G.fast broadband expected at 29m premises by 2021: Ovum

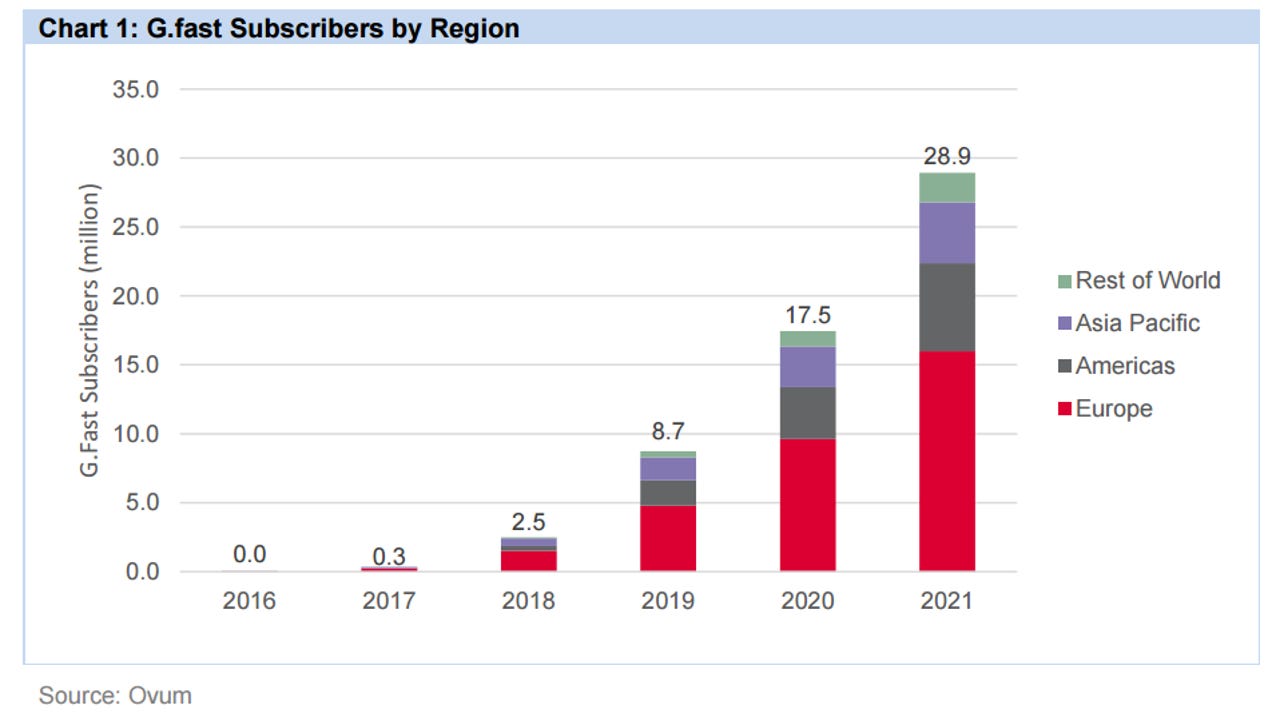

Approximately 29 million premises connected to fixed-line broadband via a combination of new fibre services and legacy copper lines will be enabled by G.fast network technology by 2021, according to a report conducted by Ovum, with the network technology to deliver speeds of up to 500Mbps.

Gigabit Networks: The future of G.fast & XG-FAST Services, commissioned by Australia's National Broadband Network (NBN) company and the United Kingdom's BT, said G.fast is used to enable more bandwidth over existing network assets in order to improve its capacity to compete with more costly fibre-to-the-premises (FttP) networks.

"G.fast is a central component of a FttDP [fibre-to-the-distribution-point] deployment architecture, with fibre deployed deep into the network and the VDSL tail reduced to under 400 metres and, in many instances, under 100m," the report explained.

Australia's NBN is in the second stage of G.fast adoption, having conducted a lab test and a small field trial, along with Cable & Wireless in Panama; Elisa in Finland; Homenet in Norway; Hrvatski Telecom in Croatia; TeliaSonera in Finland; and Windstream in the United States.

