Jive's S1 suggests how little has happened in social business

Jive has filed its S1. For those that don't know, this is a document filed at the SEC which is the precursor to an IPO. The IPO doesn't have to happen but that's the general intention.

I was particularly keen to see this S1 because it provides valuable insights into a a company before it launches on the public markets. In relatively new categories like so-called social business, it also gives us a glimpse about the shape and size that market might become. In this case, Jive is one of the early start up vendors that is attempting to make collaboration a business reality. It's been around a few years so has the market positioning and experience to tell a credible story.

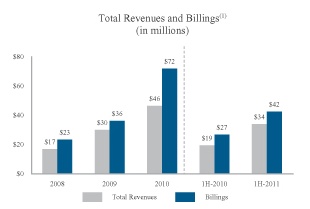

Let's look at some of the numbers to get a sense of where we're at:

For any company to double up on billings between 2010 and 2011 in this way is impressive. Looking at the numbers so far for 2011, it's not unreasonable to assume that Jive will get close to or hit $100 million in billings by year's end. That's a nice round number but is it that impressive when taken in the context of enterprise IT spending?

Colleague Frank Scavo, who runs Computer Economics and is a principal with Constellation Research recently put out the results of a spending survey conducted earlier in the year. While operational IT spending budgets are increasing, there's not a lot more money on the table in general. (see below)

When viewed against that backdrop, you might be tempted to think that as a social business software bellweather, Jive has done pretty well. And it has. Except that in the scheme of things, its total revenues are a rounding error. SAP's HANA is expected to contribute $100 million alone in sales revenue this year. From nothing. At a company turning some $18 billion. See what I mean by rounding errors?

Dig further and you find that after something of a recession driven hiccup in 2010, Jive now has 635 customers on its engagement platform. More telling is the statement that:

Our total revenues have grown at a faster rate than our customer count as we have realized greater upsell with our existing customers and as the average contract size has increased over that time.

In addition, it looks like SAP accounted for a big chunk of change on 2009 (11% of revenue.) I know they did a global deal because I've been taking some training sessions on the replatformed SAP Community Network which, when fully launched, will run on Jive for a seven figure community.

What this tells me is that we're seeing a company that might be heavily dependent upon mega deals at certain times which distort the figures. You'd expect that from a relatively young vendor but it is one to watch. But the numbers and attendent notes also suggest that Jive is able to sell the platform at a good price and keep customers paying.

Although Jive dresses up the numbers in accounting speak, my guess is the average overall deal size is something around $100,000. That's not shabby for any deal but it is hardly the stuff of a billion dollar business anytime soon and is relatively easy to push through into the IT spend budget. Critically, Jive says:

As the substantial majority of our subscriptions are for annual terms, in order for us to continue to grow our business it is important that existing customers renew their subscriptions after the existing subscription term expires...We measure renewal rates on transactions with annual subscription values over $50,000. Our average dollar based renewal rate, excluding upsell, for transactions over $50,000 in the first half of 2011, was over 90%...We focus on renewal rates with annual subscription values over $50,000 because we believe that those transactions best represent customers who have made a significant investment in their Jive deployment. We believe measuring these customers over time gives us the best indicator for the growth of our business and the potential for incremental business as they renew and expand their deployment. These renewals represent over 75% of our renewals billings on a dollar basis. Including upsell, our average renewal rate was over 125% for all transactions.

In short, we've done a great job keeping customers sticky and are upselling them. Extrapolating the numbers out what can we guess about the total global social business software market today? $1 billion? $2 billion? $5 billion in a couple of year's time? The Apple AppStore was bigger than that in 2010. And 635 customers? That's it?

On the ground, things are much more nuanced.

As I implied earlier, SAP is a big Jive house. I'm aware of some of the detail around the SCN project and can say with confidence that it is a huge undertaking. Regardless of how good the offering may be, enterprises will likely have a serious amount of technical work to do in order to get to the starting blocks of building out a digital collaborative environment. And therein lies one of many problems.

There has been so much dismissive bloviating about the claimed benefits, that the harsh realities of execution have almost been swept aside. Until very recently. The almost incessant media racket and the round of self congratulatory conferences on the topic should have created a huge market. But if Jive is the best example we have then it simply doesn't exist as a global phenomenon. IBM will likely disagree but then if they can spin Notes into the social sphere and have gullible customers pay for it then who am I to argue?

I've said this many times, based upon the dearth of real world success stories only to be pushed back by a dribbling out of modest successes, some of which have subsequently proven to be self serving, borderline false. But - the numbers do not lie. I can now add that I feel vindicated in my assessments of this trend.

