Can Sun's product roadmap convert the skeptics?

Sun Microsystems CEO Jonathan Schwartz may have considered the company's fourth quarter a great one, but his take seems to be a tough sell among analysts.

Sun last night reported fourth quarter earnings of 9 cents a share, or four pennies better than Wall Street expectations. You'd think that this quarter would have been a woo-hoo moment for Sun and its Wall Street followers.

Think again. Analysts were pooh-poohing Sun's 47 percent gross margins because it was due mostly to lower component costs. Factor out those price gains Sun's earnings were about a penny better than Wall Street estimates. Analysts across the board are saying Sun's performance won't last.

"Frankly, lower component costs were the largest element of the increase," said CFO Michael Lehman on Sun's conference call.

And cheap components don't last forever, says JP Morgan analyst Bill Shope. "Component prices and mix were factors here and, of course, the sustainability

of this unusual gross margin strength will be a key issue to consider in coming months," wrote Shope in a research note.

Nevertheless, Sun does appear to be on the right track.

But to be a big Sun believer you have to buy into its upcoming product cycle. Why? The current products aren't doing so hot when it comes to growth.

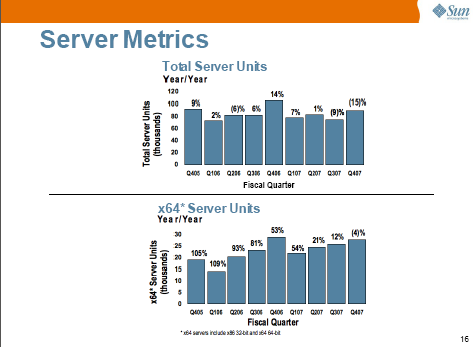

Sun's overall server units fell 15 percent this quarter largely due to weakness in SPARC-based systems. Storage systems fell by 10 percent year over year. Toss in the fact, Sun is a big UNIX player and the worries just increase.

"We continue to fear that a moderation in the

Virtualization also appears to be impacting server sales in the short-term. Schwartz laid out the landscape.

I think just as the market saw a decline of tower servers which were eventually replaced by rack level servers, our view is that the volume of rack level servers will eventually be somewhat displaced by much more highly configured and virtualized larger scale systems, and that is both on the systems side as well as on the storage side.

The good news is that plays to our strength. We’ve got a tremendous amount of intellectual property there, both on the storage design as well as with an operating system that knows how to scale up quite well. So I think we definitely saw a bit of a slowdown in the U.S. specifically, but we also saw an increase in revenue and margin dollars available to us because we have got more, and better, frankly, higher scale systems than the rest of the marketplace. Whether that is on the blade side or on the core computing platform side. So we don’t view this as in the least bit discouraging; I think our view is that in a way the market is going to play to our strength now and we can reflect that with better returns going forward.

So virtualization in the near term looks like it has a depressing impact on units, but our view is that actually contributes to demand for more richly-configured systems. That is what we’ve got, that is where we think we can grow revenue, margin and ultimately units as well.

Schwartz did add that big enterprise class systems appear to be in demand.

Meanwhile, Lehman noted Sun's channel inventory increased in the fourth quarter to top $250 million, up 10 percent from the prior quarter. Sun had thought channel inventory was going to decline.

Now these concerns will be moot if Sun can deliver on its product roadmap, which includes Solaris 10 virtualization features, systems powered by Sun's Niagara 2 processors and other commodity servers. "Coming into FY '08, we have the strongest product road map in the history of the company," says Schwartz.

Here are the new products look the most promising thus far:

"It is clear that any material upside to expectations in FY08 will be the result of strong adoption of its new products (Niagara 2, Intel servers, Victoria Falls, etc) as the company is not planning another major restructuring at this time. If these new products disappoint, Sun will need to be more aggressive in its cost cutting measures," said Credit Suisse analyst Robert Semple.

The trick is going to get those new products ramped up fast enough to offset weakness in legacy server and storage gear. Sun is projecting fiscal 2008 revenue growth in the "low to mid single-digits." With that outlook, analysts like Shope want to see more restructuring from Sun to make the numbers look better.