PwC: Tech deals, IPO activity achieving levels 'not seen in years'

Despite some up-and-down observations about tech IPOs and mixed earnings over the last six months, IPO markets "have reached activity levels not seen in years," according to PricewaterhouseCoopers.

Tech Earnings

Analysts chirped on Wednesday the upward trends have been building from positive momentum from the second half of 2013, fueled by the strong US equities markets tech deals.

During the quarter, tech IPOs consisted of 22 new pricings valued at more than $5.1 billion.

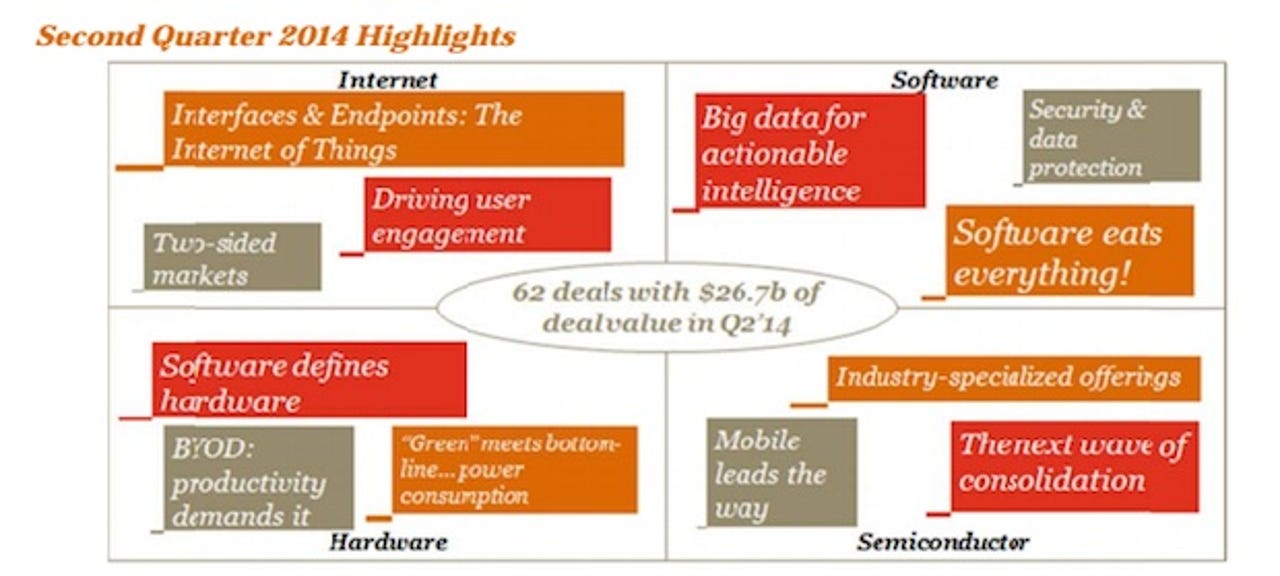

Deal activity was also on the rise, with 62 deals worth approximately $26.7 billion in value. High-profile examples include Oracle’s $5.3 billion acquisition of Micros, SanDisk's $1.2 billion acquisition of Fusion-io, and Apple's $3 billion purchase of Beats.

According to the global consulting firm's Q2 2014 Technology Deals Insights report, software is one of the key verticals with higher deal volume.

Noting that volume deal grew 18 percent to 20 transactions closed during the quarter (albeit the value was actually down year-over-year), analysts presented a myriad of reasons why software is looking brighter quarter after quarter.

The second quarter of 2014 continued to keep pace with 2013’s rebound finish and the end is not yet in sight. As the year progresses, look for software and internet deals to play an active role, especially as enterprise software is positioned as the highest growth area within technology. Broader IT spending increases beyond 2014 will nudge leading companies to start positioning now through inorganic growth to capture future value.

Shareholders and analysts alike have been skittish over notable stumbles by big tech during the last two quarters, with stalwarts like Amazon even sending investors questioning how much can be really overlooked.

On the IPO side, a few high-profile entries such as enterprise cloud darling Box have chosen to delay public debuts while the markets calm down.

Nevertheless, despite some blips on the radar and endless debates about being in a bubble, there are plenty more positive signs on the horizon, including much better-than-expected Q2 earnings from Twitter and the upcoming IPO from Alibaba — poised to become the largest initial public offering in history.

It also doesn't hurt that PwC highlighted the top 25 technology firms collectively have a cash balance of more than $350 billion.

Chart via PwC