HP CEO Mark Hurd resigns amid sexual harassment investigation; Company raises full year guidance

Updated: HP said today that Chairman, President and Chief Executive Mark Hurd has resigned, effective immediately, surrounding the investigation of a sexual harassment claim. The company appointed CFO Cathie Lesjak, a 24-year veteran of the company, as CEO on an interim basis.

In a statement, the company said:

Hurd’s decision was made following an investigation by outside legal counsel and the General Counsel’s Office, overseen by the Board, of the facts and circumstances surrounding a claim of sexual harassment against Hurd and HP by a former contractor to HP. The investigation determined there was no violation of HP’s sexual harassment policy, but did find violations of HP’s Standards of Business Conduct.

HP said that Hurd tried to hide expense reports, which were not material to the company, that would have revealed his relationship with the contractor. Hurd will get a $12.2 million separation package and the right to exercise vested and restricted stock units.

Also: HP after Hurd: May the CEO guessing game begin

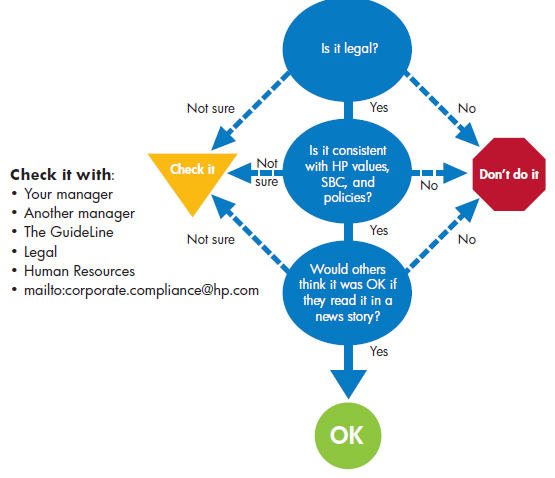

- HP ousts CEO - Hurd Fails 'The Headline Test'?

- CBS News: Hurd Scandal Just the Latest Episode in HP's Peyton Place Annals

Hurd said:

“As the investigation progressed, I realized there were instances in which I did not live up to the standards and principles of trust, respect and integrity that I have espoused at HP and which have guided me throughout my career. After a number of discussions with members of the board, I will move aside and the board will search for new leadership. This is a painful decision for me to make after five years at HP, but I believe it would be difficult for me to continue as an effective leader at HP and I believe this is the only decision the board and I could make at this time. I want to stress that this in no way reflects on the operating performance or financial integrity of HP.”

Indeed, Hurd failed HP's headline test listed in its business conduct brochure.

The release was issued just after the financial markets closed on Friday and the company put together a brief, short-notice conference call for the press. During that call, chief counsel Mike Holston referenced a former marketing assistant, who was not employed by HP, and Hurd and also referenced improper expense reports charged to the company. He would not provide any details about the woman, noting that she has chosen to not come forward.

Asked specifically if the company would pursue civil charges against Hurd, Holston said that the board and Hurd entered into an agreement related to his exit. Pressed further on whether that agreement included references to civil suits, Holston replied that there has not been any litigation filed. He did not elaborate.

Holston, during his introduction of Lesjak, said that the board has "complete confidence [in Lesjak] to lead the company during this transition." Lesjak, 51, is a 24-year veteran of the company who has served as HP’s CFO and as a member of the company’s Executive Council since January 2007.

On the call, Lesjak said that she "has never been more confident in the company's future."

Andreessen at the center of HP's future

Hurd's abrupt departure puts Marc Andreessen, who sold Loudcloud to HP, at the center of HP's future. Andreessen will be a key player in HP's CEO search. On conference calls with press and analysts, Andreessen couldn't say much.Andreessen's message kept to the company line that HP wouldn't miss a beat and had a strong management bench. He added that internal and external candidates would be considered. HP was looking for a CEO with "strong leadership and strong operating skills," said Andreessen, who added that the goal was to find a "great CEO for this great company."

