Revolut’s clumsy automated FinTech bank compliance results in frozen accounts and lack of customer service

Following on from my previous post about modern, mobile-first FinTech bank customer's frozen account nightmares, with UK 'app banks' locking clients out of their accounts for security and compliance checks, I have continued to attempt to get feedback from vendors.

I focused a lot on Revolut in my last post, partially because while visiting the UK regularly over the past year they often came up in conversations and business in both good and bad ways as a ground breaking and market leading european finTech bank. I am separately an advisor to a UK tech incubator company who has had their Revolt account frozen with a very substantial amount of money in it for compliance issues since November of last year, and so have had some first hand insights into what happens when things go wrong as well as right.

Banking is a tightly regulated business with quite high barriers to entry and strictly enforced regulatory standards, so the achievement of launching modern, mobile first digital banks is not to be underestimated in a hostile, entrenched banking world that protects its old revenue streams.

What is so odd about the current scenario for digital banking customers is the sharp contrast with old world 'brick and mortar' banks. If you walk through the doors of a bank branch in England or the USA you can hardly move for customer service, with people greeting you and showing you to the appropriate window or service, and generally maximizing positive customer experience. In the case of California Wells Fargo there was a lot of apologizing and candy hand outs by employees after they were publicly disgraced in 2016, a 'please don't close your account' move.

The contrast with the digital bank experience couldn't be more opposite - it's almost impossible to talk to a real human except through chat apps (if you are lucky - they may just be running automated responses to your questions and you think it's a person).

The digital banking world we are now in is essentially AI driven compliance systems and algorithms that are automated to adhere to law such as the UK 'Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017' and freeze your account if anomalies are found. In some cases these exceptions are resolved in seconds or minutes and users may not even notice. Clearly where all this can turn into a customer disaster is when accounts are frozen for months -- Revolut outsources some work to partners for resolution and the unfortunate account holder enters a semi automated bureaucratic limbo. It is this aspect of FinTech banking - the frontline between algorithm driven processes and support staff and partners processing exceptions - where the old paper shuffling world of showing documents, passports and paper trails rears its ugly head and customers are tearing their hair out.

For small businesses needing to make payroll and rent this is catastrophic, and the many plaintive online posts from people stranded abroad with no money due to locked accounts and other similar horrible scenarios are the human face of these algorithm and chat app automated processes gone awry.

