BlackBerry's real first quarter win: Fending off FUD ahead of BES 12

BlackBerry's first quarter results highlighted how the company has managed to cut costs, refocus on the enterprise and begin a turnaround under CEO John Chen. More importantly, BlackBerry's quarter allows the company to fend off fear, uncertainty and doubt from its enterprise mobility management rivals.

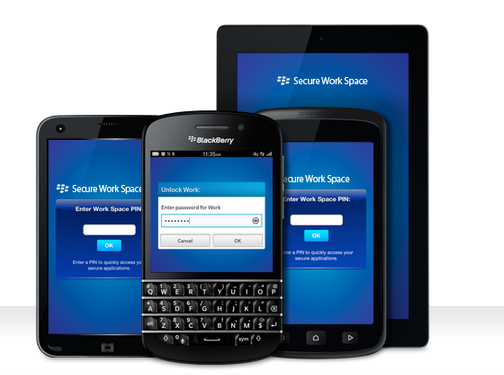

Keep in mind that the enterprise mobility management (EMM) space is a bit of a bloodbath right now. Good Technology has an initial public offerings on deck and MobileIron hit the markets June 12. AirWatch is now owned by VMware. Citrix is in the mix. And then you have BlackBerry, which is transitioning from a hardware to a software and services company, betting its future on BlackBerry Enterprise Server 12. BES12 allows reverse compatibility for companies with older BlackBerry devices in the field and enables enterprises to manage their iOS and Android devices too.

According to analysts, the BES12 launch is critical to BlackBerry's future. BES12, which launches in November, can reposition BlackBerry and restore it as an enterprise stalwart. Let's illustrate how BlackBerry's first quarter upside surprise matter based on a before and after view.

Before BlackBerry's earnings report Wednesday, the company made the following moves:

- The company cut a deal with Amazon to offer its Appstore on BlackBerry's devices. The win-win is that BlackBerry won't have to focus on its app marketplace. BlackBerry users get more apps. "This agreement will allow us to free BlackBerry up and our resources up to go after secure enterprise-class applications," said Chen.

- BlackBerry took on Gartner's Magic Quadrant, which put BlackBerry's EMM tools in the niche category. Gartner said BlackBerry lacks support to manage multi-platform environments. BlackBerry's John Sims, president of enterprise services, blasted Gartner. To be fair though, Gartner's assessment can't include BES12 so BlackBerry has to remain a work in progress.

- And BlackBerry fought back against Good and MobileIron and has generally taken an aggressive tone led by Eric Lai, the company's resident blogger and evangelist. BlackBerry's point: The company has cash and financially speaking is better off than its rivals looking to the public markets.

BlackBerry's QNX: Why it's so valuable to Apple, Google, auto industry

My reaction to those aforementioned items was a bit muted. I appreciate the spunk, but BlackBerry is a "show me" story with its turnaround. Meanwhile, I try to avoid vendor pissing matches. Tech buyers, who have more than a few show-me stories to ponder in the EMM market, are correct to think long and hard about BlackBerry.

Now let's fast forward a day after BlackBerry's first quarter results. Consider:

- BlackBerry reported net income of $23 million, but that was largely due to one-time items. Adjusted operating loss was $60 million. Revenue in the first quarter was $966 million, down a bit from the fourth quarter and well below the $3.07 billion in sales in the same quarter a year ago.

- The company's cash balance grew $400 million to $3.1 billion due to real estate sales and tax returns. That balance sheet boost didn't come from operations, but the extra $400 million is welcome. BlackBerry expects to have a floor of $2.5 billion in cash. There's no death spiral coming.

- BlackBerry should be cash flow neutral to positive by the end of the fiscal year.

- The company continues to wind down its device inventory and TD Securities analyst Scott Penner estimates that BlackBerry's device business can be profitable at 10 million units. A deal with Foxconn will also improve margins.

- BlackBerry expects to have $100 million of BBM revenue in fiscal 2016. QNX also remains an enterprise Internet of things play.

Download IT policies from Tech Pro Research

And on a conference call with analysts, Chen said:

"On the BES front, the enterprise server front, we have a very strong uptick of the EZ Pass program. Over 2,600 customer have registered with us. We have issued 1.2 million plus, meaning more than 1.2 million licenses, and over 10 percent of those licenses were traded in from competitive MDM platforms, most notably from Good Technology and MobileIron. The EZ Pass is important to our future monetization — which included the upselling from the silver license to gold license and the new you value-added service like identity management.

With BES12 we have six beta customer installation completed in Europe and North America and we have six more in the plans, starting July. Feedback has been very positive regarding our features, functionality and stability."

BlackBerry isn't out of the woods yet, but now it has a few numbers to back up its new combative attitude. Going forward, BlackBerry has more ammo to fend off FUD and if it delivers BES12 to a solid reception the company won't as easily be dismissed.