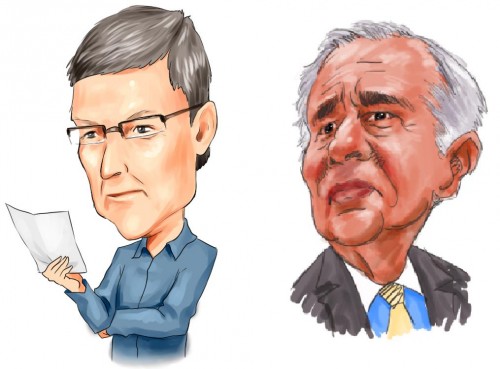

Tim Cook announces $14 billion Apple stock repurchase

The Wall Street Journal is reporting that Apple ($AAPL) has repurchased $14 billion of its own stock within the past two weeks. The move means that Apple had bought back more than $40 billion of its shares over the past 12 months, which Cook called "a record for any company over a similar span."

In an interview Cook said that Apple was "surprised" by the 8 percent drop in AAPL share since it reported quarterly results on January 28, 2014. Cook said that Apple wanted to be "aggressive" and "opportunistic."

It means that we are betting on Apple. It means that we are really confident on what we are doing and what we plan to do. We're not just saying that. We're showing that with our actions.

According to Cook the recent share repurchase is part of Apple's previously disclosed plan to repurchase $60 billion of its own shares. He said Apple plans to disclose "updates" to its buyback program in March or April.

One name came to mind as soon as I read the WSJ headline: Carl Icahn. The activist shareholder has been pressuring Apple to be more aggressive with its $160 billion cash horde. Icahn owns approximately $4 billion in Apple shares and wants Apple to repurchase an additional $50 billion of its own shares by the end of September, over and above the $60 billion that the company has already committed to.

When the stock was under pressure after Apple's Q1 earnings announcement, Icahn announced he'd purchased another $500 million worth of AAPL shares. Today's announcement comes just three weeks before Apple's February 28 shareholder meeting, where further stock repurchases could be announced.

How would you use Apple's $160 billion in cash if you were CEO?