ServiceNow's Q2, outlook shines; share gains ahead

ServiceNow reported a better-than-expected fiscal second quarter, raised its outlook and has analysts thinking it can deliver $1 billion in revenue by 2016 as it grabs share from entrenched rivals.

The company on Wednesday reported a fiscal second quarter net loss of $21.4 million, or 16 cents a share, on revenue of $102.2 million, up 80 percent from a year ago. The non-GAAP loss for the second quarter was 6 cents a share.

Wall Street was looking for a non-GAAP loss of 5 cents a share on revenue of $97.4 million. Overall, analysts were pleased that ServiceNow passed the $100 million in quarterly sales mark for the first time.

As for the outlook, the company projected third quarter revenue between $104 million and $106 million and a net loss between 2 cents a share and 3 cents a share. For the year, revenue will be between $406 million and $410 million. Those projections were both ahead of estimates.

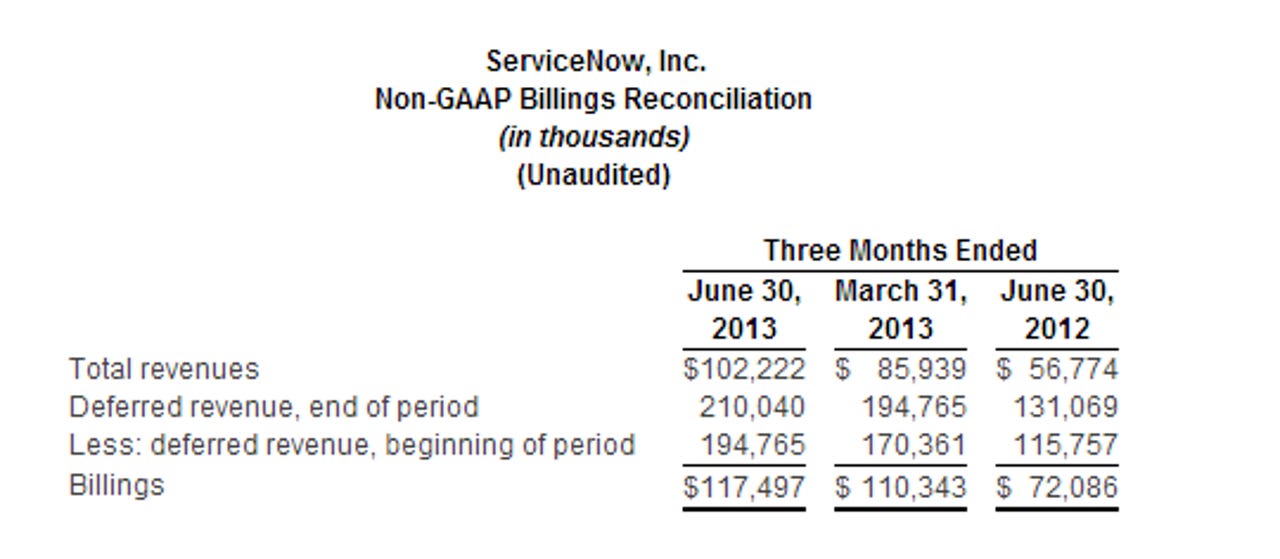

Simply put, ServiceNow's billings and deferred revenue project more gains ahead. ServiceNow, which has expanded from IT support to automation and cloud management, appears to be taking share from the likes of BMC, CA and HP with a low-cost SaaS model.

Morningstar analyst Norman Young said in a research note:

The IT operations management industry has traditionally been dominated by software giants that leveraged their mainframe management or operating system expertise to build productivity and management tools for distributed systems. By tying their tools to mission-critical technology infrastructure and business functions, BMC, CA, Hewlett-Packard, and others have built entrenched positions in the ITOM industry. These firms enjoy high switching costs driven by complex and time-consuming implementations combined with extensive and necessary user training. With its innovative and intuitive software-as-a-service product, no-moat ServiceNow has dramatically lowered these costs.

Meanwhile, ServiceNow applications are being used for other functions in the enterprise. Speaking on an earnings conference call, ServiceNow CEO Frank Slootman said:

The resulting transparency sharpened IT's priorities along with the IT organization to track service performance by business and application type and to reduce failure rates and resolution times by 90%. We saw increased utilization of every ServiceNow application as measured on the so-called same-store basis compared to last quarter. But the biggest jumps in the use of service catalog in Knowledge Management which often involves use outside the traditional ITSM service model...

We continue to see adoption of the ServiceNow platform for service domains outside of enterprise IT. For example, European Railway with over 200,000 end-users was looking to consolidate its purchasing procurement and other organizational processes. ServiceNow was awarded the business due to our ability to tightly link the online services experience with the underlying IT backbone.

ServiceNow is also being used for everything from automating workflows to even human resources.

The growth story has Wall Street gushing. An example from Wells Fargo analyst Maynard Um:

We see no reason why ServiceNow cannot grow to be a multibillion dollar revenue company.