Westpac New Zealand goes adaptive on mobile banking

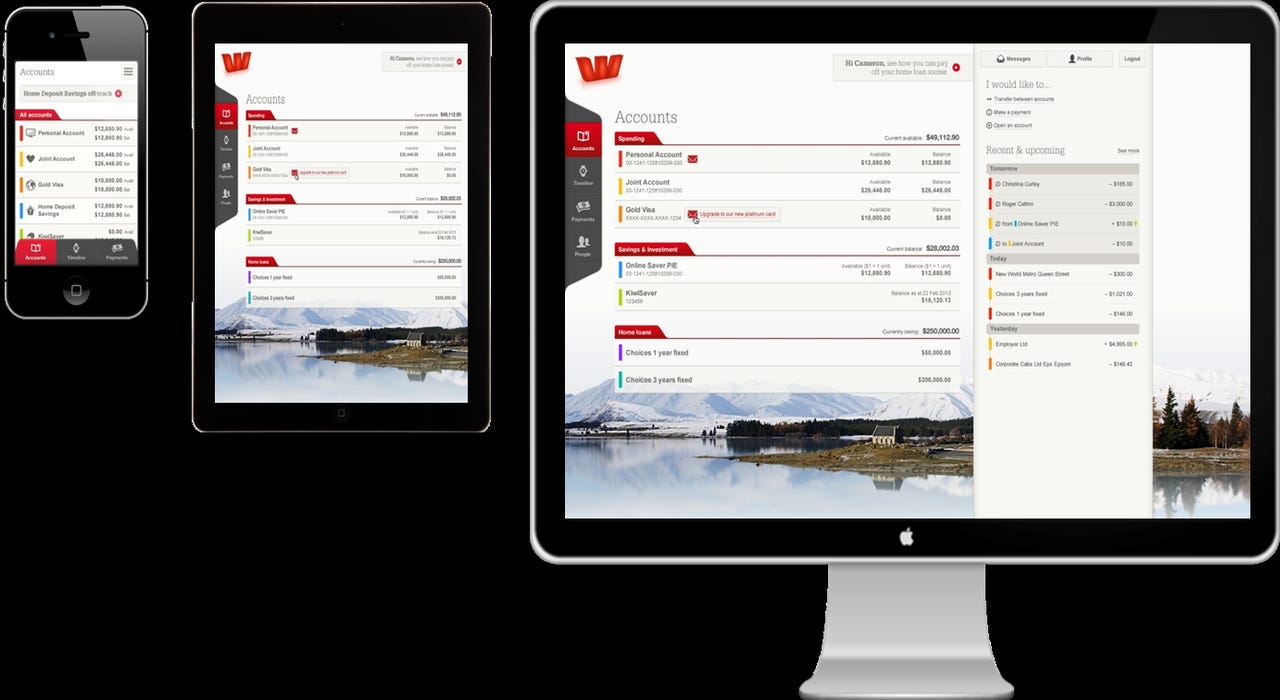

Westpac has taken the wraps off the first stage of its new online banking platform, and is boasting of a new adaptive website that will be used across desktops, tablets, and mobiles.

The first stage of the NZ$15 million, 18-month project has already been released to 5,000 staff and will be rolled out progressively to customers from next month, with full availability scheduled to be completed by early 2014.

The bank says that it has more than 280,000 logins per day, and payments and transfers have increased 21 percent per month over the last year.

"With customers wanting to take control and self-serve more and more of the transactional side of banking, the opportunity is to significantly improve the way we interact with customers," said Simon Pomeroy, Westpac NZ head of digital.

"Our objective is to provide a seamless experience no matter what channel the customer chooses to use and no matter what the customer wants to do, with all our digital and mobile channels leading back to appropriately qualified staff to help."

Pomerey said that Westpac is the only bank in New Zealand eschewing the approach of others to banks to focus on mobile phones, whereas Westpac views the customer as the "driver".

"Technology is a great enabler, but it is not a silver bullet on its own to meeting the evolving needs of customers. We understand that."

Over the next 18 months, the bank expects to add functionality for payment to mobile devices and email, applications for loans and other services, and integration with accounting packages for SMBs.

As Westpac drives down an adaptive website path, its competitors are continuing to focus on mobile applications.

Yesterday, National Australia Bank launched its Flik app that customers can use to send and receive payments from/to their transaction accounts without needing to enter account information. Payments are able to be sent via email, SMS, Facebook, NFC, or with QR codes.

Payment claims made from Flik can only be redeemed from within the app, so if the mobile user has a BlackBerry, Windows Phone, or simply does not want to install the app, there is no method for claiming the payment.

In its yearly results, the Commonwealth Bank of Australia revealed that its New Zealand subsidiary, ASB Bank, has seen its number of mobile users increase by 250 percent, and has mobile users making up over 50 percent of its online account access.