Report: Cleantech investments bounce back in 1Q

The latest cleantech venture capital tracking report from the Cleantech Group and Deloitte show a continuing shift in funding away from renewable energy companies and toward technologies focused on transportation alternatives and energy efficiency.

Overall, there were 180 clean technology companies that received investments during the first quarter, for a total of $1.9 billion in capital. This was a 29 percent increase quarter to quarter and an 83 percent increase over the year-earlier quarter.

Sheeraz Haji, president of the Cleantech Group, pointed to several highlights in the quarterly data. For one thing, many of the companies receiving money previously had received funding. So, there were fewer early stage investments.

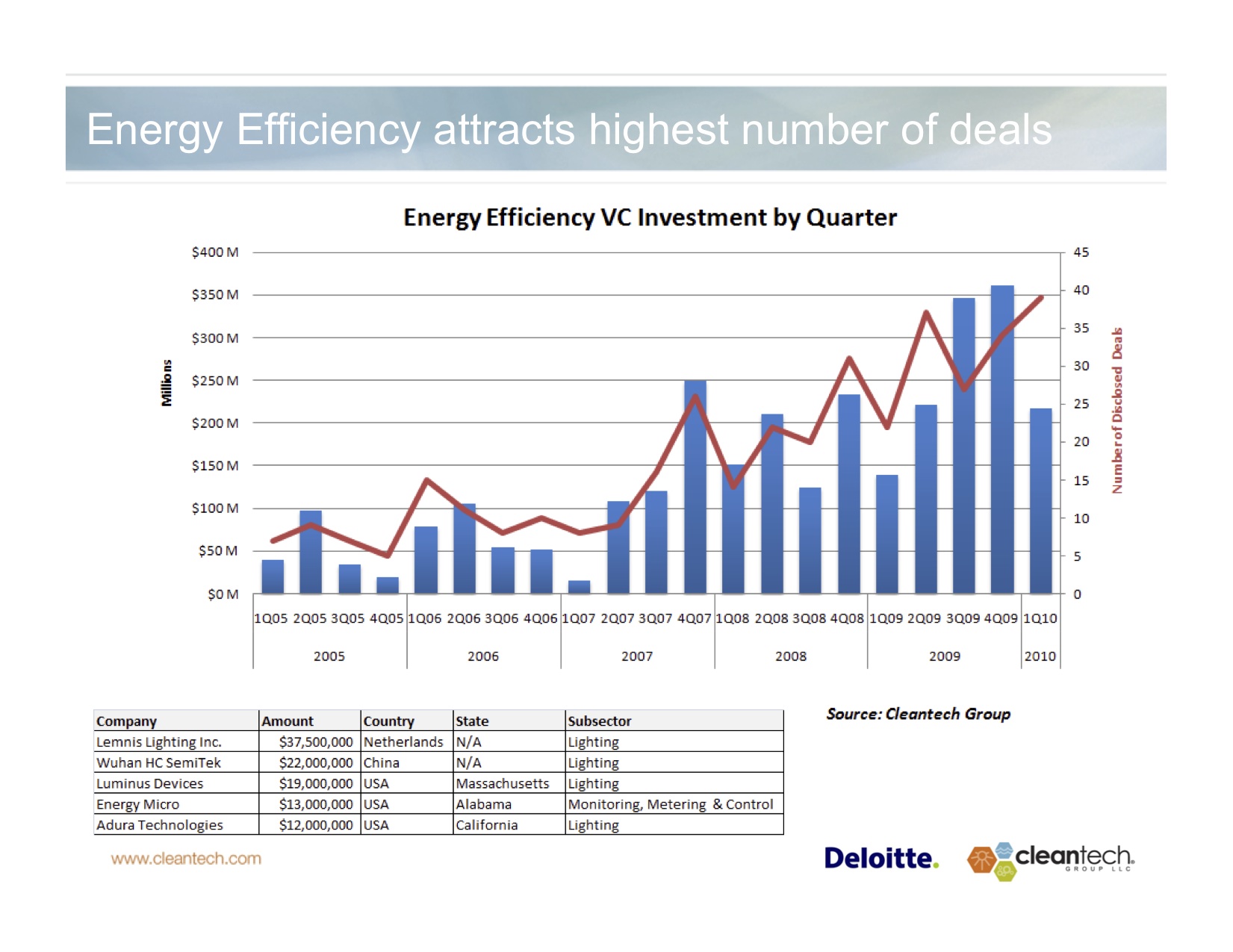

Among the energy efficiency investments (which totalled $217 million over 39 deals), funds for companies who are working on more efficient approaches for lighting as well as LEDs were among the beneficiaries, according to Haji. One example is Adura, which provides wireless mesh technology for automating lighting installations. Haji says another strong focus was energy storage technologies, such as new battery approaches. Although there weren't a record number of dollars invested in this sector, there were more companies receiving money in this segment during this quarter than previously.

There were 27 total deals in the transportation portion of the cleantech tracking service, bringing the total to $704 million. It's important to note that one of those deals, for Better Place, was worth $350 million alone.

According to Deloitte managing partner Mark Jensen, who is with the company's U.S. venture capital group, utilties continued to put their investment focus on alternative energy (especially wind and biomass) as well as on smart grid projects. Their investments are very driven by government incentives in these areas, Jensen says. "Capacity investments for renewables continue," he says.

Overall, about 81 percent of the funds invested in the quarter, or $1.5 billion, went to North America. China got 4 percent of the total.