Dell aims to diversify away from PCs, but how?

Dell chief Michael Dell said that the company will pursue acquisitions, alter its business mix upstream away from PCs and be an innovator in the data center. The exact game plan, however, was unclear.

Dell's analyst day on Tuesday was designed to show the company's overall strategy, but was short on detail in many areas. After all, why would Dell signal what companies it planned to acquire?

Much of Dell's initial focus was on data center innovation to indirectly counter efforts from the likes of Cisco Systems to retool data centers. Dell didn't mention any rivals by name, but he did note the landscape is changing as vendors like Oracle and Sun converge and new players like Cisco enter the server market (Techmeme).

Dell downplayed "proprietary stacks" and said that talk of next-generation data center models were "overhyped and overdone." "We're not hearing a lot of it in the market place," said Dell. That said "this is really only the start of the evolution of the data center," he noted.

Also see: IT budgets: Shifting by the week?

- Dell: IT demand has stabilized, but margins pinched

- Dell's analyst meeting: Looking for the big vision

From there, Dell went on to talk about simplifying the IT environment and moving up the stack to software and services, but it wasn't clear how exactly Dell would get there. The chart below illustrates how outgunned Dell is on the services front relative to enterprise technology economics.

The big question at the analyst meeting was this: How will Dell diversify from a business that relies primarily on PCs and servers?

CFO Brian Gladden showed a few slides that illustrated the Dell conundrum. The company is garnering 59 percent of its revenue from PCs. In an understatement, Gladden said depending that much on client revenue "is a challenge."

Executives acknowledged that Dell will shift its business, organically and via acquisitions, but timing and specific markets were sparse. How many years will this transformation take? Dell did note that the company's $5.4 billion services unit is larger than folks realize. The rub: Those services are typically field support, help desk and other low margin items. The real dollars are in those big consulting gigs.

Dell executives noted that they would be interested in acquisitions that would scale the services business faster. These deals would focus on intellectual property, technology and in some case headcount. However, it didn't sound like Dell would go for some big bang services deal.

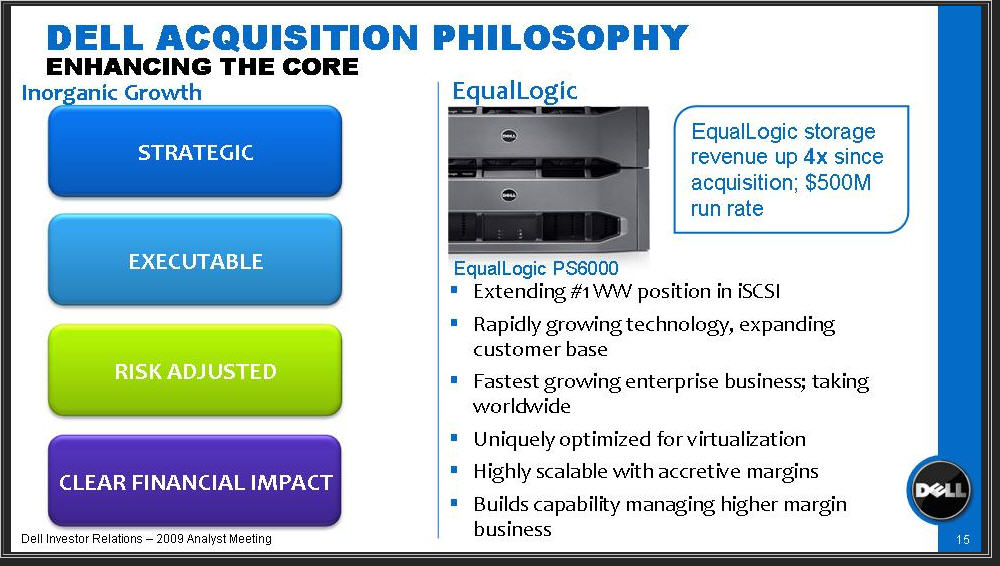

While it's unclear how Dell will break into new markets, Dell did say that "you can expect us to be disciplined with our/your capital." In other words, Dell will pursue more acquisitions like its purchase of EqualLogic, a deal that has paid dividends and boosted growth in the storage market.

On IT spending, Dell said he expected enterprises to "refresh first in storage and servers and then clients."