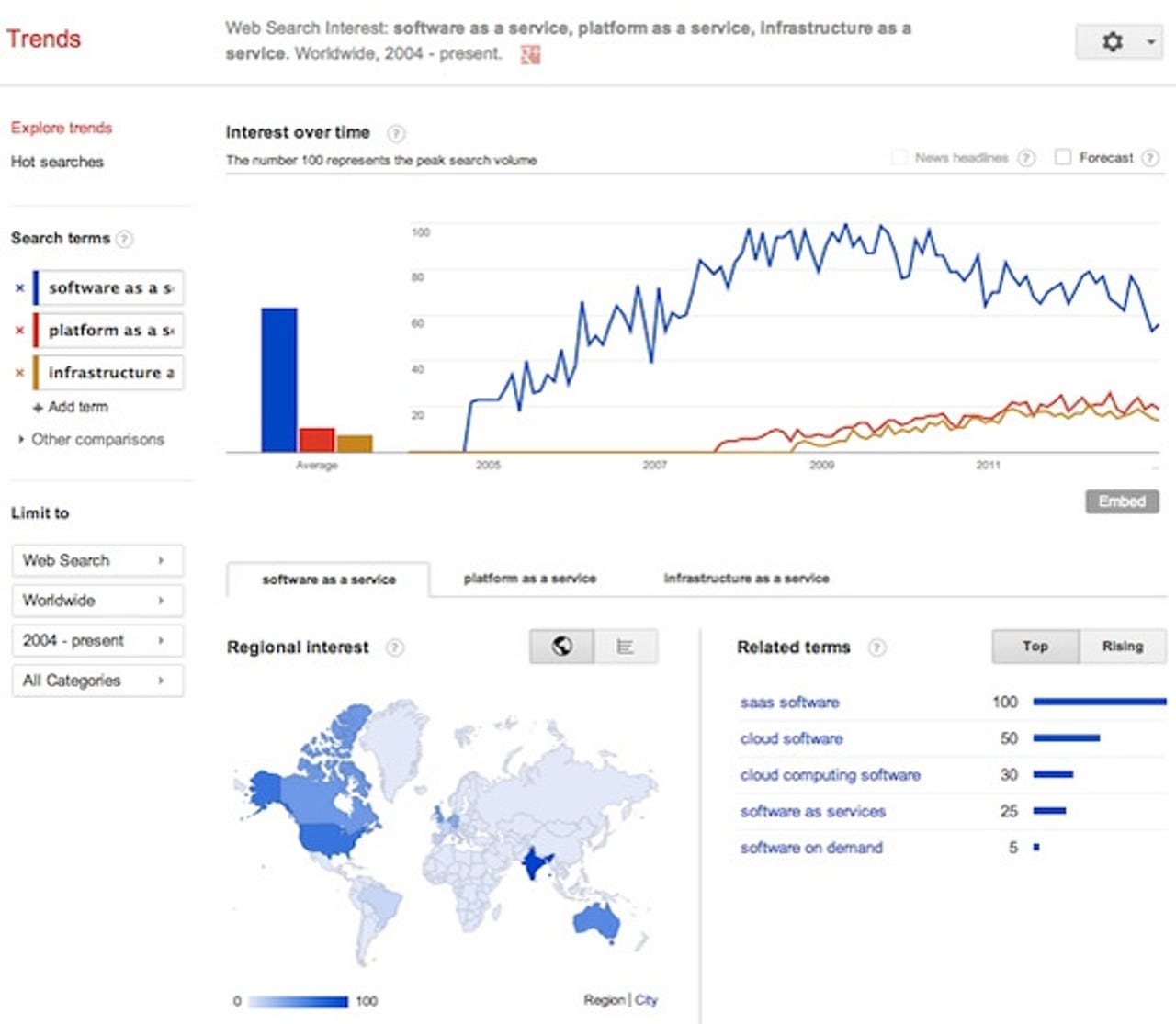

As a term, 'Software as a Service' has been in common usage for nearly a decade, with its cloud-stack companions Platform as a Service (PaaS) and Infrastructure as a Service (IaaS) gaining currency more recently. (PaaS refers to the on-demand delivery of tools and services that allow SaaS applications to be coded and deployed, while IaaS covers the on-demand delivery of virtualised servers, storage, networking and operating systems):