Most recently I saw one tender document from a very well known operator in this space. I was truly taken aback at how little demonstrated understanding of basic business operations came out in the recommendations. Long on rhetoric that almost required its own dictionary to decipher and yet painfully short on addressing real world issues. Some organisations will fall for that, many won't.

And then there is the experience of practitioners willing to talk publicly about this topic. The Big Failure of Enterprise 2.0 Social Business is a terrific case study of something I have been saying for years. For most organisations, this is a crock. In a tale that exposes many of the problems on the ground, the author says:

When asked why they don’t use the internal platform, one responder stated,“Bottom line, we’ve had a social community internally (for a while) and it doesn’t feel natural.” Translation: It isn’t in their workflow. I personally have struggled with pervasive use of Google+ even thought I really like the product. Why? It is outside of how I get my work done ; my peeps aren’t 100% present and it isn’t integrated into social aggregation tools, such as Tweetdeck. The foundation for which enterprises are building their social collaborative house is cracked. If you add more layers, the fissures widen. If you don’t provide the “easy button” with integrated tools that are “just there” in your workflow, adoption will not cross the chasm. Culture will not change. Enterprise 2.0 social business becomes the bad sequel to Knowledge Management.

This is a fear I have heard expressed by those at IBM charged with evangelising this topic. In the comments, Sameer Patel who does this stuff for a living said what few will publicly admit:

Money line for me: "Lack of cultural change is not social business’s biggest failure. The biggest failure is the lack of workflow integration to drive culture change."

This is one of the most important aspects that separates the activism vs pragmatic thinking on the topic to embracing social and collaborative ways of work. Stated another way, the difference between what in-the-trenches practitioners experience and learn the hard way vs the armchair practitioners. I say this not to antagonize anyone but because its the root cause to relative stagnancy the industry has faced when you compare uptake of innovative process improvement innovation spurts in the past.

In short and as I said almost two years ago to the day: content without the context of business process is meaningless. Nothing has changed. And it wont because in all this, we're talking about dealing with the intersection between software, which slavishly obeys its instructions and humans, who have a tendency to be messy and unpredictable. The vendor that comes up with the algorithm to resolve that paradox wins my vote but it hasn't happened yet.

From what I can tell, those who are charged with actioning social business projects are often poorly equipped to understand just what needs to get done organisationally. Almost none of those I have met have any relevant large business operational experience. There are some exceptions but most come out of a world that is much smaller and simpler. They have to learn on the job. Who wants to pay for that? Worse still, few seem to have the power necessary to break the internal silos and power structures needed in order to make the collaborative integrations work as intended and for everyone's benefit. And then there are all the engineering, data architecture, implementation and integration issues.

The tragedy is that while consultants have done a stellar job selling perceived benefits, companies often find themselves with something that at first seems incredibly simple - certainly compared to an ERP project - but which in fact is infinitely more complicated. Is it any wonder that this 'stuff' doesn't work out?

Jive itself is guilty of spinning that line - from the apps page:

Who made the rule that business apps have to be complex, soul-sucking, require ten layers of approval to purchase, and an army of consultants to deploy?

Heck I'll buy that but I'm finding that as we go through the SCN training phase, there are plenty of things that will need changing. For example, taking the Twitter/Facebook notion of 'friending' might sound like a good way to connect with others. Yet that's not the way business connections operate in the real world. Simple? You bet. Capable of implementation? No. And straight away we have what has always been denied: the taking of social metaphors that work in our personal lives but do not automatically carry over into our work lives. The divide between the two may be merging on a time allocation basis but not in the way we want to interact or the perceptions we have about those relationships. Even the janitor knows that users of the executive bathroom are never going to be his 'friend.' Those things introduce the complexity that Jive thinks it avoids.

The social business mavens will continue to beat the drum. Analysts who believe this is a mega trend will continue to pimp the story. Jive will have a good future; at least in the short term. The band will keep playing but I sense we're getting towards the end of this particular party. But if I have to hear Kumbaya one more time then I might just end up begging for a vacation at the local funny farm. It might make for a more sane set of conversations.

This segment of the industry need to get honest, wake up to what it is facing and address the problems. If not then we'll still be wondering if social business is truly meaningful in another two years. By which stage apologising by saying 'were early in the adoption cycle' is going to be wearing mightily thin as the catch all excuse for what scares the heck out of the vendors wedded to this segment: failure.