Splunk's IPO debut: the rundown

Big data and business intelligence company Splunk made a nice splash on Wall Street. Here's what you need to know about the company and your buying decision, whether it's for stocks or Splunk's software.

The company priced its IPO for 13.5 million shares at US$17 each, and generated a good bit of buzz. Morgan Stanley was the lead underwriter, but a bevy of big firms were in on the deal. Shares doubled initially, and then topped US$34 as trading ended.

Here's the rundown on Splunk, a company that's likely to lead a big-data IPO parade going forward:

What does Splunk do?

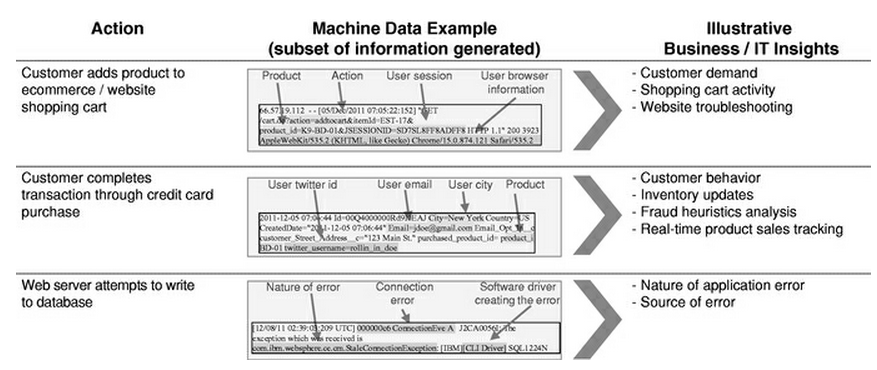

The company sits at the intersection of big data and business intelligence software. Splunk aims to take machine data from corporate networks, and turn it into real-time analytics. Use cases vary from RFID tracking to online marketing to scientific applications.

How many customers does Splunk have?

At last count, Splunk had more than 3700 customers across 75 countries. Reference customers include Autodesk, Bank of America, Comcast, Etsy, Harvard University, Viacom and Zynga.

How does Splunk's software work?

The company says it has a platform that collects data in any format and analyses it. Splunk is tailored to machine-generated data, and is set up to take information and monitor corporate operations.

(Credit: Splunk)

What's the Splunk product portfolio?

Splunk has a series of apps that ride on top of its data engine. These apps, developed by Splunk and third parties, are developed for roughly 350 use cases. Notable products are Splunk for Enterprise Security and Splunk for PCI. The company is also developing Splunk for VMware and SplunkStorm, a cloud service.

What are the benefits of Splunk?

The company noted that its software doesn't require high-end hardware, consultants or customer code, reducing total cost of ownership.

How does Splunk make money?

Customers pay Splunk licence fees based on their estimated indexing capacity.

Does Splunk make money?

No. For the year ended 31 January Splunk reported a net loss of US$10.99 million on revenue of US$120.96 million. In 2011, Splunk lost US$3.8 million on revenue of US$66.2 million.

What will Splunk do with its IPO dough?

The company said it will invest in R&D, expand its salesforce and eye adjacent markets.

What companies compete with Splunk?

The list is huge when it comes to IT giants eyeing machine data analysis. Splunk listed systems and security vendors BMC, CA, Compuware, HP, Intel, IBM, Microsoft and Quest. For web analytics, Splunk cited Adobe (Omniture), Google, IBM and Webtrends as rivals. Business intelligence players EMC, Oracle and SAP are also competitors. And, yes, any Hadoop-based player in big data could also focus on machine-created data.

Via ZDNet US