Verizon Q1 solid amid multiple moving parts

Verizon's first quarter, which included five weeks of full ownership of Verizon Wireless after the Vodafone purchase, had multiple moving parts and the company's enterprise business slumped as the telecom giant tries to become more of a cloud player.

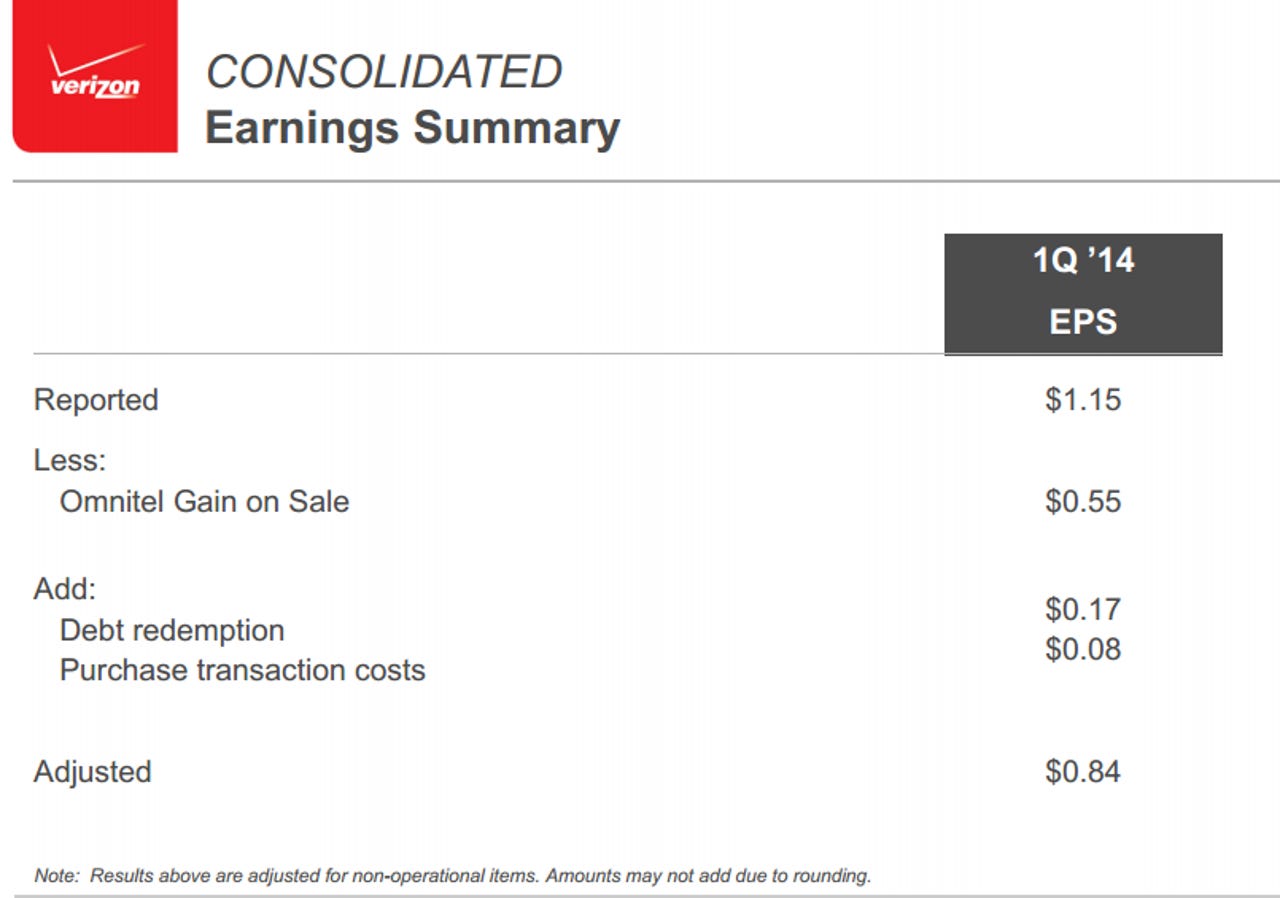

The company reported first quarter earnings of $3.95 billion, or $1.15 a share on revenue $30.82 billion. Since Verizon bought the remaining stake it didn't own in Verizon Wireless from Vodafone on Feb. 21, the quarter wasn't as clean as analysts expected. First quarter non-GAAP earnings were 84 cents a share, but analysts were looking for 87 cents a share on revenue of $30.7 billion.

Verizon said that if Verizon Wireless was fully owned, non-GAAP earnings in the quarter would have been 91 cents a share. Verizon added that it is projecting 4 percent revenue growth for 2014.

Here's the breakdown:

On the wireless front, Verizon added 539,000 net retail postpaid connections and ended the quarter with 103.3 million connections overall. Revenue for the wireless unit was $20.9 billion, up 7 percent.

Verizon's FiOS revenue in the first quarter topped $3 billion and the company added 98,000 Internet and 57,000 video net connections. Consumer revenue for Verizon on the wireline front was $3.8 billion, up 6.2 percent from a year ago.

The company's enterprise business continued to struggle, but Verizon added that it is rapidly deploying its cloud, security and machine to machine services and landing customers.

On a conference call, CFO Fran Shammo said Verizon is playing for flat in the enterprise:

On the enterprise side, the United States is the highest corporate taxpayer in the world and until we fix that situation, there's just too much uncertainty out there for enterprises to really lock down on where they are going in the future. The public sector is still a major drag on our results. As you know, we include the public sector in our enterprise results and that's also now impacting the strategic services because they are also starting to cut move away from some of the more strategic products. We just are satisfied with being flat with last year, which is when I came into this year saying, and I think if we can resolve some of the issues in the uncertainties, I think we are on a better path for enterprise.

We are extremely competitive and have a great product set in our enterprise space. Obviously if we get into the details, if you look at security of look at our cloud services, they are growing. If you look at the Hughes Telematics platform, that's growing in the enterprise space, but then we have all this legacy voice and core and even within the IP products, so you see the price compression happening on those products. Each year it comes up for renewal, you have a price compression. Enterprises are still focused on cost structure. They are not increasing their investments. They are not increasing their spend. That is where we sit.