Oracle delivers solid third quarter; Strong dollar dings fourth quarter outlook

Oracle's fiscal third quarter earnings were better than expected and the company declared its first-ever dividend as a way to spin off its excess cash directly to shareholders.

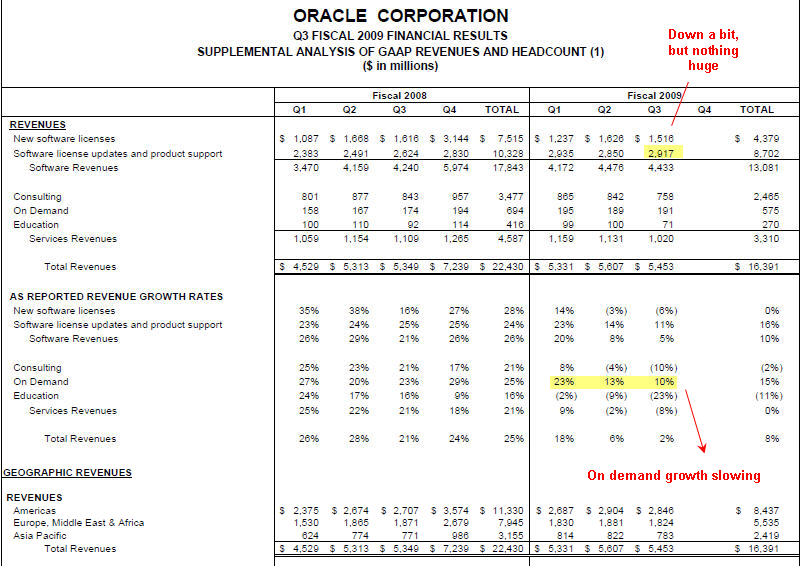

The applications and database giant reported net income of $1.33 billion, or 26 cents a share, on revenue of $5.45 billion, up slightly from the $5.35 billion a year ago (statement). The company said it was hit with currency fluctuations that shaved 5 cents a share off of its third quarter earnings. Oracle added that non-GAAP earnings were 35 cents a share compared to Wall Street estimates of 32 cents a share.

Software revenue in the third quarter was up 5 percent to $4.4 billion, but new software license sales were down 6 percent to $1.5 billion. Analysts were expecting a sharper decline of about 12 percent. Software license updates and support revenue was up 11 percent to $2.9 billion.

Meanwhile, Oracle declared a dividend of 5 cents a share payable each quarter. The move to declare a dividend is an interesting one. For starters, Oracle's dividend may provide a downside buffer on its stock since it may attract investors that focus on quarterly payouts (even though Oracle's dividend isn't that large).

Oracle execs said that the third quarter results were solid considering the currency fluctuations and economy.

"We're pleased with the quarter and delivered the highest third quarter operating margins in our history," said Safra Katz, Oracle's co-president, on a conference call with analysts. She said Oracle is "clearly gaining share, but continued to cite currency headwinds as a problem--the dollar has strengthened vs. foreign currencies in recent months and that effectively lowers the company's growth. Katz added that currency fluctuations will cut about 7 cents a share from Oracle's fourth quarter earnings.

The guidance was a little lighter than expected. Oracle expects non-GAAP earnings in the fourth quarter to be 42 cents a share to 46 cents a share assuming current rates for the U.S. dollar. In constant currency fourth quarter earnings will translate to 49 cents a share to 53 cents a share. Based on GAAP, Oracle's earnings will be 34 cents a share to 38 cents a share. Wall Street was expecting earnings of 46 cents a share.

Total revenue for the fourth quarter is expected to be in a range from down 3 percent to up 2 percent. New software licenses are expected to be down 17 percent to 27 percent.

As far as topics go, executives focused on middleware (BEA contributed $140 million in third quarter sales) and the Exadata database machine venture with HP.

Looking forward, CEO Larry Ellison said the company is looking to grow via innovation and acquisition. He said Oracle's Fusion middleware business is a combination of the two and the company's fastest growing unit. Ellison also focused on the Exadata database machine business, announced at Oracle OpenWorld, and touted it against Teradata's offerings.

President Charles Phillips said the Exadata pipeline is "the largest build I've ever seen." "This is internally developed technology and why we spend $3 billion a year on research and development," said Phillips.

Ellison also took his usual shot at SAP. When asked why Oracle's applications business held up better than SAP's, executives said SAP is more reliant on big mega deals.

"We have a much broader portfolio than SAP. We're also more modern. I think we're going to be able to take market share from them for years to come," said Ellison adding that "all of our applications are on-demand or cloud ready."

My notes on the quarter (click to enlarge):

By the numbers:

- Research and development spending in the third quarter was $677 million, down 1 percent from a year ago.

- General and administrative expenses were $192 million, down from $206 million a year ago.

- Operating margins were 36 percent in the quarter, up a percentage point.

- Oracle ended the quarter with $8.2 billion in cash and $3 billion in marketable securities.

- The company ended the quarter with 86,588 employees, down slightly from the prior quarter.

- Database revenue is saving the day for Oracle. In the third quarter, new software licenses for database and middleware revenue was $1.12 billion, or down 4 percent from a year ago. Support and license update revenue was up 16 percent to $1.91 billion.

- Applications revenue for the third quarter took a hit as new software licenses were $396 million, down from $451 million a year ago.