The company also announced that a committee of the board has been established to conduct a search for a new CEO. The committee will consist of Andreessen, Lawrence T. Babbio, Jr., John H. Hammergren, and Joel Z. Hyatt. The company would not elaborate on whether it had any specific candidates in mind, noting that Lesjak has taken herself out of consideration but that she will stay in the role until the selection process is complete. The company said that it will consider candidates from both inside and outside the company and that the selection of a new board chairman would occur at the same time as the CEO decision.

HP: Bigger than Hurd?

On a conference call with analysts, Lesjak portrayed a company that was pursing a strategy. She said that Hurd didn't drive everything, but the talent of 300,000 employees did. "I don't think you'll see us miss a beat on this," she said. "Fundamentally our strategy isn't changing."Lesjak added that HP had many competitive advantages over rivals to exploit.

What's unclear is whether Wall Street will buy that argument.

HP has multiple moving parts. For starters, HP is integrating the acquisition of Palm. It is also looking to take on IBM on services. On another front, HP is taking on Cisco Systems in the networking space.

Lesjak said that HP has a rolling three-year plan. It is holding its analyst meeting with Wall Street as planned with or without a new CEO.

Calming Wall Street worries

In a move to allay Wall Street concerns - Hurd was responsible for giving HP financial discipline and multiple solid quarters of performance - the company preannounced strong third quarter earnings.The company projected earnings of 75 cents a share on revenue of $30.7 billion, up 11 percent from a year ago. Non-GAAP earnings will be $1.08 a share. Earnings were hit by a 2 cents a share charge to settle a lawsuit with the Department of Justice. Wall Street was expecting earnings of $1.06 a share on revenue of $30 billion.

For the fourth quarter, HP also raised its outlook. HP sees revenue of $32.5 billion to $32.7 billion. Earnings will be $1.03 a share to $1.05 a share. Non-GAAP revenue will be $1.25 a share to $1.27 a share.

And for the year, HP sees revenue of $125.3 billion to $125.5 billion with earnings of $3.62 to $3.64 a share. Non-GAAP earnings will be $4.49 a share to $4.51 a share. Those targets top Wall Street expectations.

The message from HP is that the company is firing on cylinders. However, Wall Street looks ahead and Hurd's abrupt resignation is jarring. The next CEO walks into a good situation, but will have big shoes to fill.

Asked why the company chose to raise the financial outlook for the company while also announcing the resignation of the CEO, Lesjak replied that it was important to note that the Hurd's resignation and the investigation into his actions have "nothing to do with the operational performance of the company... That's all about Mark's behavior and judgment."

Previous coverage:

- HP earnings: Solid second quarter and better full-year outlook

- HP CEO Mark Hurd talks datacenters, networking and Palm

- Did HP save Palm with acquisition? Or did it save itself?

Here's the full statement from HP:

HP CEO Mark Hurd Resigns; CFO Cathie Lesjak Appointed Interim CEO; HP Announces Preliminary Results and Raises Full-year Outlook

PALO ALTO, Calif. -- HP today announced that Chairman, Chief Executive Officer and President Mark Hurd has decided with the Board of Directors to resign his positions effective immediately.

The Board has appointed CFO Cathie Lesjak, 51, as CEO on an interim basis. Lesjak is a 24-year veteran of the company who has served as HP’s CFO and as a member of the company’s Executive Council since January 2007. She oversees all company financial matters and will retain her CFO responsibilities during the interim period.

Hurd’s decision was made following an investigation by outside legal counsel and the General Counsel’s Office, overseen by the Board, of the facts and circumstances surrounding a claim of sexual harassment against Hurd and HP by a former contractor to HP. The investigation determined there was no violation of HP’s sexual harassment policy, but did find violations of HP’s Standards of Business Conduct.