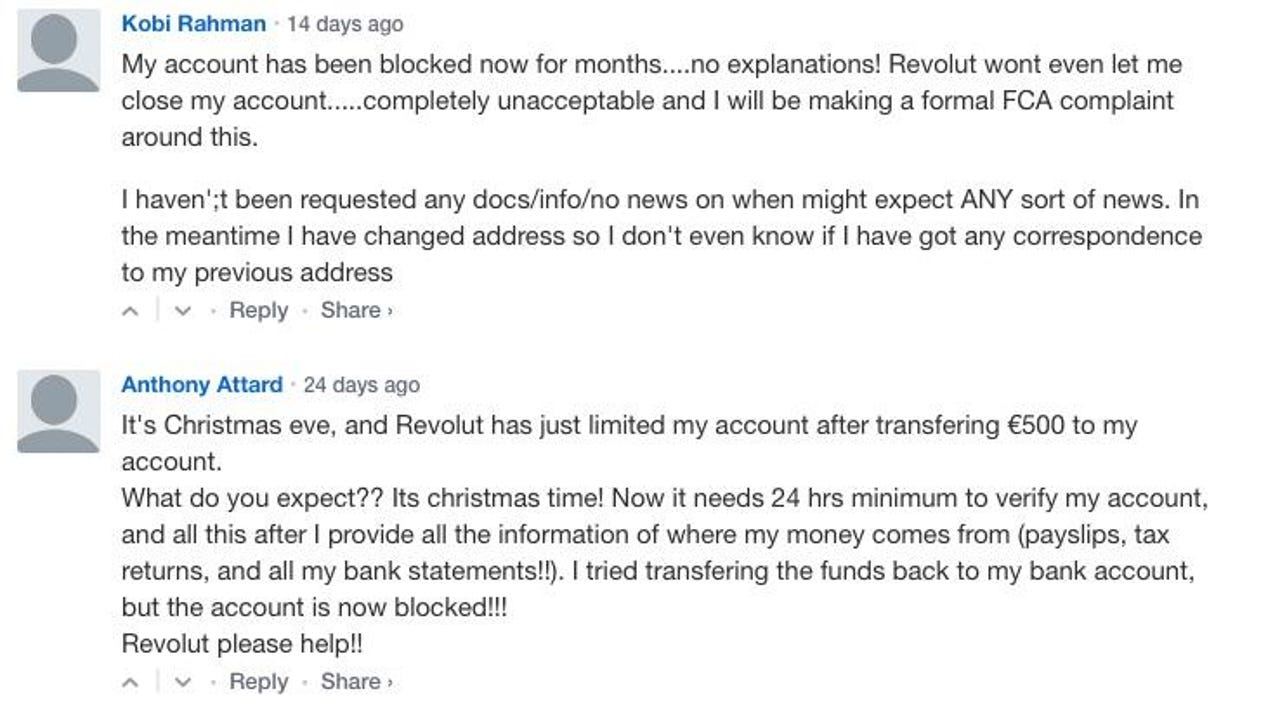

Amazingly Revolut have left dozens of angry and desperate comments (a couple of them are in the image above) on the breezy 'Why has my account been locked and how to regain access?' 'blog post' on their site, which in my opinion is more of a set of excuses than any real help to those in need. The preponderance of these anguished posts online and personal anecdotes and experiences about Revolut and other FinTech banks are why I'm writing this post, because it seems to me they have no real urgency in resolving issues which are triggered by automation, but are then processed with endless verification steps of proving who you are, sending invoices in for assessment etc etc, all at a leisurely pace and with no interest accruing on the money that is 'frozen', except to the holder.

An attempted visit to Revolut and some questions

In the specific case of Revolut - who appear to be leveraging the venerable high street bank Lloyds in the UK to underpin some of their transactions - I had sent several emails and employee LinkedIn connections last year to discuss the frozen customer money problem with no responses. Following my last ZDNet post I wrote a list of questions for Revolut and asked one of my UK assistants to hand deliver it to their offices in Canary Wharf London, which I found listed on Google Maps (along with a phone number that just goes to an automated phone tree with no ability to speak to anyone when I called).

My assistant went to the building but was unable to get past the multistory downstairs reception area, with Revolut not picking up the phone when called from downstairs. here's my feedback from my assistant:

'I went into Revolut and couldn't get past reception so I asked them to please call up and ask if i could speak to someone in person and they did. Revolut wouldn't pick up. I hung around Canary Wharf and went back in again and they said no one would come and I couldn't get up to Revolut without a scheduled meeting. So I asked could I leave the document and the reception lady said she couldn't pass it on. so I spoke to security and asked him, he said address it in an envelope and he would bring it to the courier office and it will be sent up to Revolut'.

Mysteriously my assistant noticed that when she left the envelope someone from Revolut did appear to pick up the phone when security called to tell them they had mail.

Fortunately my previous FinTech banking post did separately spur Revolut's PR and Communications manager to make contact via LinkedIn in the same timeframe, so I was able to send the questions via email.

Revolut's compliance and business teams (I'm assuming they are not more bots) responded in a reasonable 36 hour time frame and answered my follow up questions to some of their overly vague first answers within 24 hours, a much shorter timeframe than the many open ended frozen account investigation processes I was asking questions about.

Here is my Q&A dialog, edited for brevity:

Q: What are Revolut support staff levels? There appear to be huge numbers of people whose bank accounts are frozen and 'their case is being worked on'? What is the timeframe of a typical compliance procedure and what are your resolution and customer transparency policies?

