HP delivers strong third quarter fueled by blades, international, notebooks

HP on Tuesday reported fiscal third quarter earnings of $2 billion, or 80 cents a share, on revenue of $28 billion, up 10 percent from a year ago. Excluding items, HP reported earnings of 86 cents a share, 3 cents ahead of Wall Street estimates.

Revenue also topped Wall Street expectations of $27.4 billion, according to Reuters Thomson Financial. In the same quarter a year ago, HP reported earnings of $1.8 billion on revenue of $25.4 billion.

The company also upped its fiscal fourth quarter outlook (statement). HP projected revenue of $30.2 billion to $30.3 billion with earnings of 95 cents a share to 97 cents a share. Excluding items, HP projected earnings of $1.01 a share to $1.03 a share. Those targets were in line to slightly above Wall Street estimates.

HP said the EDS deal will close later this month. HP said there will be an analyst meeting Sept. 15 to update guidance.

CEO Mark Hurd said that HP had strong enterprise growth and noted the company can "continue to meaningfully expand earnings."

On a conference call, Hurd said the EDS integration is underway, cost savings initiatives are working well and the HP continues to deliver strong execution. Other items:

- Average selling prices in printing were "stable."

- There's a lot of pressure on CIOs to make infrastructure changes and that plays into HP's portfolio.

- Currency--the dollar is getting stronger relative to the euro--is a wild card for HP. The weak dollar has helped HP given that most of its sales are international. Even with currency fluctuations Hurd said he was confident about the earnings range HP provided.

By the numbers:

- Inventory was $8.2 billion, down 3 days from a year ago. Accounts receivable was up 2 days from a year ago to $13.8 billion.

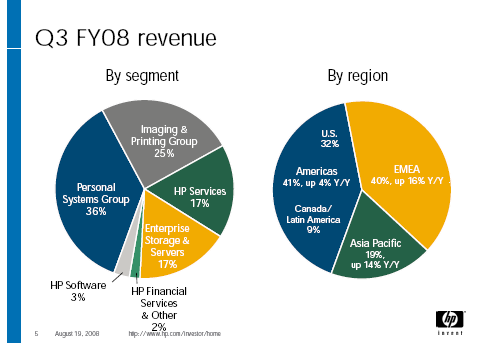

- Revenue from outside the U.S. was a whopping 68 percent of total sales at HP.

- Revenue in the Americas was up 4 percent from a year ago to $11.6 billion. Europe, Middle East and Africa sales were up 16 percent to $11.2 billion. Asia Pacific sales were up 14 percent to $5.2 billion.

- Personal systems group revenue was up 15 percent to $10.3 billion and unit shipments jumped 20 percent. Notebook revenue surged 26 percent, but desktop sales were up 6 percent. Commercial sales were up 15 percent from a year ago and consumer revenue was up 17 percent. Operating profit was $587 million, up from $519 million a year ago.

- Enterprise storage and server revenue was up 5 percent from a year ago to $4.7 billion. Revenue from blade servers was up 66 percent with storage growing 16 percent. Operating profit was $544 million, up from $507 million a year ago.

- The imaging and printing unit had revenue of $7 billion, up just 3 percent from a year ago. Consumer revenue fell 14 percent and commercial sales fell 5 percent. The division is still a cash cow. Operating profit was $1 billion, up from $981 million a year ago.

- HP services revenue was up 14 percent from a year ago to $4.8 billion. Operating profit was $574 million, up from $417 million.

- Software revenue was up 29 percent to $781 million with an operating profit of $122 million, up from $51 million a year ago.

- Research and development spending was $895 million, down from $917 million a year ago.

- HP ended the quarter with $14.78 billion.