Pizza Hut Asia to trial SoftBank's Pepper for MasterCard payments

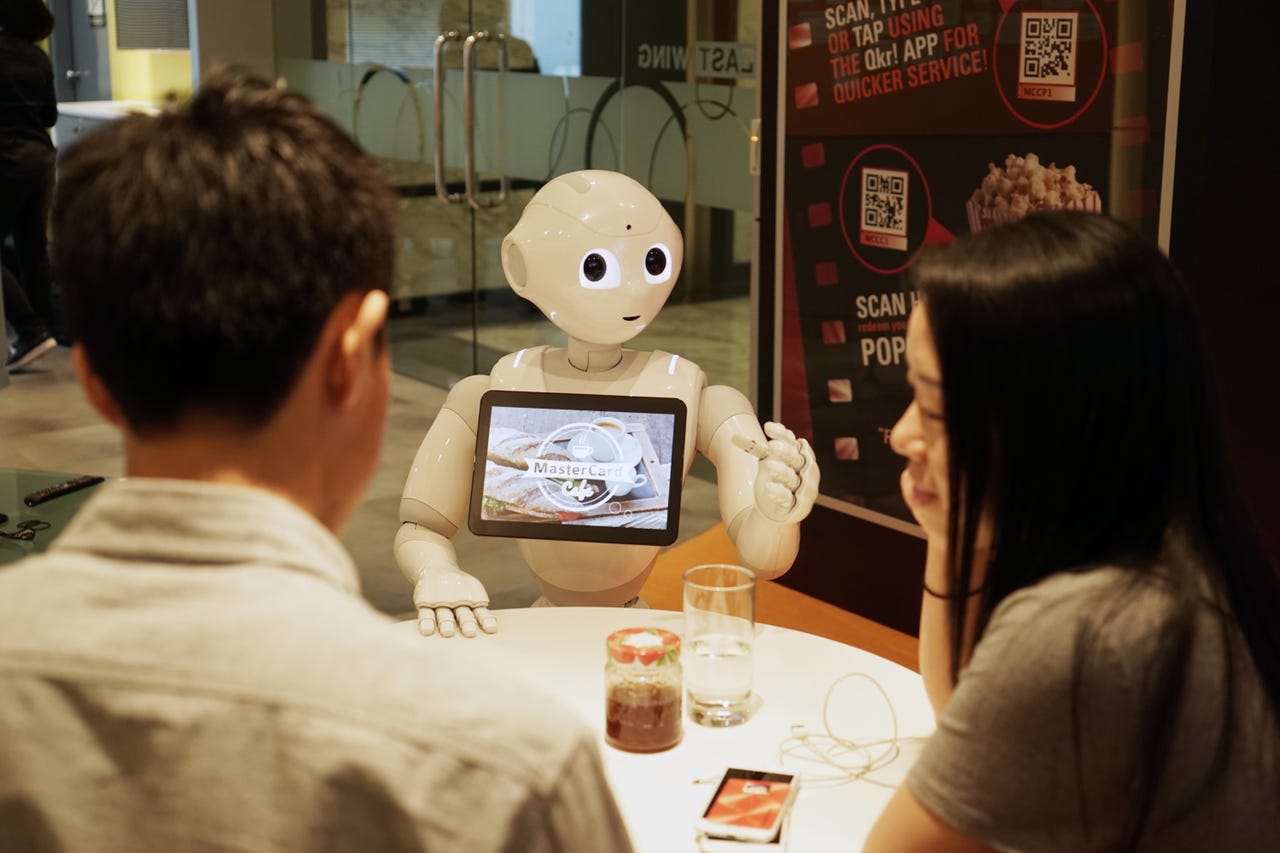

MasterCard has unveiled the first commerce application for Softbank's Pepper, with the humanoid robot to be trialled by Pizza Hut Restaurants Asia for order taking and payments processing.

To use Pepper, a customer will need to pair their MasterPass account either by tapping the Pepper icon within the wallet or by scanning a QR code on the tablet that the robot holds.

After pairing, Pepper will then be able to initiate, approve, and complete a transaction by connecting to MasterPass via Wi-Fi, with the transaction completed within the wallet on the customer's mobile device.

"Consumers have come to expect personalised service, customised offers, and simple and seamless processes both in-store and online," Tobias Puehse, vice president, innovation management, Digital Payments & Labs at MasterCard said.

"The app's goal is to provide consumers with more memorable and personalised shopping experience beyond today's self-serve machines and kiosks, by combining Pepper's intelligence with a secure digital payment experience via MasterPass."

The payments giant said the Pepper application has the potential to open up opportunities in the world of retail such as personalised shopping and concierge services, in-aisle checkout, and the ability to buy in store but get the goods delivered at home.

The same capability would also be applicable to other consumer engagement locations such as hotels, banks, airports, and other customer service industries, MasterCard said.

The app was built by the MasterCard Labs team in Singapore and is expected to go live in-store by the end of this year.

When SoftBank offered 1,000 of its emotionally intelligent Pepper robots to the consumer market last year, the entire run sold out in under a minute.

Pepper was developed for SoftBank by Aldebaran, a French robotics company specialising in emotionally intelligent humanoids that can function in unstructured environments like homes, shops, and specialised care facilities.

Up until now, Pepper has been working in SoftBank stores in Japan, assisting customers with cell phone purchases.

SoftBank announced earlier this year that IBM would be bringing Watson's AI to Pepper, in a bid to ready the robot for broad adoption in the home; and last week at Google IO, the Japanese giant said it was adding an SDK for Android Studio to enable the development of custom applications for Pepper, continuing to evolve its capabilities ahead of its US launch and opening of a new developer portal in San Francisco later this year.

MasterCard said the Pepper application also adds to its plan of bringing payments to any consumer gadget, accessory, or wearable device.

MasterCard said in February that consumers are embracing the next generation of payments, predicting digital payments to extend beyond the phone as the use of connected devices grows.

Its claims were based on its fourth annual MasterCard Mobile Payments Study which tracked 2 million global social media posts about mobile payments across Twitter, Facebook, Instagram, forums, Google+, and YouTube.

"As more choices are made available to them, the conversation has evolved and consumers seem to be fully embracing the next generation of payments," Marcy Cohen, vice president of digital communications at MasterCard, said previously.

The payments giant has also dipped its feet into biometrics, with Selfie Pay -- approving a payment via facial recognition -- trialled by the company last year.

MasterCard also announced a partnership with consumer ecommerce player Coin in January to enable payments via smartwatches, fitness bands, and other wearable devices, after labelling cash as unnecessary wallet real estate in December.

At the Consumer Electronics Show (CES) in Las Vegas earlier this year, MasterCard launched Groceries by MasterCard, an app preloaded into Samsung's Family Hub refrigerator that allows consumers to order groceries via their fridge from FreshDirect and ShopRite in the US.

MasterCard then partnered with IBM in March to give small to medium merchants access to big data analytics, integrating IBM Watson Analytics into its platform, along with its own anonymised transaction data gathered through MasterCard Advisors Local Market Intelligence, to bring AI to its payments platform.