IDC blames carbon tax for PC market drop

The Australian PC market suffered its worst quarter in two years, from January to March, according to IDC research, which laid the drop at the feet of the global economy, the carbon tax and interest rates.

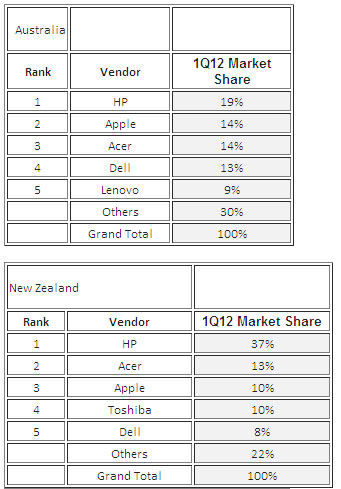

(Credit: IDC)

There were 1.55 million units shipped in the first quarter of 2012 to Australia and New Zealand, IDC said, comprising of 1.35 million PCs to Australia and 0.2 million to New Zealand. These numbers represent a 12 per cent drop for Australia quarter-on-quarter, but a 10 per cent rise for New Zealand quarter-on–quarter, as the country recovered from its natural disasters.

Year-on-year, New Zealand's shipments remained flat, while Australia's dropped by 10 per cent.

The softness of the market was expected to continue, according to IDC market analyst Amy Cheah, who said that, unlike last year, it wasn't probable that there would be a large spike in PC sales because of the end of the financial year.

"Aggressive injection of marketing funds that fuelled the price wars in 2010 and 2011 resulted in accelerated PC refreshes, but sales fatigue eventually took a toll on consumers last quarter," Cheah said.

She also thought that the Reserve Bank's interest cuts would take time to be passed onto consumers and then affect their spending.

Last year had been a big year for PC sales, Cheah said, with a large marketing spend transforming into high PC sales. Although Intel and PC manufacturers have aired advertisements pushing their new ultrabooks, the price point was much higher than mainstream PCs. According to Cheah, this made the new notebooks a bitter pill to swallow.

Business spending was also low as companies tried to cut their costs, and the Digital Education Revolution, which sought to provide a laptop for every child in years 9 to 12, drew to a close. Funding is only in place for another year. Negotiations are currently occurring between federal and state governments to map a path ahead for future student needs.

Another factor that pulled down sales in the quarter was that customers held off on PC refreshes until the release of Intel's new processor family, Ivy Bridge, which was unveiled in April.

The rising popularity of tablets was cannibilising notebook sales only slightly, Cheah said, but was significantly affecting the netbook market, a category that was already on the decline.

Since stocks from the first quarter are high, Cheah expected vendors to offer the older generation laptops that they had not sold at cheap prices, while maintaining high prices for laptops using Ivy Bridge.

"Many PC retailers are struggling to remain profitable amid severe market softness, and we are seeing many of the major Australian retailers consolidating their footprint to varying degrees," she said.

Of the PC manufacturers, HP remained top dog in Australia, after securing contracts in the government space, but also making sales in the SMB and corporate space, IDC said.

Apple's Mac sales suffered slightly as customers looked to ultrabooks, however, the affect was not considered to be significant.

"Although as an aggregate effort Windows-based Ultrabooks took share from Apple's Macbook Air, individually it failed to make a dent on Apple's position as leader in the expanding thin-and-light notebook space," Cheah said.

"In fact, Apple retook the number two spot in the overall PC market as Acer's shipments normalised, given the completion of its notebook roll out to Queensland school."