Google multi-billion dollar risks in 2007

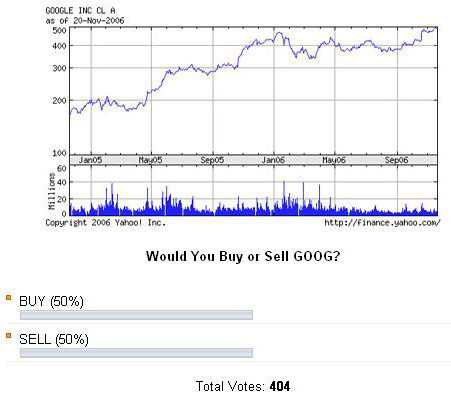

GOOG passed the symbolic $500 mark on November 21, 2006 (see “GOOG @ $510: Do you buy or sell?”).

One month later, GOOG closed 10% down off of its all-time high, but at still more than a 400% appreciation from its IPO price of $85 a share in 2004.

Digital Markets readers are split down the middle on the future of GOOG: “Would you buy or sell GOOG” poll garnered more than 400 voters, but a split decision.

Will GOOG continue its currrent downward descent in 2007 or will GOOG take 2007 by storm en route to $600 and beyond?

Contrary to general public perception, Google is not guaranteed to win at all it undertakes. Google is only winning at one thing at present: Search and the monetization of search services, as I put forth in “Google’s ‘1 percent’”.

If Google is to continue to “win,” it must diversify beyond search as well as perpetuate its gains in the monetization of search.

In 2007, Google faces challenges to its core search business model and also to its diversification initiatives.

GOOGLE 2007 CORE BUSINESS MODEL RISKS

SEARCH MONETIZATION

Sergey Brin, Founder and President of Technology, expressed unbridled optimism in Google’s ability to drive ever increasing search advertising profit margins at the Q3 earnings call:

Because we have reached a certain kind of scale, the tools and resources we have at our disposal now to really do an even better job of bringing the right advertisements to the right users at the right time is far greater. There are new kinds of things that we couldn't have even contemplated doing in the past…we seem to be able to produce new ways to monetize all the time. So I don't see an obvious ceiling.

In “Google CEO Eric Schmidt on recession, competition: Google makes more money,” I recount my discussion with CEO Eric Schmidt last August about advertisers’ willingness to continuously bid up the prices they pay for participation in AdWords.

I asked Schmidt if he was concerned that there might not come a day when advertisers object that Google’s outsized gross margins are achieved at the advertisers’ expense and, subsequently, decide to revert to advertising purchase behavior more aligned with their own interests, that is to bid down prices to achieve higher ROI.

My prediction is coming to pass, as I present in ““Travelocity to Google: Stop dissing multi-million dollar ad clients!”:

Jeff Glueck, Travelocity, put forth a business case for why keyword-based search advertising 1) embodies the law of diminishing returns, 2) is not self-funding and 3) is not inherently “golden”…Glueck told his fellow advertisers that if they succumb to Google’s self-motivated sales pitches they may end up destroying shareholder value and end up risking their own year-end company bonuses!

Search advertiser empowerment puts Google’s search advertising gold mine at risk; Advertisers will not knowingly enrich Google shareholders at the expense of their own.

"FAIR USE" GAMBLE

In “Google’s $2 million Stanford ‘fair use’ underwriting” I discuss how Google is forging ahead in its misssion to codify its "right" to perpetuate a $150 billion market cap business model based on selling ads against content it has not compensated IP owners for and that it has no explicit legal right to exploit commercially.

In “Google ’safe harbor’: ‘Nice’ way to do business?” I discuss Google’s reliance on a legal war chest to do battle in courts with the aim of establishing a body of legal interpretation favoring a free content for Google business model, at both Google and newly acquired YouTube. Schmidt is cited defending the Google “fair use” and "safe harbor” content modus operandi:

I've learned that the law is not as crisply defined in this area as you might want. So in our case, we've analyzed this pretty carefully…Reasonable people can disagree with that, but that is our view and we spent a lot of time on it. And I don't think we're going to change our tune on that.

Reasonable people are not only disagreeing, they are taking Google to court to defend their content ownership and exploitation rights and developing proprietary Web-based systems to protect their interests.

The Internet Archive is the most recent example:

More great libraries are deciding to go open rather than agree to perpetual restrictions on digital versions of their holdings…Brewster Kahle, Director and Co-Founder,: Google is so good at the media being their PR machine, that you would not know there was an alternative out there. We have brand name institutions going open and foundations like the Sloan are funding (us). It shows that the Open Content Alliance is viable, that there is support for public interest. We don't have to privatize the library system (as cited by CNET).

CLICK FRAUD

In, “Google and click fraud: As wholesome as milk?” I underscore that Google’s principal public stance on click fraud is a PR effort under the tutelage of Shuman Ghosemajumder:

Just as consumers rely on third party regulatory oversight for verification of milk freshness, however, so must Google AdWords customers demand third party oversight of Goggle’s accounting for clicks, as I have often underscored at this Digital Markets blog.

Google was sued in 2005 (Lane’s Gifts v. Google) over click fraud and entered into a $90 million settlement last July; The plaintiff alleged that Google “was unjustly enriched by collecting revenue for invalid clicks.”

A court authorized independent analysis of Google’s accounting for invalid clicks was prepared in conjunction with the case, as I present and analyze in “Court expert on CPC model: ‘inherently vulnerable to click fraud’” and “Click fraud: are advertisers sufficiently protected?”

The document, “Lane’s Gifts v. Google Report”, was written by Dr. Alexander Tuzhilin, Professor of Information Systems at NYU. He summarizes:

It is hard for me to arrive at any definitive conclusions beyond any reasonable doubt…that Google’s invalid click detection methods ‘work well’ and remove ‘most’ of the invalid clicks—the provided evidence is simply not hard enough for me, and I am used to dealing with much more conclusive evidence in my scientific work.

The most recent evidence put forth publicly by Google in defense of its efforts to combat click fraud was an in-house marketing style PowerPoint presentation, as I discuss in “Google and click fraud: As wholesome as milk?”

2007

Click fraud concerns will not go away, despite Google’s best PR efforts and Google will continue to battle content owners in 2007 over fair or unfair use of IP property. The new year may also bring more frustrated AdWords customers to the fore, protesting escalating keyword prices.

Google’s triple risk play—Search Monetization, Fair Use and Click Fraud—marks 2007 as a multi-billion dollar high stakes year for Google.

PART II: GOOGLE MULTI-BILLION DOLLAR BETS IN 2007

MORE GOOGLE 2006-2007 ANALYSIS:

GOOGLE PRODUCT HITS & MISSES IN 2006

GOOGLE 2007: MORE GOOGLERS BLOGGING?