Out of 3.7 million Revolut customers and 70,000 businesses, an "extremely small number" are currently under review. Revolut claim current average waiting times for support on their chat app (as of 15/01/19) are 'one minute for retail accounts and nine minutes for business accounts', but 'this can increase for accounts that are undergoing compliance checks'.

Revolut also 'have an automated phone line available for customers that need to block their card, and have support staff available to help with requests on social media'. 'Over 95% of the time, compliance reviews happen in minutes, however, sometimes this process can take longer. This usually happens because Revolut work with a wide variety of partners, which means that they sometimes need to get their perspective. As a result, this can cause delays. As such, the timeframes for compliance checks will vary on a case by case basis'.

Q: Is compliance work done offshore or onshore?

Revolut compliance work is handled in the UK and in an office in Poland with around 500 staff responsible for customer support and compliance 'who deal with queries 24/7' run solely through a smartphone or tablet application, with no physical bank branches. 'RITA', the Revolut AI support bot, 'successfully resolved over 25% of customer queries in 2018 and is constantly being improved, which allows our support agents to deal with the more serious cases'.

Revolut 'currently have one large support office and will be opening an additional support center in mainland Europe in 2019'.

Q: With Revolut's planned expansion into North America and Asia, what are your consumer guarantees for transparency around frozen accounts and resolution in those jurisdictions?

Revolut are currently amending their terms and conditions 'which will provide further transparency'. 'Due to regulatory requirements, Revolut are not always able to provide information directly to customers if their accounts are frozen. As a firm operating in the (UK) regulated sector, Revolut must also 'comply with the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 which set out detailed requirements in respect of customer due diligence and anti-money laundering'.

Revolut are working closely with regulators in new markets to ensure that they operate correctly around customer due diligence and anti-money laundering. Revolut are proactively working with the Singapore regulator to shape the upcoming Payment Services Bill, based on their 'knowledge and experience from Europe'.

Q: What guarantees and safeguards are there to Revolut customers conducting multiple international transactions that they will not suddenly have their accounts locked? Are there any guidelines and processes you expect these customers to abide by and where is that information made available to them?

'Be it from Revolut's own analysis or based on information from' partners, accounts can get locked'. The compliance system is designed to temporarily lock an account and place it in a queue until one of our compliance analysts can review the case. To unlock an account, an analyst must review each case before an account is unlocked. So, depending on the complexity of the issue, some accounts can be under review for longer than others. Only a 'compliance agent' is able to unlock a frozen account.

The Compliance team handle all the exceptions that aren't handled by Revolut's compliance system and algorithms. They also directly escalate items, so that 'a human is making the final decision' (presumably an uncontactable 'compliance agent' partner).

Revolut are unable to support some businesses, and Revolut's business terms and conditions can be found here:

Maybe I've been living under a rock…

...But it seems to me a lot of this automated compliance logic has a Kafkaesque quality when it goes wrong, compounded by a deep sense of account holder vulnerability and helplessness. I don't recall pre fintech banking being this difficult, but perhaps I just haven't been exposed to this type of compliance checking in the past. Regardless I think this is a major step in the wrong direction for the customer -- surely software as a service vendors should aspire to greater transparency and accessibility for customers and not just openly boast about the race to build the biggest platform which they can then dominate markets and people with on their terms.

Based on the worryingly open ended time frames and lack of communication from Revolut if you run foul of their algorithms it seems good advice to make sure you don't have all your eggs in one basket/one bank account in the event a portion of your money is out of action for compliance checking for months, particularly if you are running a small business.

I was tempted to post the South Park 'poof and it's gone' meme to illustrate this post but it would probably trigger a copyright issue. Nothing is easy these days…

--

Correction 21/1/2019 Revolut got in touch with me by email following publication of this article to state 'Revolut does not outsource compliance work to partners for resolution.' I have also been banned from accessing the Revolut Twitter account.