Qualcomm's Q3 sales fall short as demand for 4G devices slows

Qualcomm published its third quarter financial fiscal 2019 results on Wednesday, beating earnings estimates but falling short on revenue. Shares were down in after-hours trading.

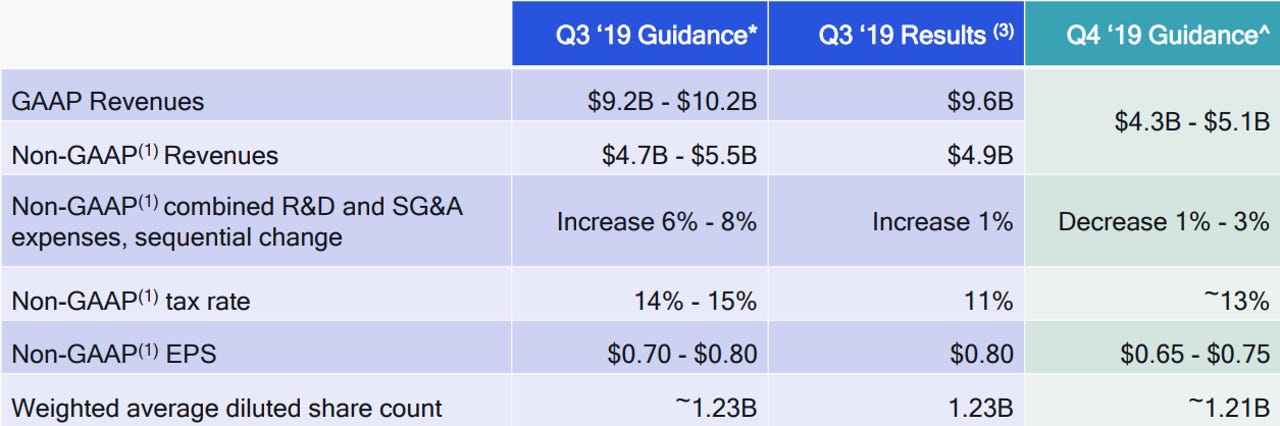

Non-GAAP earnings per share came to 80 cents, a decrease of 20 percent year-over-year. Revenue for the quarter was $4.9 billion, a decrease of 13 percent year-over-year.

Analysts were looking for earnings of 75 cents per share on revenue of $5.08 billion.

"We delivered another solid quarter operationally in the midst of slower demand for 4G devices as the market prepares for the global transition to 5G," CEO Steve Mollenkopf said in a statement. "Our 5G design wins have doubled over the last three months, leaving us extremely well positioned as 5G ramps in early calendar year 2020."

On a conference call, Mollenkopf said that industry conditions, particularly in China, will create significant headwinds for the next two fiscal quarters. Along with the pivot from 4G to 5G, he specifically cited the Huawei export ban.

"As a result of the export ban, Huawei shifted their emphasis to building market share in the domestic China market where we do not see the corresponding benefit in product or licensing revenue," he said. "In addition, our customers in the China market are working through their existing 4G inventory and deemphasizing their second half 2019 4G launches as they shift their priority to their 5G launches in early 2020. As a result, we do not expect the typical seasonal benefits given this unique market dynamics."

Qualcomm also said it's lowering its estimates for global 3G/4G/5G device shipments in calendar 2019 by 100 million units to a range of 1.7 billion to 1.8 billion.

Third quarter revenues from the Qualcomm Technology Licensing (QTL) segment, Qualcomm's licensing division, came to $1.29 billion, a decrease of 10 percent year-over-year. QTL accounts for a significant portion of Qualcomm's earnings.

The company's other business segment, QCT (Qualcomm CDA Technologies), accounts for most of its revenue. QCT revenues in Q3 were $3.57 billion, a decrease of 13 percent. Within QCT, MSM chip shipments in Q3 reached 156 million, a decrease of 22 percent year-over-year.

Qualcomm noted that in April, the company reached settlement agreements with Apple and its contract manufacturers to dismiss all outstanding litigation between the parties.

Qualcomm's QTL results for Q3 included royalties from Apple and its contract manufacturers for sales made in the June 2019 quarter. QTL revenues in fiscal 2018 and the first six months of fiscal 2019 did not include royalties due on sales of Apple or other products by Apple's contract manufacturers.

Also, QTL revenues in Q2 and Q3 of fiscal 2019 each included $150 million of royalties due under an interim agreement with Huawei -- another licensee in dispute.

For the fourth quarter, Qualcomm expects revenue in the range of $4.3 billion to $5.1 billion. The outlook excludes QTL revenues for royalties due on sales of products by Huawei, given that its negotiations with the Chinese firm are still under way.