Nutanix beats Q4 expectations

Nutanix reported its fourth quarter financial results Thursday, beating market expectations.

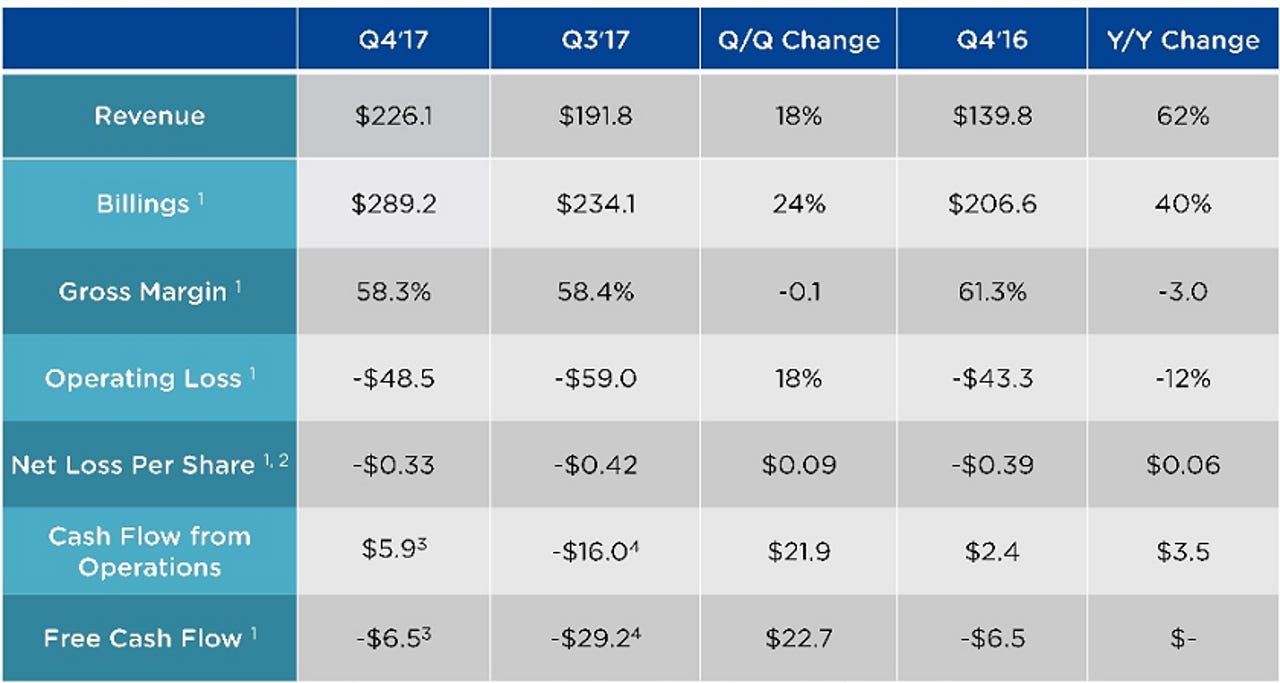

The company reported a non-GAAP net loss of $50.6 million or 33 cents per share. That's compared to a non-GAAP net loss of $46.7 million, or 39 cents per share, in Q4 of fiscal 2016. Revenue came to $226.1 million, up 62 percent year-over-year from $139.8 million in Q4 2016.

Wall Street was looking for an adjusted loss of 38 cents a share on revenue of $217.85 million.

Billings for the quarter totaled $289.2 million, growing 40 percent year-over-year. Nutanix added more than 875 new end-customers in Q4, ending the year with 7,051 end-customers. It had 43 customers with deals over $1 million in the quarter, up 39 percent year-over-year.

For the full fiscal year 2017, Nutanix posted a non-GAAP net loss of $199.1 million, or $1.40 per share. Revenue came to $766.9 million, up 72 percent year-over-year. Billings for the year totaled $990.5 million, growing 55 percent year-over-year.

"This quarter, marked by record revenues, continued adoption of AHV, increased software-only sales, strong growth from our OEM partners, and positive operating cash flow, was a great way to end our first year as a public company," CEO Dheeraj Pandey said in a statement.

Pandey highlighted the company's recently-announced products, Nutanix Calm and Xi Cloud Services, saying they extend Nutanix's market opportunity "by simplifying and harmonizing datacenter operations for the multi-cloud era."

The company also highlighted its partnership with Google, blending the Nutanix environment with the Google Cloud Platform

For the first quarter of fiscal 2018, Nutanix expects to see a non-GAAP net loss per share of 37 cents on revenues between $240 and $250 million.