Netflix: Streaming adoption accelerates; Earnings follow suit

Netflix's reported a better-than-expected fourth quarter and indicated that adoption of its streaming movie service is expected to accelerate into the first half because of distribution deals such as the one it cut with Nintendo to be embedded on the Wii.

Netflix, a company in a business model transition, appears to be firing on all cylinders. The company reported fourth quarter earnings of $30.9 million, or 56 cents a share, on revenue of $444.5 million, up 24 percent from a year ago. Non-GAAP earnings were 59 cents a share. Wall Street was expecting earnings of 45 cents a share (statement).

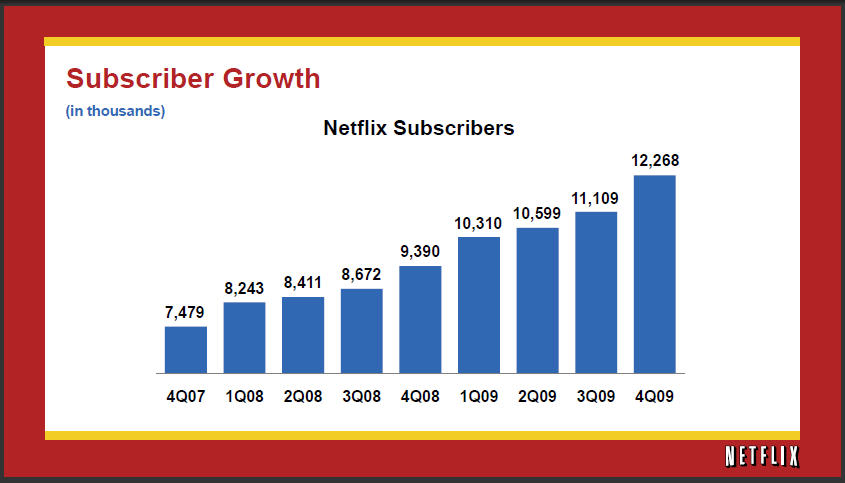

Gross subscriber additions were 2,803,000 for the fourth quarter, up 34 percent from a year ago. Netflix ended the quarter with 12,268,000 subscribers and 97 percent of them were paid.

More importantly, Netflix's churn fell to 3.9 percent from 4.2 percent a year ago. And the percentage of subscribers who used streaming for more than 15 minutes was 48 percent, up from 41 percent in the third quarter.

The company's outlook was strong. Netflix said it will end 2010 with 15.5 million to 16.3 million subscribers. In the first quarter, Netflix expects 13.5 million to 13.8 million subscribers. First quarter revenue is expected to be $490 million to $496 million with earnings of 47 cents a share to 58 cents a share. Wall Street was expecting earnings of 44 cents a share on revenue of $486 million.

For 2010, Netflix is projecting earnings of $2.28 to $2.50 a share on revenue of $2.05 billion to $2.11 billion. Wall Street was expecting earnings of $2.23 a share on revenue of $2.05 billion.

In prepared remarks, Netflix CEO Reed Hastings said distribution deals with Sony's PlayStation 3 and Xbox are paying off nicely. He said:

Two years ago, our year-over-year subscriber growth was 18%. A year ago our year-over-year subscriber growth was 26%. Now it is 31%. There are two possible interpretations: the more conservative is that we are experiencing bumps due to the expansion of Netflix streaming to video game platforms, each with large installed bases. The more generous interpretation is that we are on the front half of a big S-curve of streaming adoption. We expect our growth rate to continue to increase in the first half of this year, partially due to the Wii launch this spring, and then we'll see in the second half between the more conservative or more generous explanations of our increasing subscriber growth rate. Our guidance assumes the conservative case. In any case, roughly 30% year-over-year subscriber growth at our size is phenomenal.