Public cloud computing vendors: A look at strengths, weaknesses, big picture

Public cloud vendors are establishing unique characteristics that indicate the market won't be a zero-sum game that'll support multiple players.

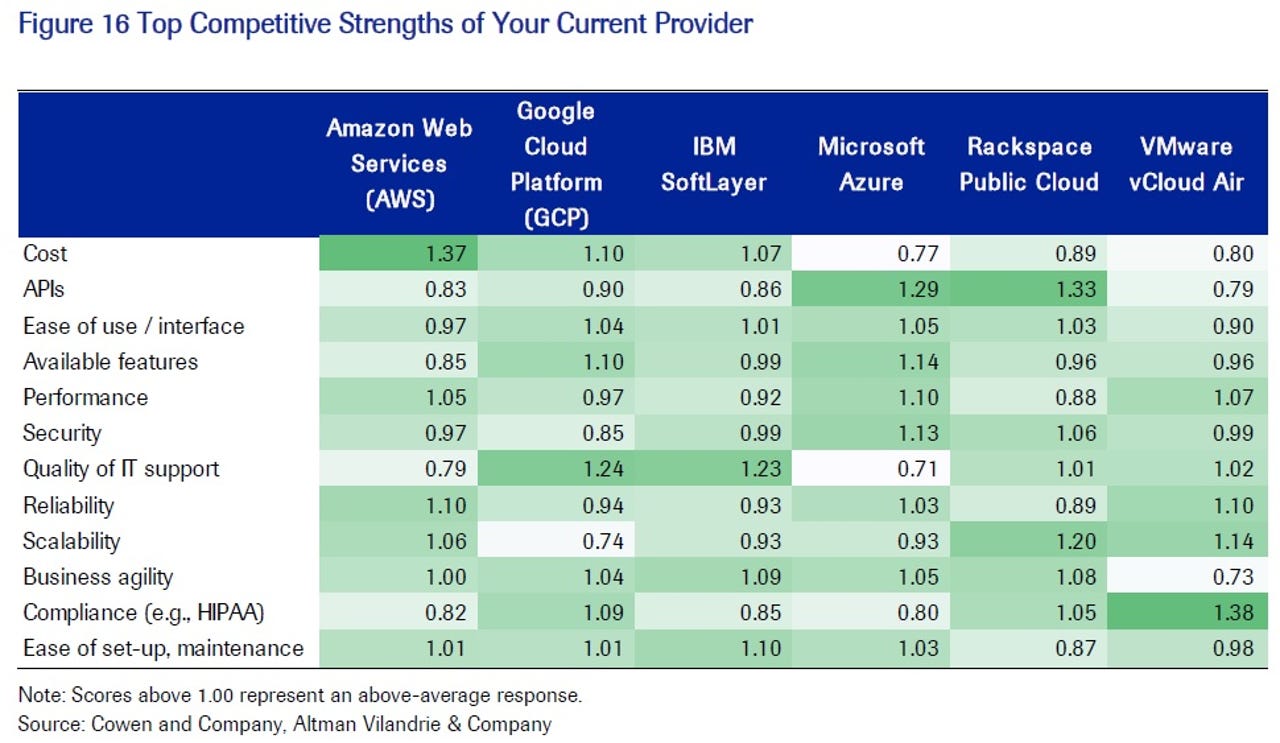

Cowen & Co. conducted a survey of 314 public cloud customers and found Amazon Web Services is the top dog with Microsoft Azure a strong No. 2. Meanwhile, IBM and Google Cloud Platform (GCP), which is grabbing more workloads, are above average in quality of IT support.

That IT support rating could be a weapon against AWS, which had support rated as a weakness. Here are the moving parts on cloud computing strengths and weaknesses:

According to Cowen those ratings by factor indicate that companies are going to mix and match providers. Cowen analysts John Blackledge and Gregg Moskowitz noted:

Respondents made clearer distinctions among the cloud vendors when asked about their competitive weaknesses, though their complaints showed less dispersion. For instance, GCP and Rackspace were most frequently criticized for available features, while IBM SoftLayer and Azure were viewed unfavorably in terms of cost, and VMware for generally poor APIs. The most notable area of competitive weakness was in quality of IT support, where AWS was identified far more frequently than its peers.

The big takeaway is that the public cloud market won't have one clear winner. Cowen found that the public cloud customer is using 2.86 of the six service providers asked about in its survey. In addition, 52 percent of customers were planning to use an additional public cloud vendor.

Also see: Apple's hybrid cloud plan: Google, AWS, Microsoft Azure like most companies