Infrastructure hosted in a third-party service provider's datacenter is called 'public cloud' infrastructure, while similar technology hosted within an enterprise's network is called 'private cloud' infrastructure. So-called 'hybrid clouds' mix the two approaches, with certain workloads or business processes remaining in-house and others -- perhaps less mission-critical -- being outsourced to public cloud services. Public cloud services can also be brought into play on a temporary basis, to cope with peaks in demand that would otherwise overwhelm a business's private cloud infrastructure.

Before SaaS, you generally rented software via an 'Application Service Provider' or ASP:

The key differences are code ownership and tenancy. ASPs generally hosted multiple instances of third-party client-server applications, whereas SaaS providers tend to develop their own applications and operate a true 'multi-tenant' model: subscribers access the same code base, with their data and any customisations kept separate.

Pros and cons of SaaS

PROS

For businesses, there are many potential benefits to be had from adopting the SaaS model. These include:

Cost savings Moving from the capital-heavy expense of installing, maintaining and upgrading on-premises IT infrastructure to the operational cost of a SaaS subscription is a tempting business proposition -- particularly in the short-to-medium term. It's important to be aware of potential hidden costs in SaaS adoption though.

Scalability As your business grows and you need to add more users, rather than investing in additional in-house server capacity and software licences you can adjust your monthly SaaS subscription as required.

Accessibility A browser and an internet connection is all that's usually required to access a SaaS application, which can therefore be made available on a wide range of desktop and mobile devices.

Upgradeability Your cloud service provider deals with hardware and software updates, removing a significant workload from your in-house IT department (whose extra human bandwidth can, in theory, be released for different tasks, such as integration with existing on-premise applications).

Resilience Because the IT infrastructure, and your data, resides in the cloud service provider's datacenter, if some form of disaster should strike your business premises, you can get back up and running relatively easily from any location with internet-connected computers.

CONS

Of course, there are also potential pitfalls associated with SaaS, which is why the world hasn't yet gone completely cloud-software-crazy. These include:

Security The number-one concern for businesses considering SaaS is often security: if sensitive company data and business processes are to be entrusted to a third-party service provider, then issues such as identity and access management -- particularly from mobile devices -- need to be addressed. And if your company uses multiple cloud services, be aware that deprovisioning an ex-employee can become a security headache.

Outages Despite cloud providers' best-laid plans, outages do happen, with causes ranging from acts of God to human error and many points in between. Any downtime is irritating, but a lengthy outage of a mission-critical app could prove disastrous. You'll need to scrutinise your service provider's SLA (Service Level Agreement) and historical performance very carefully before outsourcing mission-critical applications to the public cloud. Tools such as Compuware's Outage Analyzer and Is It Down Right Now? let you monitor ongoing cloud outages.

Compliance When your business data resides in a service provider's datacenter, ensuring that you comply with the relevant government data-protection regulations can be a problem. You'll need to determine which regulations apply to your business, ask the right questions of your SaaS vendor and implement a solution to address any failings. Alternatively, you can investigate a Compliance-as-a-Service product such as that from Niu Solutions.

Performance A browser-based application hosted in a remote datacenter and accessed via an internet connection is likely to cause worries about performance when compared to software running on a local machine or over the company LAN. Obviously some tasks will be better suited than others to the SaaS model -- at least until internet connection speed is no longer an issue. In the meantime, application performance management tools can help businesses and service providers keep tabs on how their apps are running.

Data mobility The SaaS market is awash with startups, and some will inevitably fail. What happens to your data and your carefully orchestrated business processes if your service provider goes under -- or if you need to change your SaaS vendor for some other reason? When choosing a SaaS vendor, you'd be wise to ensure you avoid lock-in by preparing an exit strategy.

Integration Businesses that adopt multiple SaaS applications, or wish to connect hosted software with existing on-premise apps, face the problem of software integration. If it's not possible to handle the relevant APIs and data structures in-house, there's a relatively new breed of Integration-as-a-Service products available, including Boomi (a Dell-owned company), CloudSwitch and Informatica.

