Business

How the three biggest PC OEMs are facing an uncertain future

Lenovo, HP, and Dell are increasing their collective dominance of the PC market, with Apple as the only threat. So how are the three big OEMs coping with sweeping changes in the computing landscape?

Lenovo, HP, and Dell have been occupying the top three spots on the PC market-share leader boards for years, and their collective hold over that market seems to be getting stronger.

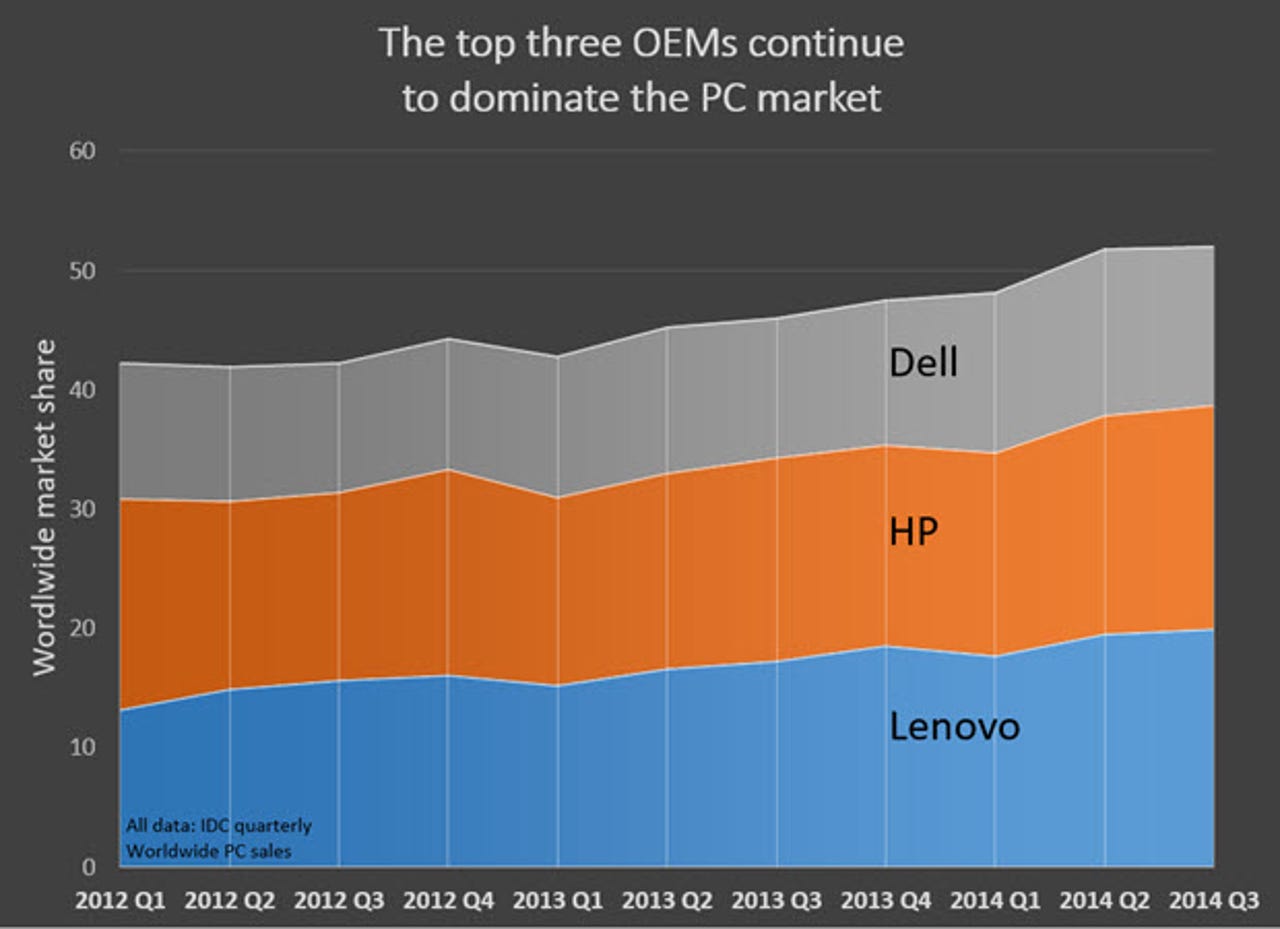

According to IDC, the three top PC makers accounted for 44.3 percent of the total PC market in the final quarter of 2012. That collective percentage has been going up, quarter by quarter. At the end of 2013 it was 47.6 percent. Heading into the final quarter of 2014 (Q4 numbers aren't yet available), the top three accounted for 52.1 percent of all PCs sold worldwide.

Ed Bott/ZDNet

The only other PC maker that has a chance of breaking into that exclusive club - a good one, in fact - is Apple, which made it into the top five last year and could well challenge Acer for the number-four spot when Q4 sales are reported at the end of this month.

Despite dire death-of-the-PC predictions a few years ago, PC sales totals have stayed relatively high. If IDC's final numbers match their prediction, PC OEMs, including Apple, will have sold well over 300 million PCs in 2014.

Of course, the 80/20 rule applies to this big market. Four out of five of those PCs are mostly undifferentiated desktops and portables, stamped from the same cookie cutters. These commodity products, with average selling prices that appear to be trending down, are used in homes and businesses where buyers are motivated by price above all else.

