Is the Salesforce.com juggernaut faltering?

Scanning through Larry Dignan's write up of Salesforce.com's Q2 results I couldn't help but observe the company is signaling a sharp slowdown in sales growth compared with fiscal 2007-8. I wasn't the only one to notice. According to Associated Press, investors were far from impressed by the 'cautious' outlook. Even though analysts are expecting top line sales in line with Salesforce.com's outlook, investors were expecting a lot more and hammered the stock price by some 10%.

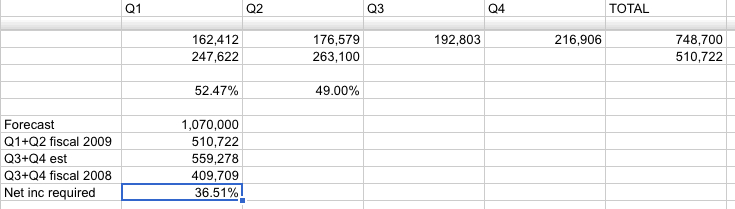

Here's how it works. Last year, the company checked in $748.7 million. This year it is forecasting $1.07 billion. So far it has racked $520.7 million. Therefore, to make its target, Q3 and Q4 need to add $559.3 million. In Q3 and Q4 last year, the company racked $409.7 million. 559.3 divided by 409.7 produces a growth figure of 36.5% a full 12.5% below the most recent growth number of 49%. In other words, Salesforce.com is anticipating a drop of a quarter when compared to the most recent growth rate. The image above shows all the relevant numbers.

I can understand why Salesforce.com is exercising caution. The $1 billion mark is a psychological watershed for many software vendors. At this point they frequently fail to fully capitalize on their position and struggle to maintain momentum. It happened to Siebel which Oracle eventually snapped up as revenues declined.

If Salesforce.com's forecasts are accurate, then I can imagine pundits coming out and blowing smoke about how the gloss is going off the saas rocket ship. That would be a hideous piece of FUD. Saas remains one of the best ways for companies to bring control to their ITC spend and when I look over the developer landscape, I don't see anything OTHER than saas solutions coming to market from emerging vendors.

There have been persistent rumors that Marc Benioff, Salesforce.com's CEO is in the mood to see his company acquired. Is this the first solid indicator in that direction? Place your bets ladies and gentlemen.

PS - don't bet on Google as a potential suitor. That's an idiotic if entertaining idea.