AT&T Q1 mixed amid COVID-19, plans more 5G investment as network traffic surges

Special Feature

AT&T said it is seeing unprecedented volumes on its network due to the COVID-19 pandemic as it reported mixed first quarter results.

The telecom and media company reported first quarter earnings and revenue that fell short of expectations, withdrew its outlook due to COVID-19 and said it had enough cash flow to invest in growth areas such as 5G.

AT&T reported adjusted first quarter earnings of 84 cents a share on revenue of $42.8 billion, down from $44.8 billion a year ago. Wall Street was expecting AT&T to report adjusted first quarter earnings of 85 cents a share on revenue of $44.2 billion. AT&T's net earnings in the first quarter were $4.6 billion, or 63 cents a share.

AT&T said that COVID-19 had a $433 million impact on its EBITDA and shaved 5 cents a share from its results in the quarter. The telecom and media company said it took a hit due to lower wireless equipment sales and lower sports-related advertising largely due to the cancellation of the 2020 NCAA Division 1 Men's Basketball Tournament.

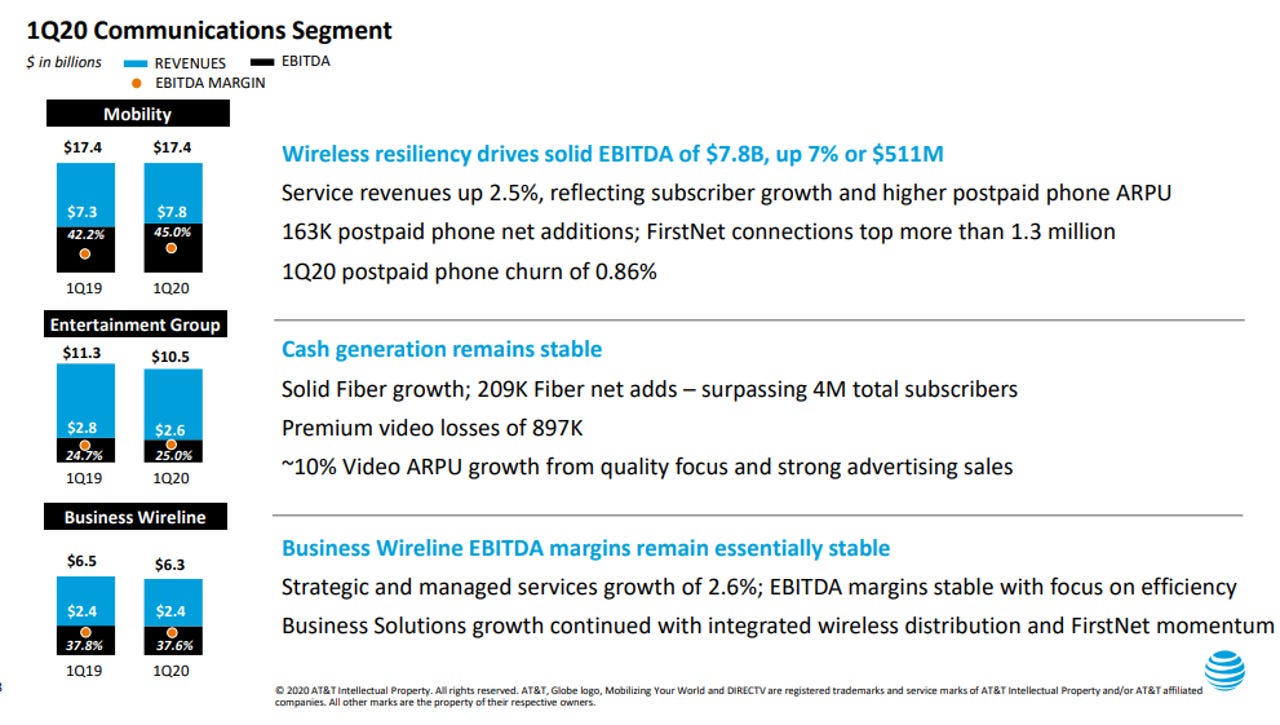

Wireless service revenue showed growth, but video, theatrical and legacy service revenue fell.

In wireless, AT&T said service revenue was up 2.5% with a postpaid phone churn of 0.86%. AT&T added 163,000 postpaid net phone additions. In entertainment, AT&T said it finished the quarter with 18.6 million premium TV subscribers with 897,000 net losses. The company added 209,000 AT&T Fiber connections.

CEO Randall Stephenson said that AT&T's cash position and cash flow will enable it to adjust capital allocation plans and invest in 5G, broadband and HBO Max and pay down debt.