Samsung overtakes Apple as top global chip customer: Research

Samsung has overtaken Apple to become the world's leading buyer of semiconductors--such as chips, processors, and memory, according to research firm Gartner.

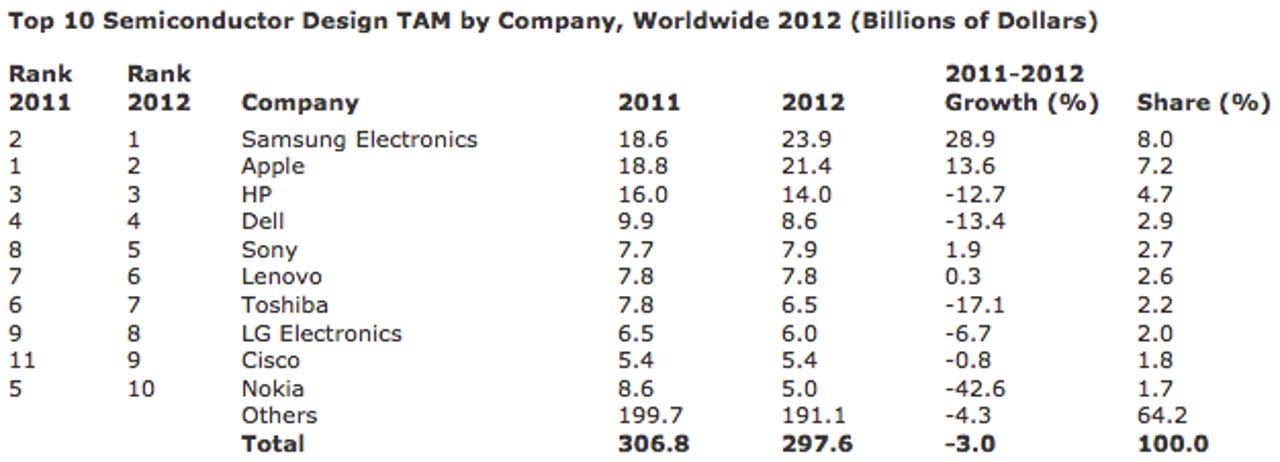

While both firms have "dominated" semiconductor demand in 2012, consuming $45.3 billion on chips during the year--an increase of $7.9 billion year on year--Samsung overtook the iPhone and iPad maker to keep up with demand for its smartphones and tablets.

The two firms together represented around 15 percent of the total semiconductor demand, despite the semiconductor market decreasing by 3 percent overall, the research firm said. The decline can be mostly attributed to waning in the PC market, as post-PC devices--such as tablets, smartphones, and even "phablets" (part phones, part tablets)--have started to take over.

Samsung spent almost $24 billion on chips for its range of smartphones and grew by 28.8 percent, while Apple spent just over $21 billion and grew by 13.6 percent.

Outside of the two giant post-PC tag teams come the traditional PC makers, trundling behind by spending significantly less than their post-PC counterparts.

HP and Dell, in third and fourth place, respectively, both decreased their spending by between 12 percent and 13 percent, while Sony and Lenovo--in fifth and sixth places, respectively--increased their semiconductor spending modestly. Both companies make smartphones, which accounts for the increase in spending, although not on the scale that they build PCs.

Gartner principal research analyst Masatsune Yamaji said in prepared remarks: "Although Samsung and Apple continue to go from strength to strength, other leading electronic equipment makers fared less well, and six of the top 10 reduced their demand in 2012."

Of course, a weak macroeconomic situation and a change in consumer demand was cited as a significant contributor to the shift in semiconductor buying, and the slow decline of the PC market was predominately the reason in the spending shift.

Here's the interesting (albeit semi-obvious) bit:

In addition to a weak macroeconomic situation, a dramatic change in consumer demand contributed to a reduction in semiconductor demand in 2012. The PC market still represented the largest sector for chip demand, but desktop and mobile PCs did not sell well, as consumers' interest shifted to new mobile computing devices like smartphones and media tablets. This shift caused a substantial decrease in semiconductor demand in 2012, as the semiconductor content of a smartphone or a media tablet is far less than that of a PC.

It isn't about Samsung vs. Apple battling it out in the market share space, or "who has the bigger budget?" It's about Samsung and Apple taking the top spot. It shows that time and investment is being put into the post-PC market and spending hasn't on the whole decreased from the two market leaders. But, for the year ahead, the spending cycle has pretty much set the agenda.

The bottom line: Expect more out of the smartphone, tablet, and "phablet" space, and a further decline in the PC market.