SAP Financials OnDemand: will it blend?

SAPPHIRE Now Madrid was the muted platform from which SAP talked about Financial OnDemand, the official name for the company's 'Your Money' leg in its SaaS apps for line of business offerings.

When I first heard about this at the US SAPPHIRE, I was unrelentingly scathing:

As I (along with colleagues) explained to SAP in the run up to SAPPHIRE Now, carving out financials from the BYD suite is both a defensive and non-differentiating play. Nobody needs a new GL, even if it is running in the cloud. SAP missed the opportunity to explain something that it does best: develop against big problems like industry specific billing or moving forward in industry specific needs such as claims management for insurance. This was something I broached with Jim Snabe, co-CEO SAP. He said that the company's initial cloud plan to compete along lines of business is very much a step one, suggesting the company will tackle bigger problems at step two.

Until a few weeks ago, nothing I heard from the company could persuade me to change my mind. The basic problem stemmed from three parallel threads:

- No-one at SAP had a clue whether Financials OnDemand could successfully compete as a stand alone product. The consensus among colleagues was that it wasn't good enough to occupy one of the top three slots in any beauty parade and would at best be a sale to some of the larger installed base as a possible Tier-2 contender.

- Messaging was not compelling. Even in the days runnning up to the Madrid event, SAP marketing was unconvincing. One post in particular evoked groans as the author sought to justify the positioning with a short diatribe on 'innovation' and then quickly descended into SAPenese, a language only understood by those deeply familiar with SAP.

- As is (almost) always the way with SAP, there is too much focus on vague futures and not enough on today's capabilities, customer success and near term enhancements.

The combination of these and past mis-steps means that in the minds of many, Financials OnDemand is associated with what some consider a tainted brand. I believe that is presumptive though I bow to those who understand the nuances of marketing far better than I.

There are three areas where Financials OnDemand now shines:

- It has been given a HANA power boost. In demonstrations I saw using crappy hotel wifi, the system works far quicker than it has in the past. Data presentation on iPad is in the sub-second range which is acceptable to anyone using that access method.

- The configurable UI is much richer than when I last saw it, has a recognizable 'grid' feel that will be compelling to many and has plenty of KPI metrics that are easily drillable against pre-defined templates.

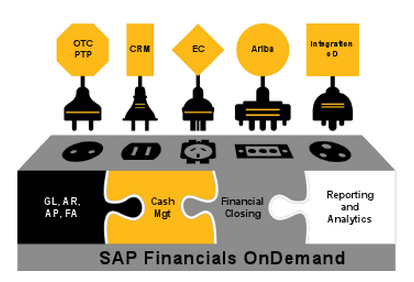

- It has a pluggable architecture that can take data from any other component in the LOB version of ByDesign to provide a 'best of suite' solution. It can also take pretty much anything that can plug into the architectural underpinnings albeit partners need to provide the requisite mappings. This more than anything else should help make Financials OnDemand more saleable in mixed environments where for example, Salesforce.com or Zuora are already happily working. It means that Financials OnDemand can become the business platform around which customers can hang whatever else they need in whatever configurations work best for them.

It is this last part - the potential to become a platform - which is most important. Others will argue that it should be customer facing apps that define future platforms since they hold the potential to drive revenue. I have no difficulty with that argument except that driving revenue without attention to profitability is pointless. You can only understand that by mashing up data from the financial systems of record. More to the point, any measures which seek to optimise business performance must include the ability to access, aggregate and analyze financial metrics. Anything else is meaningless. If you agree with that perspective then it follows that financials must lie at the heart of how you measure business performance and how you kick off processes designed to ensure the whole of the business is performing optimally.

What next? Seven points stand out:

- The good news is that the LOB apps share the same code base as ByDesign. At one time there was a real concern that the code bases would be split. When asked for my opinion, I vehemently argued against that idea as both unnecessarily expensive and a guaranteed way of killing ByDesign and likely a neutering of the LOB apps in the short to medium term. That train wreck has now been avoided.

- As currently delivered, Financials OnDemand is good looking enough and sufficiently feature rich to compete in situations where companies need general purpose fast track back office implementations that support new operations in locations where on-premise doesn't make sense.

- The iPad implementation demonstrates a better understanding of 'mobile first' than I have seen in a while from SAP but they have to take that set of ideas and popularise it on other applications so as to develop a homogenized look, feel, performance and experience.

- I am satisifed that this solution is sufficiently open to allow moderately easy third party data integration. However, I hope SAP will offer simple process integration in areas like billing and revenue recognition. This will be increasingly important in service based economies and subscription business models where governance and compliance is all over the map but where SAP could shine.

- My understanding is that Financials OnDemand is moving to a four times a year refresh cycle. If so then that puts it on par with other cloud offerings. However, SAP needs to carefully manage expectations in the implementation cycle which, while relatively short, will provide plenty of opportunities for confusion over what is being implemented now and what comes in the immediate post implementation period.

- I want to see much deeper and accelerated development in vertical markets. SAP has previously said that it expects partners to do much of the last mile development. That's fine as long as you have a happy partner ecosystem. Given this is at least the third iteration of SAP's efforts to gain serious cloud apps traction you have to ask how much more resource partners are prepared to put into something that has so far struggled? A demonstrable commitment on SAP's part plus a continuation of opening up the application to third parties can only provide comfort to a stressed part of the SAP ecosystem that can easily pick up alternatives as partner opportunities.

- All in, SAP is proving much more responsive to external critique than I have seen in the past. That is a genuine step forward for a company that too often listens with one ear but acts on its own instincts with scant regard for market dynamics or the experience of advisors. Some will say 'you would say that cuz they've done some of what you asked.' That's true but then it is equally important to remember the applications market has changed. Vendors have to demonstrate they are listening to customer and market concerns and not simply act on an arbitrary set of enhancements.

The question for buyers is simple: do you believe this approach to meeting need makes sense and if so, would you now put FInancials OnDemand into the competitive melting pot? As always, the market will decide though I suspect that perhaps for the first time, SAP has a grip on what needs to be done for its business cloud apps to be something more than a rounding error on its own earnings.

Image credit: SAP presentation

Disclosure: SAP covered some of my travel expenses to Madrid and is a current client.