Microsoft walks: Five reasons why it's a good move

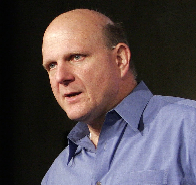

Microsoft CEO Steve Ballmer made the right call. He walked away from Yahoo.

Last ditch talks about a friendly merger between Microsoft and Yahoo unraveled when Yahoo wouldn't budge from an asking price of $37, $4 a share more than Microsoft was willing to pay (Techmeme). Given the options, Ballmer could have paid up only to lose his shareholders and employees, launched a proxy war that would have been a disaster or walk away, an outcome that just a few days ago was unthinkable.

Ballmer chose door No. 3 and walked. The Yahoo deal (blog focus, News.com roundup) was set up to define his career and I gotta hand it to him for choosing the do-nothing option. Is this deal over? Perhaps. If Yahoo falls to $20 a share (think about those fellows who doubled down) perhaps $31 a share will look wonderful. But for now that concern is Yahoo CEO Jerry Yang's. Yang will have to answer to shareholders now.

On Saturday, Ballmer sent Yahoo a Dear Jerry letter:

In our conversations this week, we conveyed our willingness to raise our offer to $33.00 per share, reflecting again our belief in this collective opportunity. This increase would have added approximately another $5 billion of value to your shareholders, compared to the current value of our initial offer. It also would have reflected a premium of over 70 percent compared to the price at which your stock closed on January 31. Yet it has proven insufficient, as your final position insisted on Microsoft paying yet another $5 billion or more, or at least another $4 per share above our $33.00 offer.

Mary Jo Foley noted that the move "restores my faith in the future of the company." For days, Mary Jo was told that her thesis that Microsoft should walk was too girlie. After all, this Yahoo bid was war. It was about testosterone. The reality: This Microhoo saga was about opportunity cost. How could Microsoft better spend its $44.6 billion?

Yahoo Chairman Roy Bostock issued a statement noting that Yahoo is "focused on maximizing shareholder value." Try explaining that one on Monday at market open. Yang added:

"With the distraction of Microsoft's unsolicited proposal now behind us, we will be able to focus all of our energies on executing the most important transition in our history so that we can maximize our potential to the benefit of our shareholders, employees, partners and users."

The ultimate analysis of Ballmer's move to walk away, however, goes beyond price. If it weren't for other moving parts perhaps Microsoft would have paid up for Yahoo. Realistically, a higher bid just didn't make sense. Here are five reasons that contributed to Microsoft's decision to walk:

The EU and regulator scrutiny. Let's state the facts: The EU hates Microsoft, which repeatedly finds itself in the antitrust crosshairs. The EU will stand in the way of the Yahoo purchase and ultimately decide whether the acquisition proceeds. Now we can debate whether the EU is correct or not until we're blue in the face, but the EU would have determined whether Ballmer's Microhoo vision actually became reality. Microsoft faced an uphill battle with regulators--and China could have been a factor because of Yahoo's stake in Alibaba.Divestitures. Given the regulator scrutiny Microsoft would have faced some serious divestiture decisions. Would regulators care if Microhoo dominates that free email market? Yahoo Mail and Hotmail would have had the market locked up. How about IM? MSN Messenger meets Yahoo Messenger would be dominant. Would hooks to Yahoo from Windows be forbidden?

Backend integration. Microsoft and Yahoo come from two different worlds. MSN is about Microsoft infrastructure on the front and backend. Yahoo is about Hadoop, open source and creating a network of properties that's open to developers. How exactly do you bridge that gap? Do you have to? The integration was a migraine waiting to happen.

Portfolio management. Microhoo would have had at least two of everything--ad networks, dashboards, online Office suites, photo, news and video sites, search tools etc. How would that have been rationalized?

Windows. Narrowing this list down to five items wasn't easy. Culture, morale and a dozen of other items could have made the cut. But I think the distraction factor was huge. Windows needs work. Vista has image problems. The operating system is under attack from multiple fronts and needs to become more lightweight and modular. Windows is what made Microsoft and there are serious questions about its future. The biggest knock on this entire Microhoo saga: It was a distraction that could take focus away from the real cash cow. If you think the negotiations were a distraction just imagine how dealing with regulators and integrating Yahoo would have diverted attention. Despite all the Microhoo chatter Windows 7 (all resources) may be the thing that determines whether Microsoft stays relevant or not.