Salesforce.com delivers mixed fiscal year outlook: Earnings up, revenue light

Updated: Salesforce.com delivered a strong fiscal first quarter, but delivered a mixed outlook where it raised its earnings projections based on cost cutting yet pared its revenue forecast. Meanwhile, Salesforce.com's deferred revenue tally was lower than expected.

Salesforce.com on Thursday reported fiscal first quarter earnings of $18.4 million, or 15 cents a share, on revenue of $304.9 million, up 23 percent from a year ago. Wall Street was expecting earnings of 11 cents a share on revenue of $304.7 million.

The company (statement) said it added 3,900 new customers in the quarter to bring its total to 59,000. Meanwhile, the company raised its outlook for the second quarter and fiscal 2010. Analysts had expected a rocky first quarter. For instance, Piper Jaffray analyst Mark Murphy wrote:

We suspect business activity improved in April, offset by overall sluggish demand in February and March, and occasionally lower pricing for contract renewals.

Indeed, Salesforce.com's outlook portends some choppiness ahead. For the second quarter, Salesforce.com projected earnings of 14 cents a share to 15 cents a share with revenue of $312 million to $313 million. Wall Street was expecting earnings of 13 cents a share on revenue of $319 million.

However, Salesforce.com cut its full year revenue forecast from February. It projected revenue of $1.25 billion to $1.27 billion. Earnings will be 59 cents a share to 60 cents a share. Wall Street was expecting earnings of 55 cents a share on revenue of $1.3 billion.

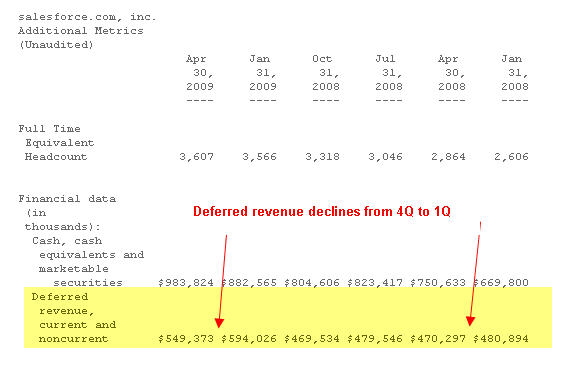

There was more at work in Salesforce.com's quarter than just the outlook. One of the more closely watched figures for Salesforce.com is its deferred revenue line. That figure for the quarter was $549.4 million, down from $594 million in the previous quarter. Wall Street was expecting deferred revenue of $565 million. Salesforce.com's fourth quarter to first quarter deferred revenue totals have become more seasonal.

Piper Jaffray analyst Mark Murphy handicapped the deferred revenue line for Salesforce.com (NYSE: CRM) ahead of the report.

The Street expectation of $565M deferred revenue represents a $30M sequential drawdown; this would represent a drawdown 3x larger than CRM has ever reported in its history. On a percentage basis, this 5% sequential drawdown would be 2.5x larger than CRM has ever reported. While a spate of very weak recent results from other SaaS vendors warrants considerable caution, and any decrease in invoicing duration could cause an adverse oscillation, we believe the bar has been set at a relatively lower level for CRM. Furthermore, whereas Q4 was an extremely difficult y/y comparison for billings growth, Q1 represents the beginning of a period of much easier y/y comparisons; in our opinion, it is not inconceivable that billings growth could accelerate above last quarter's 16% even if conditions remained challenging during Q1.

On a conference call, Salesforce.com CFO Graham Smith said the company trimmed its revenue outlook due to an uncertain IT spending environment. Smith said the company will save money by:

- Significantly paring back hiring plans;

- Cutting marketing costs, notably conferences;

- Using video conferencing instead of travel.

- Salesforce.com had first quarter revenue of $220.6 million in the Americas, up from $178.4 million a year ago. Europe revenue was $51.6 million, up from $45 million a year ago. Asia-Pacific revenue was $32.7 million, up from $24.08 million a year ago.

- The company ended the quarter with 3,607 employees, up from 3,566 in the fourth quarter.

- Cash from operations was $98 million, up from $76 million in the fourth quarter.

- Salesforce.com ended the quarter with $984 million in cash, equivalents and marketable securities.