Xero’s customers drag accountants to modern technology

Cloud Technology Uptake Case Study: Xero

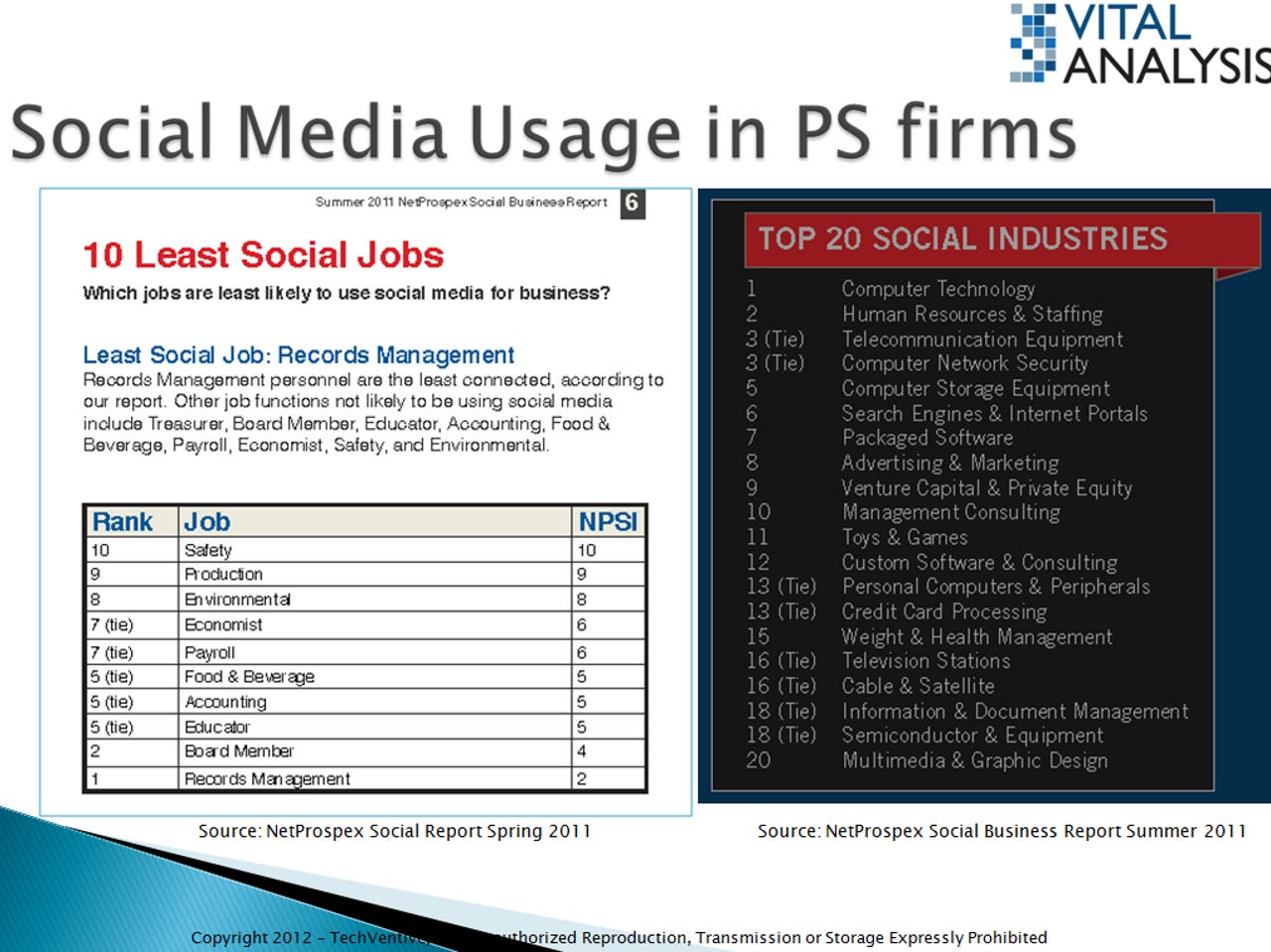

NetProspex famously studied a number of professions to find out which ones are big users of social technology (and which ones aren’t). Accountants tied for fifth from the bottom with food & beverage firms and educators (see graphic below). That’s probably why some accountants’ kids can’t find their parents on Facebook.

