Nvidia beats Q2 estimates with record data center sales, Mellanox growth

Nvidia posted strong second quarter financial results on Wednesday, thanks to record-setting data center revenue and a solid contribution from Mellanox.

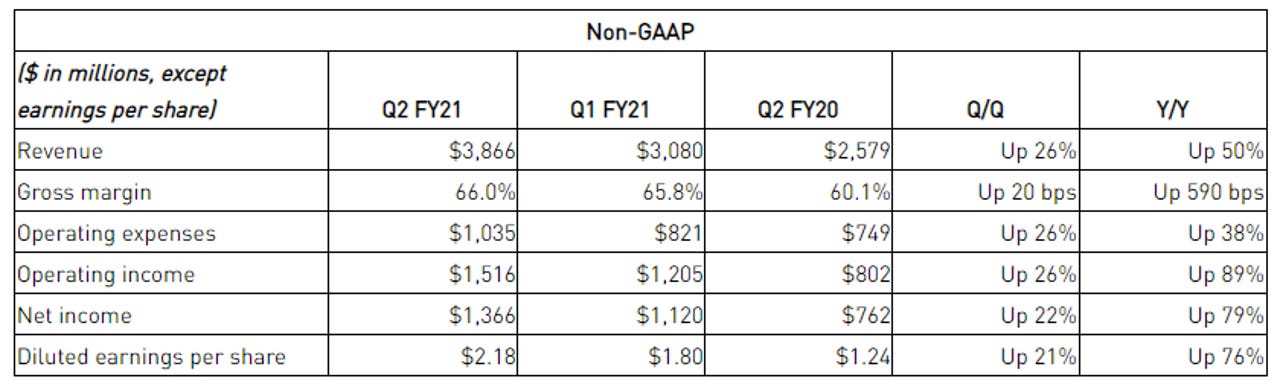

Second quarter non-GAAP earnings per share came to $2.18 on revenue of $3.87 billion, up 50 percent from a year earlier.

Analysts were expecting earnings of $1.97 per share on revenue of $3.65 billion.

"Adoption of NVIDIA computing is accelerating, driving record revenue and exceptional growth," CEO Jensen Huang said in a statement. "Despite the pandemic's impact on our professional visualization and automotive platforms, we are well positioned to grow, as gaming, AI, cloud computing and autonomous machines drive the next industrial revolution around the world."

Nvidia's data center revenue came to $1.75 billion, up 167 percent from a year earlier. Data center revenue includes sales from Mellanox, which contributed 14 percent of Nvidia's overall revenue and just over 30 percent of data center revenue. Nvidia closed its $7 billion Mellanox acquisition in April. The interconnection vendor's growth was driven by the need for high-speed networking in cloud data centers to scale-out AI services.

Within the data center segment, both compute and networking set a record with accelerating year-over-year growth, CFO Colette Kress said on a Wednesday conference call. Mellanox revenue growth accelerated with strength across Ethernet and infiniband products.

Gaming revenue for the second quarter was $1.65 billion, up 26 percent from a year earlier. Gaming laptop demand is very strong as students and professionals turn to GeForce-based systems to improve how they work, learn and game from home, Kress said.

On Wednesday's call, Huang said growth in gaming was driven by the COVID-19 pandemic. However, he argued the increased popularity of gaming won't recede once the pandemic is over.

"With all that's happening around the world, and it's really unfortunate, but it's made gaming the largest entertainment medium in the world," he said. "More than ever, people are spending time digitally, spending their time in video games. The thing that you haven't realized about video games is that it's not just the game itself anymore. The variety of different ways that you can play, whether you can hang out with your friends in Fortnite, go to a concert in Fortnite, building virtual worlds in Minecraft, you're spending time with your friends, you're using it to create... There's just so much that you could do with video games now. And I think that this this way of enjoying entertainment digitally has been accelerated as a result of the pandemic, but I don't think it's going to return. Video game adoption has been going up over time and pretty steadily. PC is now the single largest entertainment platform -- is the largest gaming platform. And GeForce is now the largest gaming platform in the world."

Professional Visualization revenue in Q2 was $203 million, down 30 percent from a year earlier, with declines in both mobile and desktop workstations. Sales were hurt by lower enterprise demand and of the closure of many offices around the world, Kress said. Industries negatively impacted during the quarter included automotive, architectural, engineering and construction, manufacturing, media and entertainment and oil and gas.

Automotive revenue was $111 million, down 47 percent from a year earlier -- slightly better results than Nvidia had predicted.

"The impact of the pandemic was less pronounced than expected, with auto production volumes starting to recover after bottoming in April," Kress said. "Some of the decline is also due to the roll-off of legacy infotainment revenue, which remained a headwind in future quarters."

Nvidia paid $99 million in quarterly cash dividends in Q2 and will pay its next quarterly cash dividend of 16 cents per share on September 24.

For the third quarter, Nvidia expects revenue around $4.4 billion, plus or minus 2 percent.