Nvidia reports record sales in gaming and data center segments

Nvidia on Wednesday published fourth quarter financial results above market expectations, with record revenue in both its Gaming and Data Center segments.

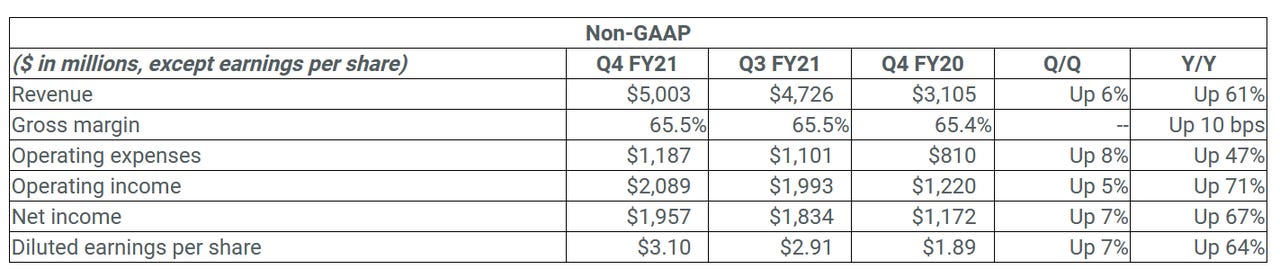

Fourth quarter non-GAAP earnings per diluted share were $3.10 on revenue of $5 billion, up 61 percent year-over-year.

Analysts were expecting earnings of $2.81 on revenue of $4.82 billion.

For the full fiscal year, non-GAAP earnings per diluted share were $10. Revenue was a record $16.68 billion, up 53 percent.

"Q4 was another record quarter, capping a breakout year for Nvidia's computing platforms," CEO Jensen Huang said in a statement. "Our pioneering work in accelerated computing has led to gaming becoming the world's most popular entertainment, to supercomputing being democratized for all researchers, and to AI emerging as the most important force in technology."

In the Data Center segment, fourth-quarter revenue was a record $1.9 billion, up 97 percent from a year earlier. Full-year revenue was a record $6.7 billion, up 124 percent.

After rolling out the A100 series GPUs in May, Nvidia in the fourth quarter announced the first wave of OEM servers with A100 Tensor Core GPUs. The company also introduced support for Google Cloud's Anthos on bare metal for Nvidia DGX A100 systems.

"Our A100 universal AI data center GPUs are ramping strongly across cloud-service providers and vertical industries," Huang said in his statement. "Thousands of companies across the world are applying NVIDIA AI to create cloud-connected products with AI services that will transform the world's largest industries. We are seeing the smartphone moment for every industry."

In a conference call Wednesday, Huang explained that the "smartphone moment" refers to "an opportunity to change the way [industries] interact with their customers."

Rather than sell something once -- whether it's a medical device, a lawn mower or a tractor -- companies will be able to "sell something and then provide a service on top of it, just like your smartphone."

"All of the enterprises in the world used to have computers for IT to host their employees and their supply chain," Huang continued. "In the future all of these industries, whether medical imaging or lawn mowers, you're going to have data centers hosting your products, just like CSPs."

In Gaming, Q4 revenue was a record $2.5 billion, up 67 percent from a year earlier. Full-year revenue was a record $7.76 billion, up 41 percent. In the quarter, the company announced its biggest-ever laptop launch, with more than 70 new laptops for gamers and creators, powered by GeForce RTX 30 Series GPUs.

"Demand for GeForce RTX 30 Series GPUs is incredible," Huang said. "Nvidia RTX has started a major upgrade cycle as gamers jump to ray tracing, DLSS and AI."

In the Professional Visualization business, Q4 revenue was $307 million, down 7 percent from a year earlier. Full-year revenue was $1.05 billion, down 13 percent.

Automotive revenue in Q4 was $145 million, down 11 percent from a year earlier. Full-year revenue was $536 million, down 23 percent.

In his statement Wednesday, the CEO said that Nvidia is "making good progress toward acquiring Arm, which will create enormous new opportunities for the entire ecosystem." In September, the company announced its intent to acquire chip IP vendor Arm for $40 billion. The proposed acquisition has met some resistance in the industry, but Nvidia leaders on Wednesday said the regulatory review process is on track.

For the first quarter of fiscal 2022, Nvidia expects revenue of $5.3 billion, plus or minus 2 percent.

The company will pay its next quarterly cash dividend of 16 cents per share on March 31.