Report: What to expect from your new car in 2030

By 2030, nearly every new car will have built-in connectivity, according to new research from SBD Automotive. That presents a challenge for the automotive and mobility industry, according to an advisory council for tech and auto stakeholders, to build connected experiences that actually meet consumers' needs and preferences -- without being too complicated.

Currently, 48 percent of all new cars globally include built-in connectivity, but by 2030 that figure will rise to 96 percent, SBD Automotive says. Their research was included in a new report from the Experiences Per Mile Advisory Council, a group recently formed by stakeholders like VW, Salesforce, Ford, Spotify and Harman.

While mobile connectivity is growing, a large portion of consumers are still dissatisfied with the experience of using connected services in cars. In a survey of car buyers in the US, China and Germany, nearly 40 percent agreed with the statement that the "technology is getting too complicated overall."

In a blog post, the Council wrote, "Today, the automotive ecosystem is challenged to not just deliver more technology, but deliver smart solutions as holistic, connected experiences that reinforce usability and drive mass adoption."

According to surveys conducted by Otonomo of current connected car drivers in the US (in 2018) and in Europe (in 2020), drivers are mostly interested in connected car services that alert you of dangerous driving conditions ahead.

Drivers in the US were also very interested in services that provide early detection of necessary maintenance and repairs, as well as services that suggest quicker routes. In Europe, the next most-popular services are those that suggest quicker routes, as well as services that provide discounted insurance rates based on driving data.

Of those who expressed interest in each service, approximately 80 percent were willing to share anonymous or personal connected car data to gain access to these capabilities.

Meanwhile, both SBD Automotive and Otonomo found that about 60 percent of survey respondents say it's very important to be told exactly what data is being collected, how it is being used and by whom when deciding whether to share their data.

While there's plenty of interest in connected services, the report also explores why the consumer experience has fallen short so far. It cites rigid mobility platforms that are hard to update or integrate with other technologies, a culture in the auto industry that's hardware-driven rather than consumer-driven, as well as siloed digital experiences. It also cites the use of too much jargon in the industry that's not consumer-friendly, as well as antiquated partnership and business models.

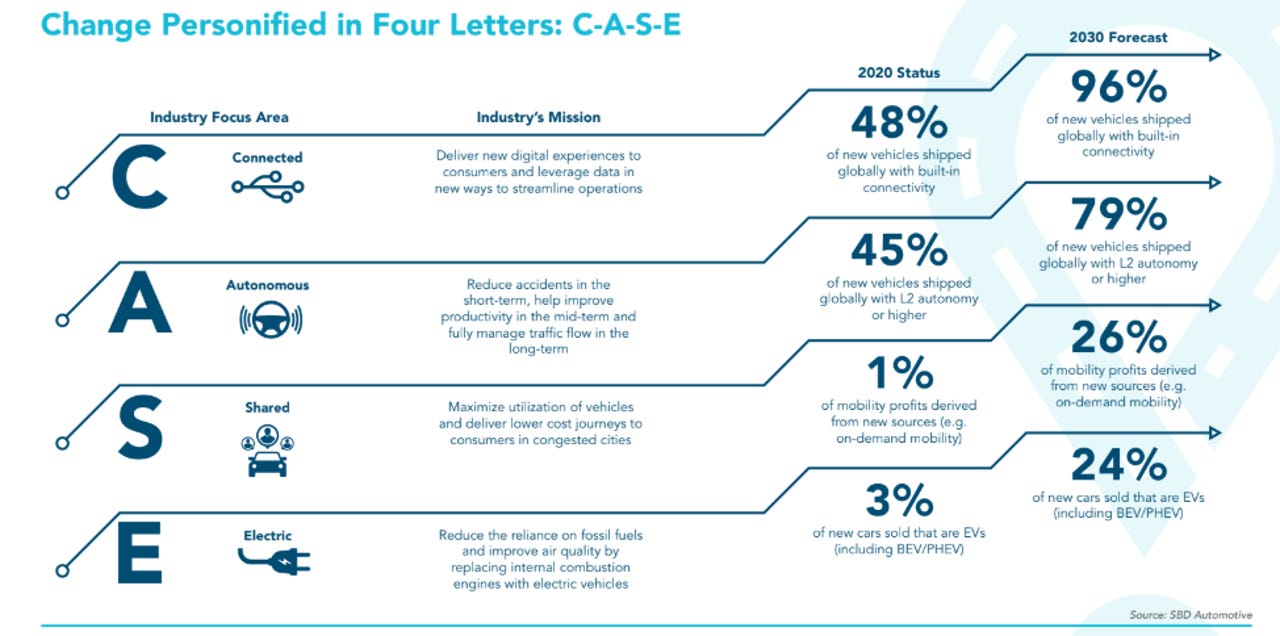

In addition to forecasting built-in connectivity, the report explores expectations for the growth of the "CASE" model for the auto industry -- the push for more Connected, Autonomous, Shared and Electric mobility solutions.

"Developing a dynamic mobility experience cannot be achieved without the CASE building blocks," the report says.

By 2030, the report says, 79 percent of new vehicles in 2030 are expected to have at least L2 autonomy, which offers partial automation with the driver still in control of the vehicle. Currently, 45 percent of vehicles are shipped with L2 autonomy or higher.

Meanwhile, as consumers become more interested in the sharing economy and sustainability, SBD automotive estimates that 26 percent of mobility profits will be derived from new sources such as on-demand mobility.

The report notes the significant industry push for electrification -- for instance, nine automakers have promised a full-range of EV's by 2030. Additionally, it says, "Disruptive OEMs and start-ups are rapidly expanding ranges and demonstrating compelling options for the end consumer, which are inching closer to cost parity with internal combustion engine vehicles."

Still, just 24 percent of all new cars sold by 2030 will be electric, the report forecasts. That's compared to 3 percent currently.