Verizon tops 100M retail connections in Q2; 7.5 million smartphone activations

Verizon on Thursday reported fiscal second quarter earnings in line with estimates.

The largest U.S. cellular network by subscribers reported second quarter profit of $5.2 billion, or 78 cents per share, compared to 64 cents a share on the year-ago quarter. Excluding a one-time benefit over pensions, earnings per share stood at 73 cents per share, on revenue of $29.79 billion, a rise of 4 percent.

Wall Street was looking for 72 cents per share on revenue of $29.83 billion.

On the follow-up call, the company said it sold 3.8 million iPhones, representing just over half of all smartphones sold. Verizon said it added a net 1 million new customers, with 941,000 signing up for contract service.

By the numbers:

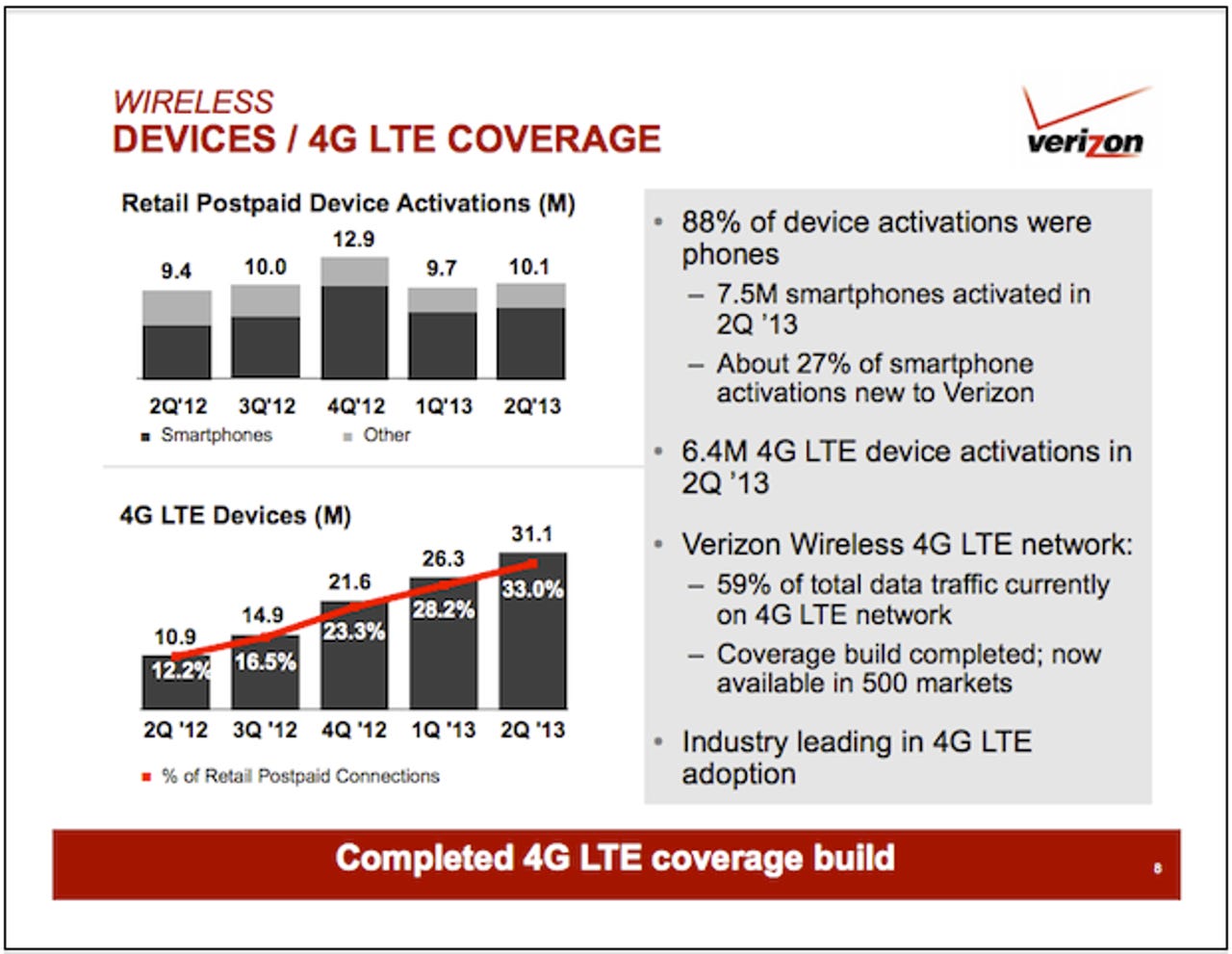

- 64 percent of Verizon Wireless postpaid customers use smartphones, up from 61 percent in the first quarter

- 301 million people now covered by Verizon's 4G LTE network

- 100.1 million retail connections, a rise of 6.3 percent quarter-over-quarter

- 27 percent of smartphone activations new to Verizon

- 6.4 million 4G LTE devices added during the quarter

- 59 percent of all traffic goes through Verizon's 4G LTE network

- 94.3 retail postpaid connections at the end of the second quarter

- 14 percent year-over-year increases in FiOS fiber revenues

- 5 million customers added during the quarter

- 4.8 percent revenue increase year-over-year for Verizon's global enterprise strategic services.

Verizon also noted that it ended the quarter with a non-GAAP free cash flow of $9.5 billion, a 20 percent increase from the first-half of 2012.

On the follow-up conference call, Verizon chief financial officer Francis Shammo said: "Underpinning our success is the consistent investment in these networks and platforms, which position us to take advantage of growth opportunities in the rapidly evolving wireless and wireline markets for broadband, video, and cloud services."

In prepared remarks, Verizon chairman and chief executive Lowell McAdam said the company's investments in wireless, fiber broadband and its global networks drove its well-performing quarter.

Having posted double-digit earnings growth in five of the last six quarters, we are focused on continuing to provide the best portfolio of products on the most reliable networks; capturing incremental revenue growth in broadband, video and cloud services; and sustaining our earnings and cash-flow momentum

Sales of services to global enterprise customers — such as security and IT, cloud and datacenter solutions — rose by just shy of 5 percent on the second quarter, representing 57 percent of total enterprise revenues, compared to 52 percent in the quarter prior.

On the follow-up conference call, Shammo noted: "We continue to work through economic challenges in the enterprise space. Many of our customers are focused on improving their cost structure, which can result in reduced services with us."

He warned: "In addition, many customers continue to be cautious regarding new investment decisions.

Consumer revenues were up by 4.7 percent year-over-year. Broadband connections totaled 8.9 million at the end of the first quarter, a 1.9 percent year-over-year increase.

Year-to-date, Verizon's shares ($VZ) have risen from a low of $41.51 to $53.91, a jump of 30 percent, before stabilizing out around the $50 per share mark. On Thursday before the opening bell, shares remained about the same, pegging in around the $50 mark.

Corrected headline at 8:15 a.m. ET: Verizon saw 7.5 million smartphones activated in the second quarter, not 7.2 million.

Updated at 9:10 a.m. ET: with iPhone figures