How big is the SaaS market?

In March last year, Gartner forecast that worldwide SaaS revenue would reach $14.5 billion in 2012 -- a 17.9 percent increase over 2011's $12.5bn. This healthy growth rate is set to continue, according to the research company, which predicts a $22.1bn SaaS market in 2015.

Regional SaaS revenue forecasts for 2012 were headed by North America with $9.1bn, followed by Western Europe with $3.2bn. Other regions failed to break the $1bn barrier: Asia/Pacific ($934.1 million), Japan ($495.2m), Latin America ($419.7m) and Eastern Europe ($169.4m).

Gartner's research also highlighted regional differences in the most prevalent software categories deployed via the SaaS model: expense management, financials, email and office suites, and web conferencing in North America; financials and accounting, ERP, office suites, email and CRM in Asia/Pacific; CRM and groupware in Japan; email, accounting, sales force automation and customer service, and expense management in Latin America.

Next we'll look at some of the vendors in these and other business software categories.

Continued

Leading SaaS providers

There is now a multitude of SaaS providers, covering all major categories of business software. The selections below are intended to give a flavour of the available variety rather than make any claim to comprehensiveness.

Business Intelligence & Analytics

Business Intelligence (BI) and Analytics software marshals disparate data on past and present business performance, delivers customisable reports and dashboards, and supports informed decision-making for the future. Traditionally deployed in-house (because that's where the relevant business data resided), BI is rapidly gaining a footprint in the cloud. Listed below is a selection of BI vendors. To find more, take a look at GetApp, which lists 83 SaaS BI & Analytics tools available on subscription at the time of writing.

Business intelligence

BIME, Birst, BIRT onDemand (Actuate), Cloud9 Analytics, EasyInsight, EdgeSpring, GoodData, Indicee, Information Builders, InsightSquared, Jaspersoft BI Professional for AWS Edition, Lattice, NetSuite (SuiteAnalytics), Pentaho, SAP BusinessObjects BI OnDemand, Sumall, Yellowfin, Yurbi, Zoho Reports

Analytics

1010 Data, Datameer, Google Analytics, Kognitio, Kontagent, Microstrategy Cloud Express, Mixpanel, PivotLink, Precog, Rosslyn Analytics, SAS (Solutions OnDemand), SpatialKey, Tableau Software, Tibco Spotfire, Trackerbird

Collaboration

There are many ways of collaborating -- ranging from asynchronous document storage and sharing to real-time online video meetings, with many variations in between. That's why collaboration is one of the most heavily populated and fastest-changing SaaS categories. Listed below is a selection of collaboration vendors. To find more, take a look at GetApp, which lists 212 SaaS collaboration tools available on subscription at the time of writing.

Team collaboration

Campfire (37 Signals), Centroy, Confluence (Atlassian), Huddle, HyperOffice, IBM SmartCloud for Social Business, Jive, LogMeIn, Moxie, Podio (Citrix), Rebooth (formerly Teambox), SAP Jam (SuccessFactors), Zimbra (VMware), Zoho Collaboration Apps

Project management

Basecamp (37 Signals), Binfire, Clarizen, Daptiv, Jira (Atlassian), Liquid Planner, Projectplace

Web conferencing

AnyMeeting, Arkadin, Cisco WebEx, Citrix GoToMeeting, iMeet, Fuzebox, TeamViewer

Video conferencing

BlueJeans Network, Vidtel, Vidyo

Content storage/sharing

Box, Dropbox, Egnyte

Email/productivity

Google Apps, Microsoft Office 365

Miscellaneous

Acrobat.com (document/form sharing, signing, sending); Agreedo (meeting management); Asana (task management); Collabnet, Rally Software (agile software development); KnowledgeTree (sales document management); RunMyProcess (workflow)

Customer Relationship Management

CRM software, once confined to orchestrating in-house customer information and automating salesforce operations, now encompasses a wide range of social media interactions and other external information sources that help to shape the relationship between businesses and their customers. Salesforce.com was the first big SaaS success story, and it continues to dominate its field. However, there are many other SaaS players in the CRM and related markets, and a lot of merger/acquisition activity. A selection is presented here. To find more, take a look at GetApp, which lists 273 SaaS Customer Management tools available on subscription at the time of writing (118 of which are defined as CRM).

