Downturn dampens Asia's services outlook

The slowing of the U.S. economy and weaker greenback will dampen the consulting and systems integrator (C&SI) market in the region over the next 12 months, according to IDC.

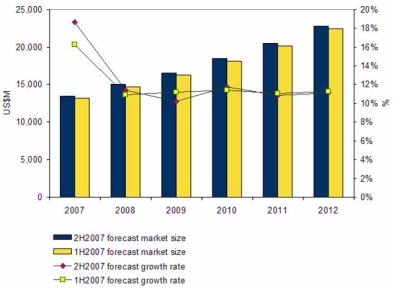

In a statement late Thursday, the research analyst said it has revised downward its growth estimates for the C&SI market in the Asia-Pacific excluding Japan region. IDC now forecasts a 10.2 percent growth rate between 2008 and 2009, down from the previous estimate of 11.2 percent.

The C&SI market in the Asia-Pacific region excluding Japan will grow at a five-year compound annual growth rate (CAGR) of 11 percent from US$15 billion in 2008 to US$22.6 billion in 2012, IDC predicted. In the revised estimates, the analyst pointed to a slight increase in market size for the region.

| C&SI market forecast for Asia-Pacific excluding Japan region |

Source: IDC |

China, Korea and India will be the key drivers of growth for the industry over the next few years. By 2010, China is expected to have the largest contribution to C&SI spend in the region.

Mayur Sahni, IDC's senior market analyst for IT services opportunities research, said: "The key challenge for IT service providers is addressing the evolving buying behavior of CIOs as they question the business value of IT spending in a challenging economic environment.

"In order to be successful, IT service players need to build vertical-specific and business-consulting capabilities into their offerings to gain a favorable perception in the market," he added.