Canalys: Falling prices breathing new life into laptop market; tablets stumbling

Read more

Another analyst report has emerged supporting observations that the PC market might finally be stabilizing while tablet shipment growth starts to slow for the first time in months.

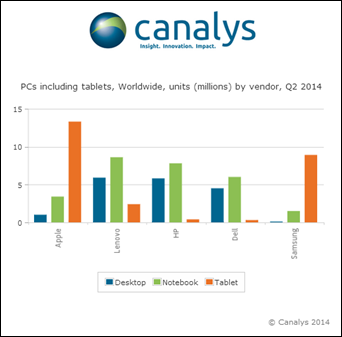

Canalys reported on Monday that 123.9 million PCs shipped worldwide during the second quarter, not much growth sequentially but still up 14 percent year-over-year.

But tablet shipments dropped by roughly five percent to just 48.4 million units shipped globally during the three-month period.

The market research firm called out Apple and Samsung, the two largest tablet manufacturers on the planet, for sharper declines — especially on Apple's part.

The iPad maker shipped under 13.3 million units worldwide during the quarter, which Canalys characterized as Apple's weakest quarter (for tablets) since the first quarter of 2012.

Samsung's quarter wasn't as dramatic, but the Korean tech giant only shipped 8.9 million units in Q2.

Canalys analysts pointed toward different factors behind Apple and Samsung's flailing performance, especially pricing on the former's account.

On the flip side, pricing is what's helping out laptop vendors more and more. According to Canalys, higher prices are keeping Apple from expanding into more markets while lower prices on laptops are opening many more doors finally.

Canalys senior analyst Tim Coulling noted in the report that consumers should expect to see these patterns continue "as Microsoft responds to the increasing threat from Google."

"It has dropped licensing costs on small form-factor tablets and announced 'Windows with Bing,' which will provide Windows for free on low-cost notebooks," Coulling continued. "Falling prices are great for consumers but will do nothing to ease the pain for vendors, whose margins are under constant pressure."

Coulling hinted at a warning for tablet vendors, in particular, suggesting a slump in innovation is what is also hampering the mobile form factor. He explained:

The tablet market has quickly found itself in the same position the notebook market was in some years ago, with minimal increases in hardware performance forming the basis for an argument to upgrade. But when considering the most common tasks that tablets are asked to perform, the need for more horsepower is often not evident. Vendors will need to work harder to give reasons to upgrade if things are to improve in Q3. In addition, as smartphone screen sizes increase, the potential for such products to disrupt the market for 7-inch tablets is also increasing.

Chart via Canalys