Yahoo's Q2: Slight miss on revenue target but surpasses EPS goal

Read this

Yahoo has been racking up a serious credit card bill, so to speak, over the last few months, with the acquisition of several social and mobile startups.

But what analysts and investors really want to know is how much the Sunnyvale, California-based corporation brought in on its second-quarter earnings report, published after the bell on Tuesday.

The self-described "technology company" reported a net income of $331 million, or 30 cents per share (statement).

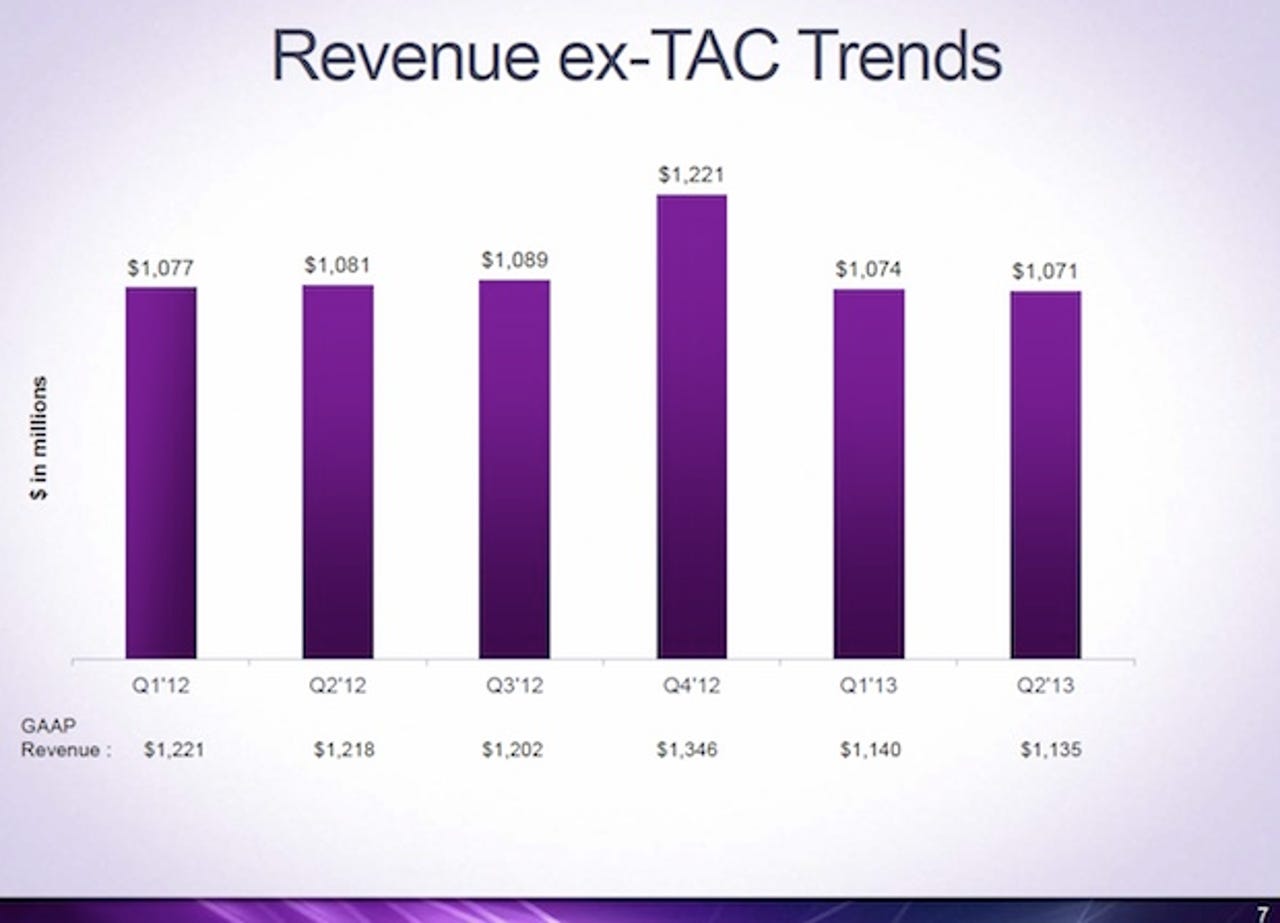

Non-GAAP earnings were 35 cents per share on a revenue of $1.135 billion, including traffic acquisition costs (TAC).

Excluding TAC, Yahoo posted revenue of $1.071 billion.

Wall Street was looking for earnings of 30 cents per share on a revenue of $1.08 billion.

Focusing on nearly a dozen new product upgrades and revamps instead, CEO Marissa Mayer made an initial reflection on the quarter in prepared remarks.

I'm encouraged by Yahoo's performance in the second quarter. Our business saw continued stability, and we launched more products than ever before, introducing a significant new product almost every week. From the new Yahoo News, the new Yahoo Sports app, the redesigned Yahoo search, the new Flickr, the new Yahoo Mail for tablet, the Yahoo Weather app, our new Yahoo app with Summly — this quarter drove tremendous improvements in our product line, and our users responded with increased usage and engagement.

Mayer only called out one acquisition in her statement, but the full list consists of Astrid, Milewise, Loki Studios, Go Poll Go, PlayerScale, Rondee, Ghostbird Software, and (most notably) Tumblr.

Yahoo paid $1.1 billion for Tumblr in May, shortly followed by some controversy among the core user base when the news was revealed.

Such a major deal prompted speculation that Yahoo would go after Hulu next, which at the time was at the center of a rumor-filled bidding war.

But as of last week, Hulu's current ownership coalition of 21st Century Fox, NBC Universal, and The Walt Disney Company is staying put.

For the outlook, Wall Street is expecting Yahoo to deliver a third-quarter revenue of $1.12 billion with earnings of at least 34 cents per share.

Yahoo offered Q3 guidance of $1.06 billion to $1.1 billion in revenue. For the year, Yahoo is projecting revenue to fall between $4.45 billion and $4.55 billion.

More numbers to know from Yahoo's Q2:

Yahoo repurchased 25 million shares for $653 million and used a $1 billion in cash for acquisitions (including a $970 million to acquire Tumblr).

Yahoo has now completed promise to return $3.65 billion from Alibaba Group proceeds to shareholders.

Number of Ads sold (excluding Korea) decreased by roughly 2 percent on an annual basis.

Price per ad (excluding Korea) decreased by 12 percent annually.

In search, paid clicks (excluding Korea) increased 21 percent annually. Price per click (excluding Korea) decreased by nearly 8 percent.

Mayer and Co are expected to follow up with further comments during the quarterly conference call later today at 2pm PT/5pm ET.

UPDATE: Following an update on Q2 financials during the video webcast, Mayer outlined that Yahoo's growth hinges on the following four pillars: Search, mobile, display, and video.

Mayer was frank on some notes, acknowledging that the mobile strategy at Yahoo was "seriously fragmented" ahead of her arrival last year, as well as that search revenues need to grow faster.

She also suggested that analysts can't expect more significant revenue numbers yet, specifying that the fourth quarter is typically Yahoo's strongest.

To back that up, Mayer said Yahoo has eliminated more than 30 products and features to "reinvest" company talent and resources.

Without diving into specifics, Mayer singled out Tumblr as the new asset that has "significant opportunities" across the board.

She asserted, "Yahoo's future is mobile, and we're delivering our products mobile first."

Related article: