Regulators don't need to promote a fourth mobile network: NZ ComCom

New Zealand's Commerce Commission has published a study into its mobile market, that claims regulatory intervention is not needed for a fourth national network.

The purpose of the study was to better understand the competitive landscape of New Zealand's mobile market, as well as how the market has developed and performed in 2018.

According to the study [PDF], market distribution has become more balanced as Vodafone and Spark's market shares for mobile subscribers have dropped by 12.5% and 8%, respectively, since 2009. The drops have been primarily due to the emergence of 2degrees, which has created "an increasingly competitive mobile market".

Vodafone still leads the pack with 40.5% of the mobile market, Spark owns 37.9%, and 2degrees has 20.5%, the study showed.

Separately, the study indicated there has also been an uptick in wholesale agreements with mobile virtual network operators (MVNO) in the past 18 months, with Kogan Mobile NZ signing an agreement with Vodafone, while Trustpower and Vocus separately partnered with Spark.

See also: New Zealand ComCom lays charges against Vocus subsidiaries

"Having assessed the state of competition in the mobile market we haven't identified any particular problems or structural issues that could be hampering competition," Telecommunications Commissioner Stephen Gale said.

"We do not believe there is a case for regulatory intervention to promote a fourth national MNO to enter the market."

The study did note however, that the upcoming 3.5GHz spectrum auction for 5G networks will not preclude new parties from entering into the fray, and that acquisition limits will be created to prevent any parties from dominating spectrum holdings and distorting competition in downstream markets.

'Unlimited plans' are in demand

In terms of usage, the amount of New Zealand mobile broadband users increased, according to a Consumer NZ survey, cited by the commission. Of the mobile consumers surveyed, 82% of respondents used mobile broadband in 2018, up from 77% in 2017.

Mobile plans offering higher volumes of data have also become increasingly popular in New Zealand, the study said. As an example, it pointed to how the total number of residential on-account subscribers purchasing bundles of voice, SMS, and data allowances of 3GB or more increased from 133,000 subscribers in 2016 to 497,000 subscribers in 2018.

According to the study, Spark has said the predominant trend in the retail market is the shift towards "unlimited" data plans, including plans that can be shared across several users.

The average volume of data used by mobile consumers in New Zealand, however, is still relatively low at 2GB per month in comparison to other Organisation for Economic Co-operation and Development (OECD) countries. The report said the OECD average amount of monthly data use in 2018 was around 5.5GB.

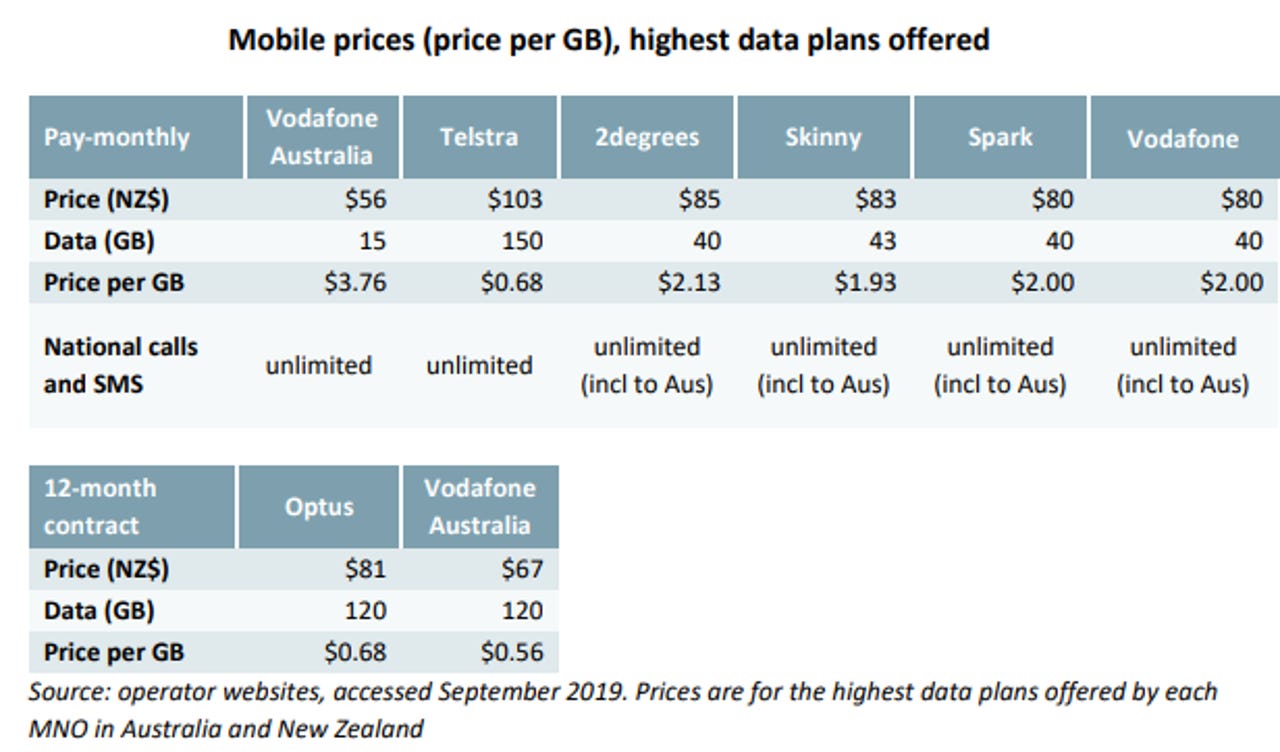

New Zealand's unlimited plans are currently more expensive in comparison to Australia, the study said. This is primarily due to the plans offered in New Zealand being open while Australian telcos offer 12-month fixed plans.

For unlimited plans, New Zealand's average price per GB across its three telcos is NZ$2 while Australia's average price for its fixed plans was AU$0.62.

According to 2degrees, New Zealand's small population and challenging topography has made it relatively expensive to supply mobile services.

While the price per GB remains higher in New Zealand for the largest bundles, there have been a number of recent market developments which have resulted in improved value for higher usage mobile consumers in New Zealand, the commission said. These developments included the rollout of group subscriber plans, increased thresholds at which speeds are throttled on unlimited mobile plans, and the emergence of MVNOs.

Mobile voice minutes also continued to grow during 2018, both in aggregate and on a per subscriber basis, when the study examined usage trends, while SMS volumes declined as consumers increasingly favour over-the-top based messaging services.

Meanwhile, New Zealand's 4G speeds ranked fourth among 88 countries, while its availability came 57th in comparison to 87 countries, the commission cited OpenSignal as reporting.

As anticipation for 5G networks in New Zealand continues to pick up steam, Vodafone has announced it will launch its 5G network in Auckland, Wellington, Christchurch, and Queenstown later this year.

Spark has also signalled its intention to launch 5G services as soon as spectrum becomes available while 2degrees has yet to set a timeline.

Related Coverage

Commerce Commission gives Infratil all-clear to acquire its half of Vodafone NZ

With Brookfield Asset Management to acquire the other 50%, the overall deal is worth a total NZ$3.4 billion.

Chorus CEO Kate McKenzie leaving at end of 2019

Announcement comes as the broadband wholesaler reports lower revenue and earnings as New Zealand moves off copper, and onto fibre and wireless.

Chorus has over 50% of NZ broadband on fibre

Peak data usage on its network now above 2Tbps, a 77% increase on June 2017 numbers.

Spark copper voice services to be deregulated across New Zealand

There is enough competition for New Zealand to deregulate copper voice services, the Commerce Commission has decided.

Kogan Mobile live in New Zealand as prepay player

Online-only brand backed by Vodafone New Zealand's network.