Intuit's Q4, outlook powered by SMB

Intuit is best known for its tax prep software and services, but the company continues to ride small and mid-sized businesses for its growth.

The company reported a small fourth quarter profit of $4 million, or a penny a share, on revenue of $651 million. The company had a few moving parts. In the quarter, Intuit sold its web site unit and took a restructuring charge. In addition, Intuit completed the acquisition of Demandforce.

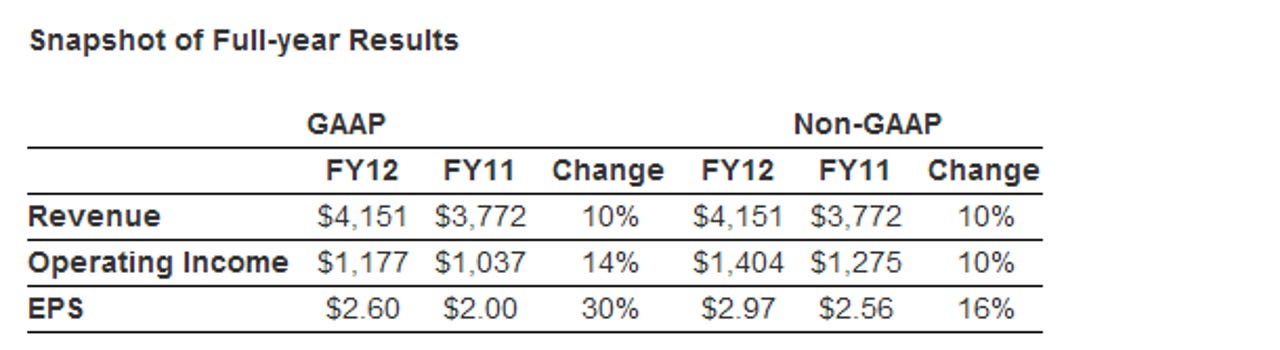

For the fiscal year, Intuit's results played out like this:

In the fourth quarter, Intuit was carried by its small business unit, which saw revenue surge 19 percent from a year ago. Intuit's employee management and payment software continues to do well.

Intuit CEO Brad Smith said in a statement that the company is confident it can grow both profit margins and sales. Smith said Intuit can "continue to deliver double-digit growth."

On a conference call with analysts, Smith said:

Our fiscal 2012 results and our guidance for next year reflect the strength of our core businesses and Intuit's resilience against ongoing fluctuations in the macroeconomic environment. The uncertainties in the economy are certainly not lost on us. The fact is, our customers need our products most when times are tough. We save our customers time and money on the things they need to manage their businesses and their financial lives.

As for the outlook, Intuit projected fiscal 2013 revenue of $4.55 billion to $4.65 billion, up 10 percent to 12 percent. Non-GAAP earnings will be $3.32 to $3.38 a share.

Wall Street was looking for fiscal 2013 non-GAAP earnings of $3.37 a share on revenue of $4.62 billion.

For the first quarter, Intuit is projecting a non-GAAP loss of 6 cents a share to 7 cents a share on revenue of $630 million to $640 million. That outlook is mixed. Wall Street was expecting a loss of 8 cents a share on revenue of $653 million.

By unit, Intuit expects small business revenue growth to be 15 percent to 17 percent for fiscal 2013. Consumer tax will be up 8 percent to 10 percent.