Workday shines in Q3, handily tops sales expectations

Workday delivered third quarter results that were well ahead of expectations and upped its outlook for the fourth quarter.

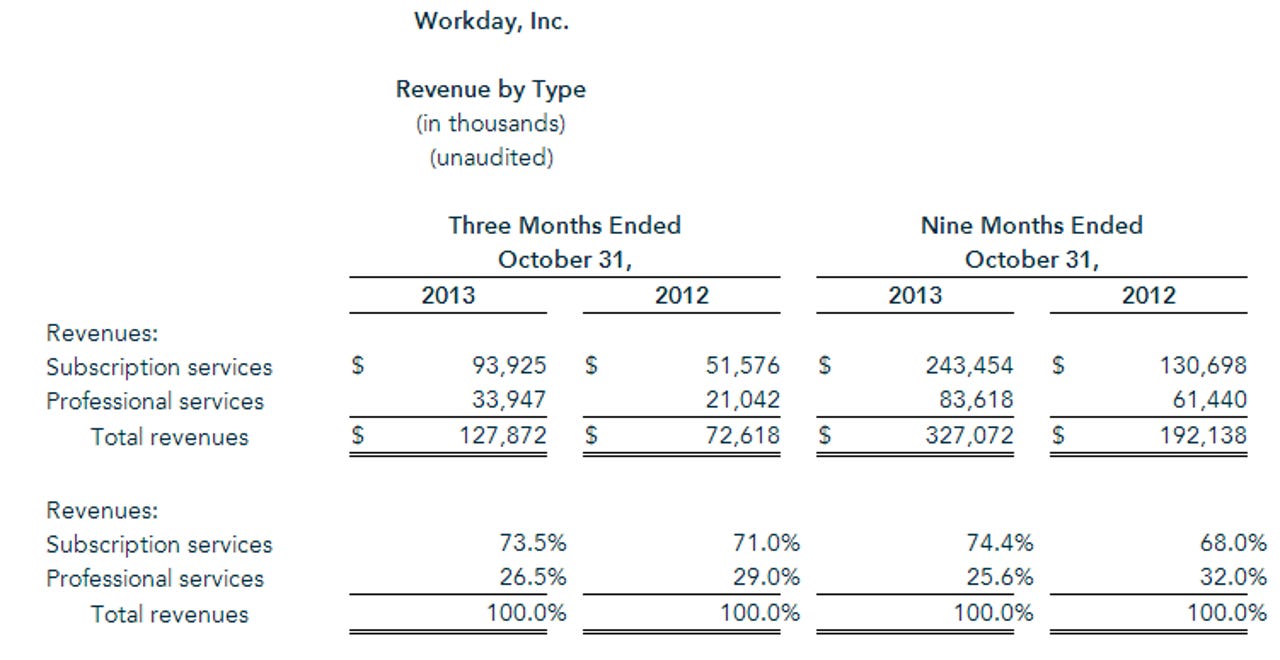

The human resources and finance cloud software provider reported a third quarter net loss of $47.5 million, or 27 cents a share, on revenue of $127.9 million, up 76 percent from a year ago. The non-GAAP loss for the third quarter was 12 cents a share.

Wall Street was looking for a non-GAAP third quarter loss of 17 cents a share on revenue of $117.7 million.

As for the outlook, Workday projected fourth quarter revenue between $133 million and $138 million. Wall Street was looking for $128.9 million.

In a statement, Aneel Bhusri, co-CEO of Workday, said the company is "progressing well" with the launch of its Big Data Analytics and schedule for Workday Recruiting.

Key points from the earnings conference call:

- Bhusri said that Morgan Stanley went live on Workday.

- The company has 550 customers globally.

- Workday is "extremely focused on broadening and scaling Workday Financials."

- Workday has 10 new financial customers, but didn't break down whether those additions were also HR customers.

Bhusri outlined the competitive landscape:

I don't think we are seeing anything new in the competitive environment. I think the only thing that's changing is we're beginning to get real traction with financials. The legacy vendors have a solution built for medium and large companies, for financials and the cloud, with a few products. So, we are translating our success in HR and moving in into financials. In the HR world, nothing has really changed. It's the same two and the lower end of the market. Their tactics haven't changed and the products are not changing quickly enough.

Overall, Workday appears to have landed some strong deals and could be taking share from larger rivals.

Analysts have been mixed on Workday. For instance, Cowen & Co. analyst Peter Goldmacher has noted that Workday will inevitably face a few bumps on along the way. Workday is likely to become a multi-billion dollar company, but has challenges ahead.

Also see: The battle in HR software: software for corporations or persons? | Workday readies OpenStack cloud | Benioff: The Salesforce, Workday clouds had to integrate | Workday tools up HR and finance with big data analytics | Workday's big data play: The gateway drug to financials? | Workday's higher ed management tools well timed

Goldmacher said:

We see competitive hurdles every step of the way. Over the long term, there is no reason Workday's's trajectory couldn't be disrupted by another start up with a better product. Near

term, Workday has to compete against SAP and Oracle, the two down, but definitely not out incumbents, that essentially created the market. While it takes time for these lumbering

giants to move, when they do move, they have the potential to move markets. While we view renewed competition from Oracle and SAP as unlikely, the stock reflects the market's opinion

that it's impossible.

Wedbush analyst Steve Koenig noted that Workday has plenty of interest, but needs more throughput on sales and distribution. He said:

Our ecosystem checks indicate Workday’s low total cost-of-ownership (TCO) and ability to push new technology immediately to its entire customer base continues to confer significant competitive advantage to the company. In addition, we believe Workday's biggest challenge is growing its distribution capacity

and partner ecosystem to meet demand for its offerings. Our checks indicate Oracle and SAP customers are deferring system upgrades as they contemplate alternatives (primarily Workday), and we think this pool of prospects is an order of magnitude larger than Workday can currently fulfill.