A Search Committee of the Board of Directors has been created, consisting of Marc L. Andreessen, Lawrence T. Babbio, Jr., John H. Hammergren, and Joel Z. Hyatt, which will oversee the process for the identification and selection of a new CEO and Board Chair. HP’s lead independent director, Robert Ryan, will continue in that position.

Hurd said: “As the investigation progressed, I realized there were instances in which I did not live up to the standards and principles of trust, respect and integrity that I have espoused at HP and which have guided me throughout my career. After a number of discussions with members of the board, I will move aside and the board will search for new leadership. This is a painful decision for me to make after five years at HP, but I believe it would be difficult for me to continue as an effective leader at HP and I believe this is the only decision the board and I could make at this time. I want to stress that this in no way reflects on the operating performance or financial integrity of HP.”

“The corporation is exceptionally well positioned strategically,” Hurd continued. “HP has an extremely talented executive team supported by a dedicated and customer focused work force. I expect that the company will continue to be successful in the future.”

Robert Ryan, lead independent director of the Board, said: “The board deliberated extensively on this matter. It recognizes the considerable value that Mark has contributed to HP over the past five years in establishing us as a leader in the industry. He has worked tirelessly to improve the value of HP, and we greatly appreciate his efforts. He is leaving this company in the hands of a very talented team of executives. This departure was not related in any way to the company’s operational performance or financial condition, both of which remain strong. The board recognizes that this change in leadership is unexpected news for everyone associated with HP, but we have strong leaders driving our businesses, and strong teams of employees driving performance.”

“The scale, global reach, broad portfolio, financial strength and, very importantly, the depth and talent of the HP team are sustainable advantages that uniquely position the company for the future,” said Lesjak. “I accept the position of interim CEO with the clear goal to move the company forward in executing HP’s strategy for profitable growth. We have strong market momentum and our ability to execute is irrefutable as demonstrated by our Q3 preliminary results.”

Lesjak has taken herself out of consideration as the permanent CEO but will serve as interim CEO until the selection process is complete. Candidates from both inside and outside the company will be considered. The selection of a new chairman will occur in conjunction with the CEO decision.

The company does not expect to make any additional structural changes or executive leadership changes in the near future.

HP announces preliminary third quarter results; raises full-year outlook for revenue and non-GAAP EPS

HP is announcing preliminary results for the third fiscal quarter 2010, with revenue of approximately $30.7 billion up 11% compared with the prior-year period.

In the third quarter, preliminary GAAP diluted earnings per share (EPS) were approximately $0.75 and non-GAAP diluted EPS were approximately $1.08. GAAP and non-GAAP EPS were negatively impacted by $0.02 pertaining to one-time charges relating to the previously announced U.S. Department of Justice settlement. Non-GAAP diluted EPS estimates exclude after-tax costs of approximately $0.33 per share, related primarily to restructuring, amortization of purchased intangible assets and acquisition-related charges.

For the fourth fiscal quarter of 2010, HP estimates revenue of approximately $32.5 billion to $32.7 billion, GAAP diluted EPS in the range of $1.03 to $1.05 and non-GAAP diluted EPS in the range of $1.25 to $1.27. Non-GAAP diluted EPS estimates exclude after-tax costs of approximately $0.22 per share, related primarily to restructuring, amortization of purchased intangible assets and acquisition-related charges.

For the full year, HP now expects revenue in the range of $125.3 billion to $125.5 billion. FY10 GAAP diluted EPS is expected to be in the range of $3.62 to $3.64 and non-GAAP diluted EPS in the ranged of $4.49 to $4.51. FY10 non-GAAP diluted EPS estimates exclude after-tax costs of approximately $0.87 per share, related primarily to restructuring, amortization of purchased intangibles and acquisition-related charges.

HP plans to release its final results for the third fiscal quarter on Thursday, Aug. 19, 2010, with a conference call at 6 p.m. ET/3 p.m. PT to provide additional details.