The real innovation, and the main opportunity for profit, is in the premium segments, especially in high-end mobile devices. If that segment makes up 20 percent of the market, that leaves some 60 million opportunities for higher-priced devices, with Apple accounting for roughly 20 million of them and premium Windows PCs (at an average selling price considerably lower than Apple's) making up the rest.

And there's no guarantee that those lofty numbers will continue to remain steady or even drop slowly. It's still possible that the bottom could fall out of the PC market as the XP upgrade cycle winds down, as tablets replace PCs for many commercial tasks, and as consumers in emerging markets skip PCs entirely in favor of phones.

CES is one opportunity when all three companies get to show off their entire product line and introduce a new product or two. Last week, I talked to executives from each of the big three PC OEMs about their latest offerings and about their plans for 2015 and beyond.

Lenovo: Fittest of the fit

"It's been a good year for us," David Roman, Lenovo's senior vice president and chief marketing officer, told me.

That's an understatement. Lenovo has been a growth machine for the past few years, going from 13.2 percent of the PC market at the beginning of 2012 to 20 percent at the end of 2014, firmly taking over the top slot from HP. In 2014, Roman says Lenovo sold its 100 millionth ThinkPad, a major milestone indeed.

At the top of Lenovo's lineup is the aptly named Yoga convertible line. At CES this year, the company introduced the Yoga 3 in 11-inch and 14-inch models (the larger model is shown here).

In a slew of announcements at CES, Lenovo introduced two "Lighter Than Air" LaVie Z 13-inch notebooks, one a conventional laptop weighing in at 1.72 pounds, the other a convertible that tips the scales at just a few feathers over 2 pounds.

There's also a new ThinkPad Yoga aimed at the professional buyer. In this case, Roman says, Yoga is a feature, secondary to the ThinkPad brand: "When someone buys a ThinkPad they are buying a ThinkPad first and foremost. The Yoga functionality gives it the extras."

A trip through Lenovo's booth at CES or at the Fall IFA show in Berlin can be dizzying, because the company has so many products at so many price points. That's a key to company's success, says Roman: "A very strong supply chain allows us to reduce costs and therefore prices. We keep costs down across the board, using innovation tactically to come up with things that are new and different and add value."

Expect more of that strategy from Lenovo in 2015, with premium products like the Yoga and ThinkPad series to set perceptions and a broad enough product line to capture price-sensitive buyers as well.

HP: Back from the brink

In 2011, HP dropped a bombshell with the surprise announcement that it was getting out of the PC business completely. The company quickly reversed that decision, and two CEOs later it is firmly back in the PC game.

I spoke with Mike Nash, a former Microsoft executive who has run the consumer PC category for HP for the past two years. HP's not-so-modest goal, according to Nash, is "reinventing the PC category."

At a PC show in Asia two years ago, Nash said, you could look around the hall and not tell who was who unless you zoomed in for a close-up. So the traditionally boring HP designs went by the way, replaced in the consumer space by some boldly different designs, including the ultra-small Pavilion Mini desktop (starting price $320) introduced at CES this year.

That new desktop comes on the heels of the colorful Stream laptop series. And what they all have in common is startlingly low prices. The Stream 11 starts at $199. The Stream Mini (a similarly colorful variant of the Pavilion Mini) starts at under $200.

If that sounds like a race to the bottom, you need to look more closely. HP is playing in the same space as Lenovo, trying to spread its chips across the entire table. So it has a new high-end Omen laptop for gamers, with a Core i7 quad-core CPU and Nvidia graphics at $1499.

At CES HP was also showing off a slew of hybrids and convertibles, including the Pavilion X360, a low-cost Yoga-like 11-inch convertible, and a pair of higher-end Envy X2 devices with Core M processors and detachable keyboards.

It's not entirely clear that HP can succeed at reinventing an entire category, but for now at least it has carved out a much more distinct identity with its new industrial designs.

Dell: Strictly business

The days of "Dude, you're getting a Dell" are long gone.

In 2014, founder Michael Dell took the company private. "As a private company," he said, "we can be bold. We were public for 25 years, and there everything you do you think about how it impacts the quarter." The new, no-longer-public Dell is much more focused on the enterprise, although it hasn't completely left consumers behind.

I spoke with Dell's Donnie Oliphant, who runs the XPS line and proudly pointed out the latest XPS 13, debuting at CES and shown here.

It's a stunning machine, amazingly small and light, with a 13-inch high-resolution (or even quad-resolution) display packed into an edge-to-edge design with almost no bezel.

For business buyers looking for ultramobile laptops, this is obviously on the short list. But Dell sees hybrids and convertibles as key to the next generation.

"The future is definitely some sort of 2-in-1 device," he told me. The new XPS 11, introduced at CES, has the same 360-degree hinge popularized by Lenovo's Yoga. The benefit of that design is cost. Other designs might be more functional, such as Dell's XPS 12 with its rotating aluminum hinge. Unfortunately, those designs are also prohibitively expensive.

Based on what Oliphant told me, we can expect to see more convertibles from Dell later this year, mostly in the 13-inch and under screen sizes. And a lot of innovation will be possible with new I/O options, including USB Type C and external graphics.