Intel Q4 revenue, profit blow away expectations, outlook much higher as well

Chip giant Intel this afternoon reported Q4 revenue and profit that blew away expectations, and forecast revenue and profit this quarter much higher than expected as well.

It was the last quarter for CEO Bob Swan as he passes the baton to Intel alum Pat Gelsinger, who will take over next month, leaving his role as head of VMware.

The release came out five minutes before the close of U.S. markets, and Intel shares surged nearly 7% into the close. The stock, however, declined by 1% in late trading.

Management will host a conference call with analysts at 5 pm, Eastern time, and you can catch it on the company's investor relations Web site.

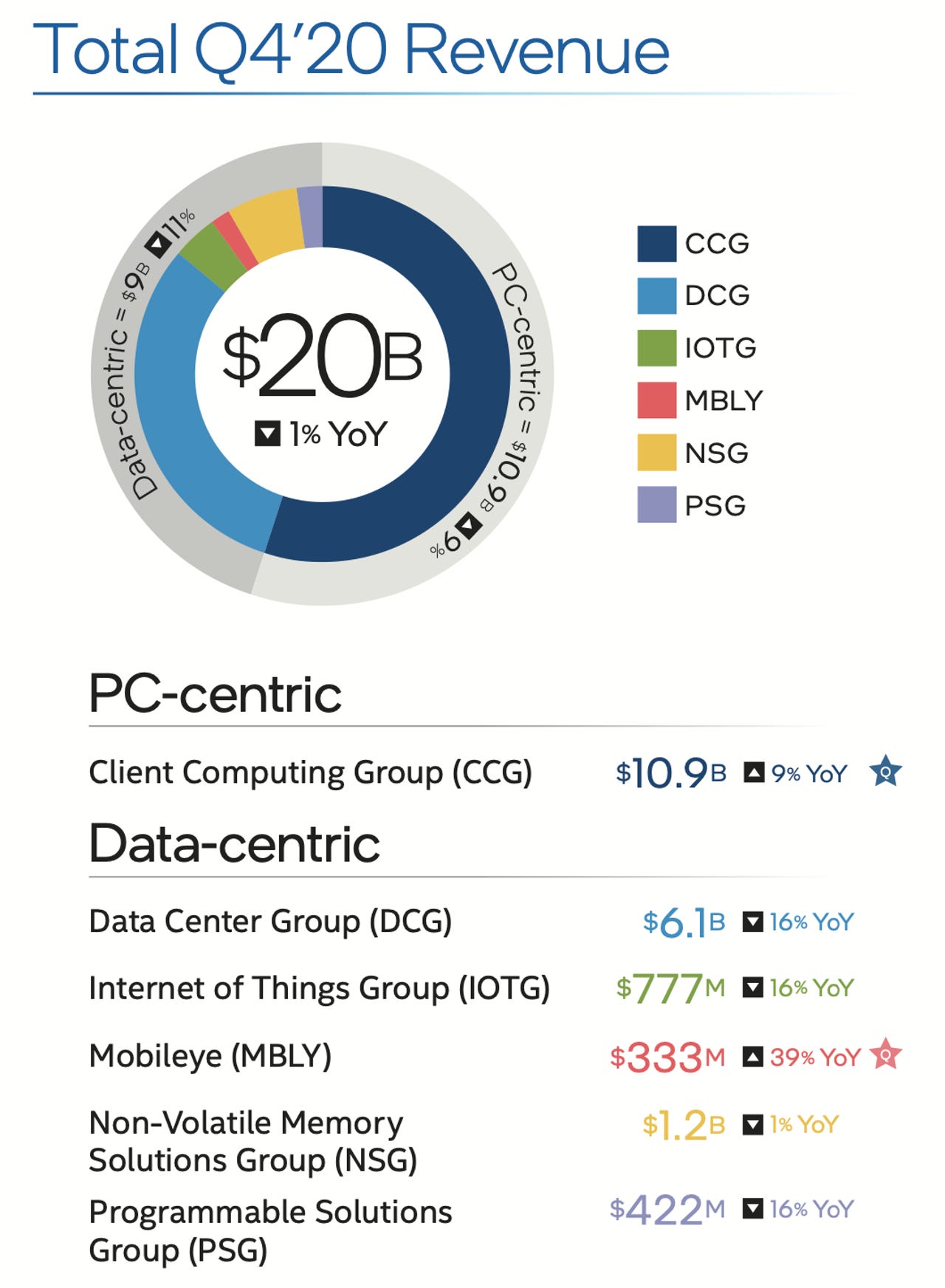

Revenue declined 1%, year over year, to $19.98 billion, yielding EPS of $1.42.

That was well ahead of consensus for $17.5 billion and $1.11 per share.

For the current quarter, the company sees revenue of "approximately" $18.6 billion, and ESP of $1.03. Analysts have been modeling $16.08 billion and 93 cents.

Intel noted it was its fifth year in a row of record revenue, with full-year 2020 revenue rising 8% to $77.9 billion.

Said outgoing CEO Swan, "We significantly exceeded our expectations for the quarter, capping off our fifth consecutive record year.

Added Swan, "Demand for the computing performance Intel delivers remains very strong and our focus on growth opportunities is paying off."

Swan added that "It has been an honor to lead this wonderful company, and I am proud of what we have achieved as a team. Intel is in a strong strategic and financial position as we make this leadership transition and take Intel to the next level."

Also: Intel CEO Swan to be replaced by VMware CEO Gelsinger

All of Intel's business units saw declines with the exception of PCs and chips for autonomous vehicles. The PC group's sales rose 9% to $10.9 billion. The Mobileye group's chips for autonomous vehicles rose by 39% to $333 million.

Intel's Data Center Group, which sells chips for servers, saw revenue fall 16%, year over year, to $6.1 billion. Sales of Internet of Things chips fell 16% to $777 million, while Intel's flash memory unit saw sales fall 1% to $1.2 billion, and the programmable solutions group, consisting of field-programmable gate arrays, or FPGAs, from the 2015 acquisition of Altera, saw sales rise fall 16% to $422 million.

More details are available in an investor infographic posted online. There is also an investor deck of slides posted.

Also: Returning as Intel CEO, prodigal son Pat Gelsinger faces daunting challenges