A cloud-based cap table for startups

When you're a startup just getting off the ground, big fancy tools simply aren't available to you: either they don't apply to your situation, or your pockets aren't deep enough to swing the expense.

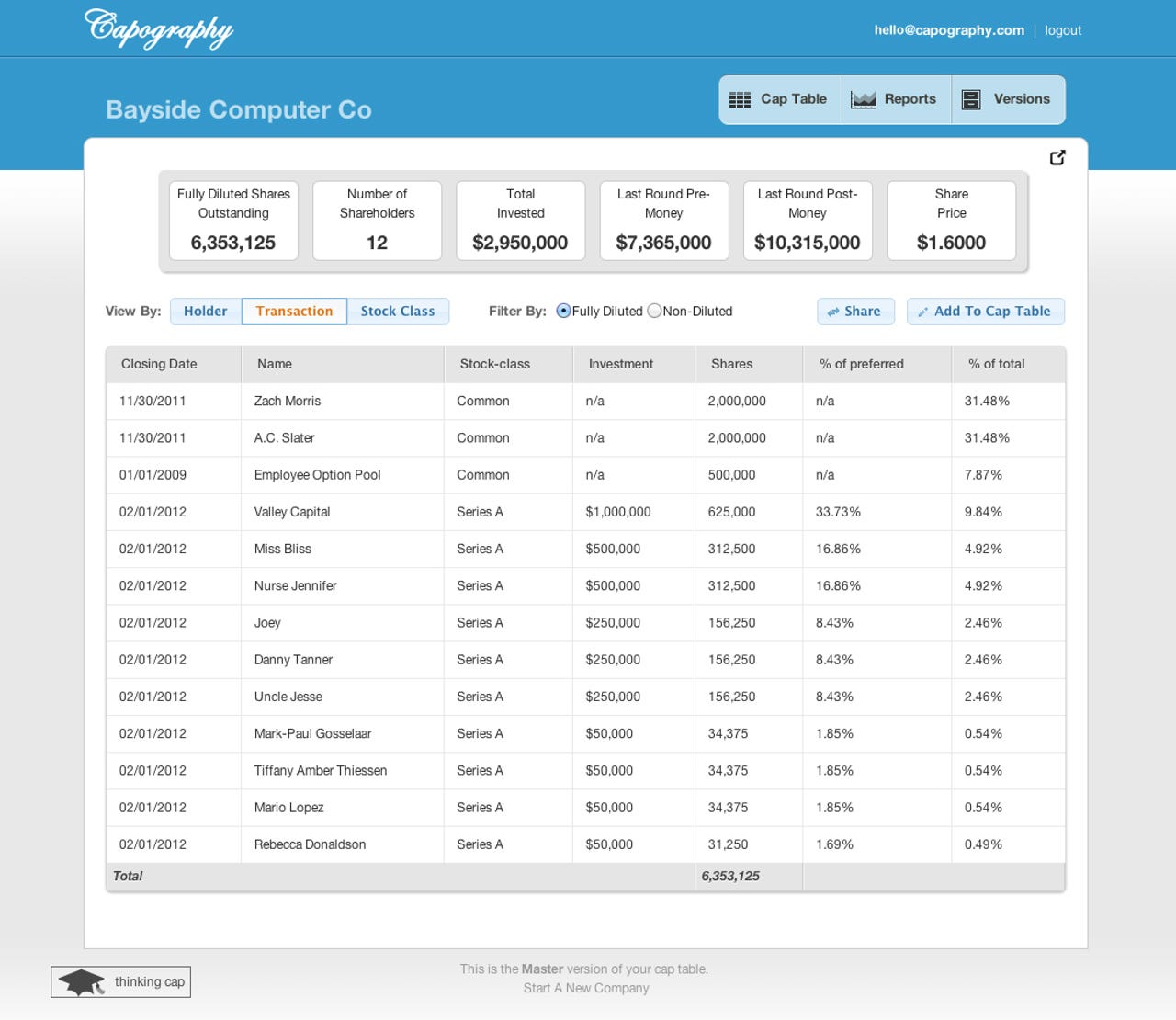

If you're the CFO of a tech startup, that means a lot of mucking around in Microsoft Excel. Including for your capitalization table, or "cap table" for short, which shows who owns how much of the company, and what they paid for it.

Early on, it's pretty simple: you, your best bud and co-founder, and Earl, your pet schnauzer. (What? You thought it would be funny to give the dog a stake. Plus, your other friends wouldn't invest.)

But as your product begins to take off, and you attract more investment, things can quickly become a bit more complicated. Which means a lot of Excel acrobatics for what is otherwise a fairly straightforward need.

Startup Capography aims to bring the cloud-based ease of a product like Mint.com to the inherent ugliness of your cap table spreadsheet.

Founder Tim Raybould -- who serves as CFO of Philadelphia-based TicketLeap when he's not moonlighting as an entrepreneur -- found himself spending an unnecessary amount of time managing his company's cap table in Excel. Frustrated, he took a crash course in coding and, over the course of nine months, managed to construct a purpose-built application that puts one-size-fits-all Excel out to pasture.

"It was solving a problem for me," he said. "At TicketLeap, I had searched a couple times for a better way to do a cap table. I couldn't find anything [appropriate], and I was looking for a project to build. This fit the bill. It was in my wheelhouse."

The resulting service surfaces the most important information you need to negotiate with venture capitalists -- outstanding shares, number of shareholders, total money invested, share price and so forth -- while offering the ability to model different scenarios so you can predict, down to the penny, just how rich you'll be when you achieve runaway success, sell it all and move to Fiji.

"It helps you learn along the way, through the 'Thinking Cap' tool. You can read about [an unknown term] right there," he said. "Also, it's not a blank slate like Excel. This walks you through the process a bit more, like a wizard.

Plus, this being a cloud-based online service -- it's hosted via Amazon Web Services -- you can share it with other team members without a dreaded e-mail attachment that fills up your inbox and gets forked down the road. Instead, you can export the data and version it, to model scenarios.

It's priced at $199 per company per year.

"There's nothing out there that's focused like this. For example, there's something called VCExperts.com, and it's a suite of tools for venture capitalists to value their companies. They have to comply with a certain accounting law to determine the fair value of their investments. It has a cap table. But it doesn't market to founders, and it's very expensive -- $500 a month*.

"There's no standalone cap table website out there like this. There are online cap tables that are part of suites of other projects, but they cost more because of it."

To wit, major league peers CapMx, Two Step and Transcentive offer similar services, but they're not sized for the homegrown startup, and instead target large firms or portfolio managers. (At $240 a year, Equity Table comes the closest to Capography.)

"CapMx is more aligned to what Capography does," he said, "but it's much more expensive."

The product is in its infancy, and there's still more to be done: for one, more granular, tiered sharing profiles are needed to keep certain information confidential; right now, the entire table is shared.

"We're also going to add export to PDF and export to Excel -- so if you send a link around to somebody, they can just download it right there. At TicketLeap, I'd send around the cap table and someone would make changes -- do I send it around again? This keeps everybody on the same page."

The goal is a cap table that won't make your or your co-founders' eyes glaze over. When all your attention is needed elsewhere -- on improving the product, on attracting potential investors, on marketing the company -- that's an upside everyone can agree on. Even Earl.

*Editor's Note: Responding to this figure, VC Experts says its products start at about $500 per year.