CRM

BPMOnline, ClearSlide, HighRise (37 Signals), Infor, Infusionsoft, InsideView, JobNimbus, KANA, LivePerson, Maximizer CRM Live, Medallia, NetSuite CRM+, Parature, Pegasystems (Pega Customer Service Cloud), Really Simple Systems, RightNow (Oracle), Sage CRM, Salesboom, Salesforce.com, SAP (Sales OnDemand), Thunderhead.com One, Workbooks, Zoho (CRM)

Hybrid (on-premise/cloud) CRM

Microsoft Dynamics CRM, Oracle CRM OnDemand, Oracle Fusion OnDemand, SugarCRM

Social CRM

Artesian Solutions, Coveo, Crowdtap, Get Satisfaction, Nimble

Miscellaneous

Clarabridge (sentiment analysis), Convio (constituent engagement for nonprofits), LiveOps (customer service), Steelwedge (sales and operations planning), SurveyMonkey (customer surveys), UserVoice (customer feedback and helpdesk), Xactly (sales performance management), Zendesk (customer service)

Demand Generation

Many SaaS providers offer tools to maximise a company's visibility among its potential customers, retain their attention when noticed and help turn leads into sales. Social media naturally play a big part here, along with more traditional tools like email campaigns and landing page optimisation. Here's a selection. To find more, take a look at GetApp, which lists 184 SaaS Marketing tools available on subscription at the time of writing.

Bizo, Bronto, ConstantContact, Eloqua (Oracle), eTrigue, ExactTarget, Genoo, Hubspot, iContact (Vocus), Kenshoo, Marin Software, Marketo, Moz, Pardot, Publictrac, Responsys, Silverpop, VerticalResponse, Vocus

Specialist services

Campaign Monitor (email marketing), Gagein (sales intelligence tracking), Infusionsoft (SMB demand-gen/CRM/e-commerce suite), MailChimp (email marketing), Unbounce (landing page testing), XYDO (third-party marketing content curation)

Document Management

The cloud is a natural place to store and track documents, and there are plenty of services available, offering traditional document management capabilities, as well as secure file sharing, file send, online backup and electronic signature functionality. Here's a selection.

Document management

Alfresco, Bitcasa, Box, CloudApp, Doctape, Documentree, Dropbox, Drupal, Netdocuments, OfficeDrop, SugarSync, Syncplicity (EMC), WordPress, Zoho Docs

Secure file sharing

ShareFile (Citrix), WatchDox

File send

SendThisFile, Yousendit

Online backup

Backupify, Carbonite, Mozy (EMC)

Electronic signature

DocuSign, EchoSign (Adobe)

Finance & Accounting

Finance and accounting are mainstays of the traditional enterprise software stack, and there are plenty of cloud-based offerings in these areas -- along with services that focus on particular areas such as revenue and expense management. A selection is presented here. To find more, take a look at GetApp, which lists 186 SaaS Finance & Accounting tools available on subscription at the time of writing.

Financial management

Acumatica, Adaptive Planning, Ariba (SAP), Kyriba, NetSuite (SuiteCommerce), SAP Financials OnDemand, Workday

Accounting

FinancialForce.com, FreshBooks, Intacct, Intuit (QuickBooks Online), KashFlow, OpenERP, Saasu, SageOne, VerticaLive, Wave, Xero

Revenue management

Aria Systems, Bill.com, Chargify, CheddarGetter, Metanga, Monexa, Recurly, Revstream, ServiceSource, Zuora

Expense management

Concur, Expensecloud, Expensify

Miscellaneous

Avalara (sales tax automation), Coupa (e-procurement), Statpro (portfolio analysis), Truaxis (loyalty reward services)

Human Resources

HR software is a fertile area for SaaS providers, encompassing traditional HR functionality, talent management, recruitment tools, workforce analytics and other niches. A selection is presented here. To find more, take a look at GetApp, which lists 194 SaaS Human Resources tools available on subscription at the time of writing.

HR

BambooHR, Epicor, Ultimate Software, SuccessFactors (SAP), SAP Business ByDesign, Kenexa (IBM), Silkroad, euHReka (Northgate Arinso), Workday

Talent management

Cornerstone, Saba, UpMo, Halogen, Taleo (Oracle), Talent, Lumesse, SumTotal

Recruitment

Bullhorn, Wowzer, HireVue, Montage, Async Interview, Chequed.com, iMomentous, Entelo, TalentBin

Workforce analytics

Evolv, Talent Analytics, Talx (Equifax), Visier

Miscellaneous

RoundPegg (culture management), CloudPay (payroll), ZenPayroll (payroll), Echospan (performance management), Work.com (SAP/Rypple; performance management), SelectMinds (Oracle; social recruiting), Replicon (time & expense tracking), TeamSeer (holiday planning and absence management), WhosOff (staff leave planner)

Social Enterprise Tools

One of the buzziest of recent buzzwords, the 'social enterprise' has two major aspects: the use of Facebook-like tools within the enterprise for flexible knowledge sharing and collaboration (enterprise social networking); and the monitoring and management of customer interactions on a variety of public social networks (social media management). Leading examples of both types of service are presented below.

Enterprise social networking

BlueKiwi ZEN (Atos), Chatter (Salesforce), Sazneo (Access aCloud), Socialcast (VMware), Socialtext, Tibbr, Yammer (Microsoft)

Social media management

Alterian SM2, Brandwatch, Gigya, Hearsay Social, HootSuite, Lithium, Repute-Me, Salesforce Marketing Cloud (Buddy Media + Radian6), Simplify360, SocialAppsHQ, Socialware, Sysomos, ThoughtBuzz, Vitrue (Oracle), Wildfire (Google), Zuberance

Continued

Cloud Services Brokerages

The burgeoning SaaS market poses a problem for CIOs, CTOs and IT managers: how do you go about selecting an optimal set of services for your particular business, and how do you manage the resulting collection of subscriptions, SLAs, APIs and data structures?

This is where a relatively new kind of service, the Cloud Services Brokerage (CSB), can help. Sitting between the customer and the cloud providers, the CSB can provide access to an aggregation of SaaS partners, adding value in the form of expertise and tooling for migration, integration, customisation and management, plus the convenience of a central billing point. Think of CSBs as the 'cloudy' equivalent of the system integrator. Examples are Appirio, Cloud Sherpas and the UK-based Nephos Technologies.

CSBs won't suit every kind of business: smaller companies are unlikely to deploy enough SaaS applications to justify going through an intermediary, while very large enterprises should have enough in-house IT manpower and expertise to effectively become their own cloud-service brokers. But for a multitude of mid-sized businesses, employing a CSB may well look like an attractive proposition.

Many telecoms, IT and other services providers will see cloud service brokerage as a useful business opportunity, and enterprises may require assistance in setting up an internal cloud brokerage. This is where Jamcracker comes in. Jamcracker helps companies become external or internal CSBs via the Jamcracker Services Delivery Network (JSDN), which includes an extensive catalogue of third-party cloud services with centrally managed provisioning, access, security, billing, administration and support.

Conclusion

The SaaS market is taking off in a big way, with startups exploring multiple niches in numerous software categories, established players busily acquiring and integrating the most promising new services, and CSBs helping to smooth companies' paths into the cloud.

For new businesses, in particular, it's almost a 'no-brainer' to quickly deploy a collection of SaaS business apps and pay for them with a monthly subscription, rather than invest heavily in on-premises IT infrastructure and in-house technical support. Perhaps the biggest problem facing small businesses is the enormous amount of choice that's already available in the SaaS market -- particularly if they're unwilling or unable to sign up with a cloud services broker.

Larger businesses have a different set of problems to contend with when it comes to SaaS adoption, mostly centering around integration with existing on-premise enterprise applications (into which many may well be locked with costly contracts). Still, enterprises looking to expand into new regions, or adopt new 'social' business processes, may well find that SaaS is the most cost-effective way to go.