Ahead of Australia, having conducted a lab test, a small field trial, and a large field trial, are CenturyLink in the US; Chunghwa in Taiwan; and Bezeq in Israel, while the frontrunners, which have also announced their rollout schedule for the network technology, are BT Openreach in the UK; Energia Communications in Japan; both M-net and NetCologne in Germany; and Swisscom in Switzerland.

AT&T in the US, Deutsche Telekom in Germany, Oi in Brazil, Orange in Poland, Proximus in Belgium, and Tunisie Telecom in Tunisia are also on the board, having conducted lab tests.

According to Ovum, Western European markets will deploy G.fast more "aggressively" than elsewhere in the world due to the European Commission's target of connecting 50 percent of all premises with speeds of 100Mbps or higher by 2020.

Around 11 percent of broadband services in this region are forecast to be delivered via G.fast within the next five years, with BT, Swisscom, Deutsche Telekom, Telekom Austria, and Proximus customers making up 45 percent of all broadband subscribers in Western Europe.

"Other regions are expected to [be] less aggressive in deploying G.fast, with only 3 percent of broadband services in other market[s] migrating to the platform. Across these regions, the share of fixed broadband subscribers will range between 1 percent and 4 percent."

Latest Australian news

Competition from hybrid fibre-coaxial (HFC) companies, which are looking to deploy DOCSIS 3.1 for speeds of up to 1Gbps across old cable TV lines, is also spurring on the adoption of G.fast for fibre/copper operators, Ovum explained.

BT's Openreach division is expected to launch the first commercial G.fast services next year. An extension to its current pilot of the technology will see another 140,000 premises obtain access to G.fast by March 2017.

"Our aim is to make ultra-fast broadband available to 12 million homes and businesses in the UK by the end of 2020, and we're embracing a mix of technologies with G.fast and FttP to achieve that," said Openreach CEO Clive Selley.

"We have pioneered G.fast in our labs, driven the global standards, and have been working closely with our communications provider customers on the trials, so we're very excited that it's time to start rolling this technology out nationwide.

"The great thing about G.fast is that allows us to deliver affordable ultra-fast speeds to customers quickly and at scale."

BT's field trials have seen average speeds of 330Mbps delivered, with 10 million premises to be connected by G.fast by 2020. The remaining 2 million UK premises will be connected with FttP.

In Taiwan, Chunghwa Telecom has deployed G.fast over single-port units with line lengths of under 200m, enabling speeds of 500Mbps down and 250Mbps up. 55 percent of the 8.4 million-premises Taiwanese market is connected by FttX, 21 percent by cable, and the remaining 24 percent is xDSL.

Swisscom in Switzerland has also announced that it will be using G.fast for its fibre-to-the-street (FttS) rollout, also over 200m line lengths. The first G.fast FttS customers will be switched on by the end of this year, with possible speeds to increase from 100Mbps to 500Mbps.

"Swisscom has accelerated its rollout, with 2016 capital expenditure increasing nearly 40 percent to CHF 2.4 billion," Ovum reported.

Swisscom's field trials, conducted in April last year and involving 100 end users, saw average download speeds of 285-402Mbps and upload speeds of 85-109Mbps.

In Australia, NBN in October 2015 attained speeds of 522Mbps down/78Mbps up during a trial of G.fast fibre-to-the-basement (FttB) technology over a 100m copper line.

In August this year, NBN also announced that it is trialling XG-FAST technology with Nokia, the next iteration of G.fast, with hopes of reaching aggregate speeds of between 5Gbps and 8Gbps.

NBN is the third operator in the world to test XG-FAST in lab trials, following BT and Deutsche Telekom. BT attained speeds of 5.8Gbps over 35m of copper, while Deutsche Telekom saw 8Gbps speeds over 50m of copper.

NBN is currently slated to roll out FttDP to 700,000 premises. The 2017 Corporate Plan also revealed a base case of 2 million or 17 percent of premises will be covered by FttP; 6.1 million or 51 percent by FttN/B/DP; 2.8 million or 24 percent by HFC; and 1 million or 8 percent by fixed-wireless or satellite.