No bailout for you? Online finance tools help you ride the economic storm

If there were any financial lessons learned in 2008, one of the big ones was understanding that your financial standing tomorrow might be very different than your financial standing today. And seeing how a government bailout to pay off your Visa bill likely isn't on the way, it's up to you - Joe and Jane Taxpayer - to take matters into your own hands.

For the past few weeks, I've been playing with a few online personal finance products. While I never came across the ultimate product for my own personal needs, I'm encouraged by the offerings out there and the tools they're offering, including the use of widgets and mobile services to stay up-to-date on changes.

Managing money is a very personal thing - every person's situation is different. With that said, there are some things that each of us has in common - money comes in and money goes out. You may have little control over the amount of money coming in but you certainly can manage what's going out. The following is a list of products I have been tinkering with and what I liked and didn't like about them:

- TheExpenseTracker: It does just what it says - tracks expenses - but not much more. If you're serious about setting up and staying on a budget, this is a good tool. It not only allows users to customize the spending amounts for specific categories - such as gas, groceries and dining out. It also comes with a mobile feature that uses voice recognition to call-in expenses as you incur them. That way you can record the $79.22 you spent on groceries right from the checkout stand - without having to remember to input it later - and you'll get a voice prompt back, telling you how much you have left to spend on groceries for the month. I would have liked to have seen an SMS feature instead of, or in addition to, the voice input feature. The service is not free - there is a set-up charge and $10 monthly service fee. Be sure to add that to your monthly expenses.

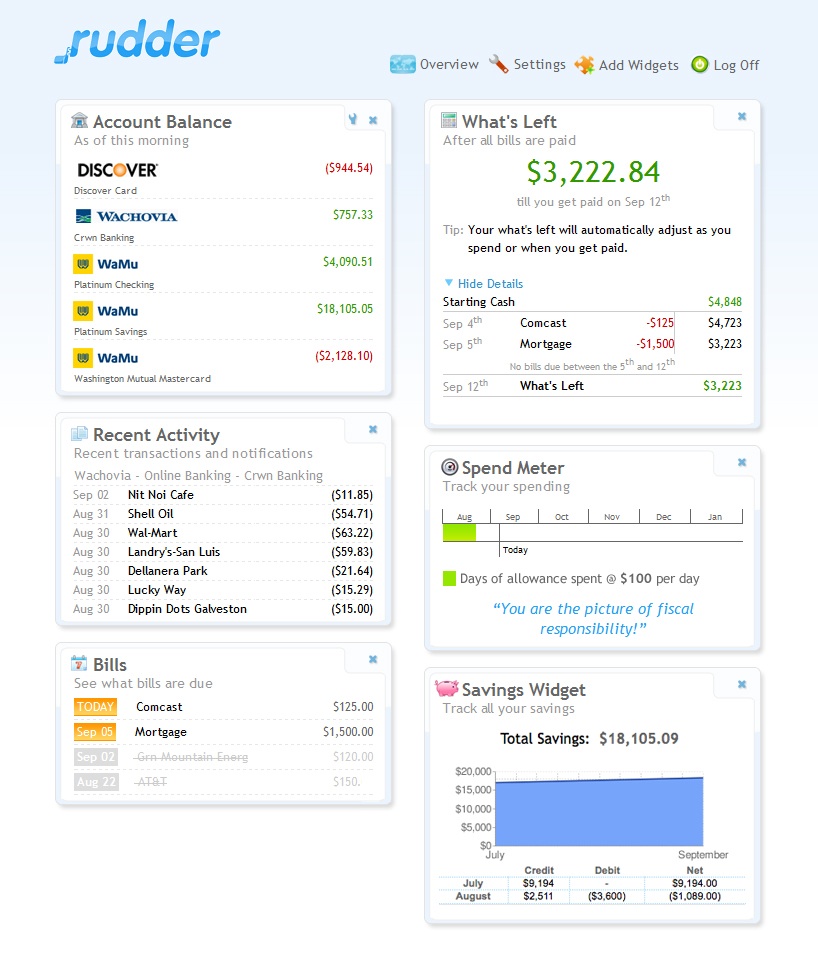

- Rudder: The thing I liked most about Rudder was its peek into the future, instead of the past. By telling Rudder about your recurring income (paychecks and other sources) and your recurring bills, it does the math to look ahead at the bills that will come due between now and your next payday. Used in conjunction with a service like ExpenseTracker, you can incorporate the "left-over" money to establish a budget for discretionary spending, such as dining out, movie dates and days at the spa. You can also add-in a one-time income (maybe you get a year-end bonus). Because you also give Rudder the access to import your banking transactions via the bank's Web site, you can track which bills have been paid and cleared. Rudder is a free service.

- Quicken Online: This Web program is close to being my holy grail of personal finance - but just misses. Yes, it looks back at spending and allows me to customize the dates for review (Maybe I want to look specifically at June 21-Aug.17, for whatever reason). It also looks ahead at what you have left, based on the transactions that are spotted when it accesses your online banking transactions. My beef though is that it "learns" what my bills are instead of allowing me to just tell it about by monthly expenses. And, if it hasn't factored in that my property taxes are due next month (because it hasn't learned about that bill yet), then it can't give me a true picture of what I have left for the month. Quicken Online is also a free service.

- Mint: Mint is a good online service that really digs deep into your finances - bank accounts, credit card accounts, investment accounts - to look at your spending habits, trends and so on in real-time. But unlike Rudder and Quicken Online, Mint looks at your past. For some people, that's probably a good way to see how your spending was on- or off-track and how you can adjust your habits in the future. But telling me that I blew my entertainment budget after the fact does me little good once it's done. I would rather know when I'm getting close to blowing my budget.

- ClearCheckbook: The one thing that was missing in all of these services was a basic checkbook register. I need a place where I can track everything - the check I wrote to the neighborhood kid selling magazine subscriptions as part of a school fundraiser, the $40 I withdrew from the ATM or the $50 I dropped into my gas tank. ClearCheckbook has been evolving and, just this month, added new features, as well as some premium services (hey, is that like a revenue plan? What a concept.) What I like about ClearCheckbook is that it hasn't compromised the long-standing basics to deliver the best of what the others are offering, including things like look-ahead balances and mobile. The company offers long-term subscription to its premium services or month-to-month (at a nicely-affordable $4 per month). There's also a free version.

- Moneydance: Initially, I liked Moneydance as a personal finance software alternative to Quicken and MS Money but was seeking something that lives on the cloud, instead of something that's downloaded and installed on a single computer. If you're still leery about banking "on the cloud," Moneycloud is a good alternative and works with Windows, Mac and Linux systems.

Overall, it's good to know that personal finance software is coming of age, recognizing that a growing number of people are banking online, paying bills online and using mobile phones to keep tabs on their money. Setting up has been a time-consuming challenge for me but now that it's all there, I'm finally ready to take back control of my finances in 2009 - at least until the government hands over a bailout check to erase my personal debt.