I’ve been actively involved in trying to get the accounting industry more clued into modern technology. I’ve testified before the Pathways Commission, spoken at three consecutive American Accounting Association annual meetings, given guest lectures at several universities, etc. From my perspective, this is a profession that loves/lives the past and accommodates change slowly, begrudgingly, if at all.

You can’t mandate that a profession adopt new technology. You can’t shame it into it either. You could give them all iPads but would they do anything with them? I doubt it. No, to get someone to take a flyer on new technology, you have to:

- Make it something that radically improves or changes their profession. Calculators and computers displaced slide rules as they were easier to use and didn’t make mistakes. Once a handful of pioneers in an industry start experiencing greater productivity, efficiency and effectiveness, the rest will follow suit.

- Make it really relevant to their profession. A social network has too thin of a link for some professionals to see value in participating within it. If the relevancy isn’t apparent and significant, adoption stops with the hobbyists.

- Make it complete. Don’t expect someone to adopt a technology if they have to go out and buy a bunch of other services, hardware components, etc. Take the friction out of the sales and adoption processes.

- Make it really simple to try. If it takes 6 IT professionals, 30 outside integrators, a foot’s-worth of manuals, etc. to install (let alone use), it won’t take off or take off quickly. The trial should be as close to free as it gets. It should inflict no pain to the user. Focus on user uptake before focusing on growing share of wallet.

I’ve had a couple of calls recently with New Zealand based Xero. Xero makes a cloud accounting software product that already boasts over 100,000 paying customers in 100+ countries. They’ve amassed this in less than 6 years.

So, how did Xero get this rapid uptake? Well, it appears that:

- Xero makes it really easy for end-users to get the product and then makes it easy for them to find an accountant who uses Xero, too. The Xero website has scores of listings of accountants, bookkeepers, etc. who use Xero to service their clients.

- Xero chooses to partner with firms that their end-users use. They have over 100 relationships with firms like ADP – the massive payroll processor that many small and large firms use.

- They made signup and testing painless. Anyone with a browser and internet connection can try out the software. Like Sonar6 (now part of Cornerstone On Demand) did, Xero isn’t going to fly out a sales team from New Zealand to do a demo, negotiate a contract, etc. Nope. They put every aspect of shopping, contracting and using the solution right on the web. It’s KISS.

- The Xero pricing is low and simple to understand. It goes from free trial to $19- $39/month.

But, Xero appears to have taken this to another dimension. They’ve also:

- Made the software free for accountants to use . (Corrected 10/6/2012)

- Helped accountancies grow their business. As new prospects and customers go to the Xero site to check out the product, Xero is helping to connect these prospects and users to local accountancies.

- Added functionality that allows accountants to annotate the financial records of their clients, in the cloud, and publish these direct to their clients.

So, Xero finds businesses that need an accounting solution. They make it easy for them to try it and buy it. They keep the pricing simple and low. And, then, they make it easy for buyers to find an accountant to work with them. Accountants get into cloud solutions because their clients (and Xero by definition) are making them get with more current technology.

While the point of this post is to showcase how another New Zealand firm is schooling the software world on smart, aggressive cloud uptake, here are some other points I’ve picked up re: Xero.

- Most of their customers are on the $29/month plan.

- They compete in the accounting space that Quicken and some Intacct users occupy. The product appears to be a full double-entry accounting system.

- The software has a fair bit of multi-country capability within it. This is not surprising given its non-U.S. heritage.

- Penetration of the U.K., Europe and Australia/New Zealand markets are high with U.S. market growth now a priority for the firm.

I'll do a more exhaustive examination of the product at a later time.