Marvell to acquire optical networking chipmaker Inphi for $10 billion

Marvell Technology said it will acquire Inphi in a $10 billion deal that signals further consolidation in the semiconductor industry. Inphi is a developer of optical networking chips used in cloud data centers and by wired and wireless carrier networks for 5G infrastructure.

Marvell said the acquisition will create a semiconductor "powerhouse" with an enterprise value of roughly $40 billion. Technologically, Marvell plans to combine its storage, networking, processor, and security portfolio, with Inphi's electro-optics interconnect platform.

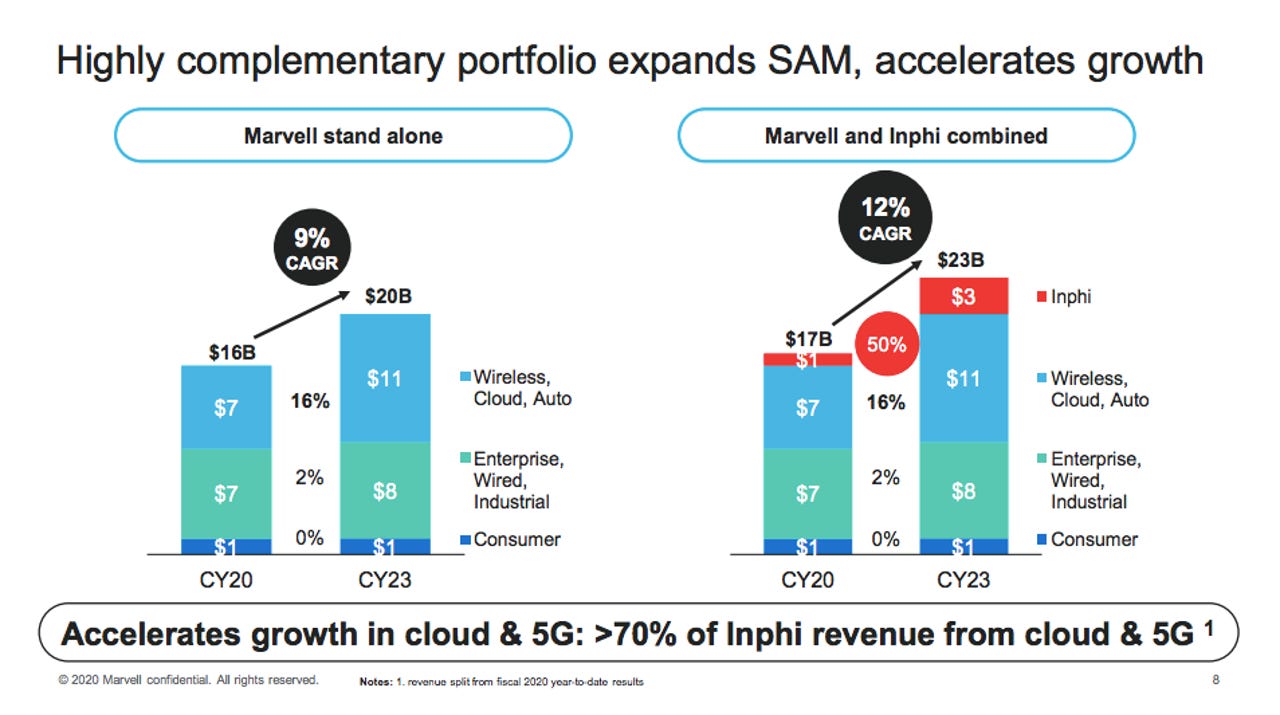

The combination will expand Marvell's total addressable market to $23 billion, and bolster its standing in the data infrastructure, hyperscale, and 5G wireless infrastructure markets, Marvell said. Marvell CEO Matt Murphy said the company also sees an opportunity to expand the reach of its DPU and ASIC products among Inphi's cloud customers.

In a presentation, Marvell and Inphi make the case that the companies are perfectly aligned for the future cloud and 5G opportunity. The companies intend to target cloud data center customers with electro-optics interconnect technology combined with data centric compute and optimized storage. For 5G wireless infrastructure, Marvell said its base station compute technology can be combined with Inphi's fronthaul and backhaul interconnect for high-speed data movement.

"Inphi has built a leading high-speed data interconnect platform uniquely suited to meet the insatiable demand for increased bandwidth and low power for the cloud data centers and global networks of the future," Marvell said in a press release. "Inphi's high-speed electro-optics portfolio provides the connectivity fabric for cloud data centers and wired and wireless carrier networks, just as Marvell's copper physical layer portfolio does for enterprise and future in-vehicle networks."

Under the terms of the agreement, Marvell will pay $66 in cash and 2.323 shares of stock of the combined company for each Inphi share. Upon closing, Marvell and Inphi will become wholly-owned subsidiaries of a new Delaware-based US holding company.

Marvell shareholders will own about 83% of the combined company and Inphi stockholders will own approximately 17% of the combined company. Inphi CEO Ford Tamer will join Marvell's Board of Directors. The transaction is expected to close in the second half of 2021.