SAPs maintenance cost sleight of hand

Last Thursday's announcement that SAP has modified its customer support offerings came just as I was boarding a plane. While I was able to hear most of the analyst call, I didn't have time to think it all through until now.

At first glance you'd be forgiven for focusing on the surrounding message that SAP has been listening to its customers and that this therefore represents a victory for customers. In one sense it is. 2010 is going to be SAP's year about 'Voice of the Customer' so for CEO Leo Apotheker, this was a good opportunity to put a stake in the ground. In reality, it is an end run for SAP maintenance issues in SAP's favor that has little downside for the company.

During the call, Apotheker said several important things:

- Customers have a choice - Standard or Enterprise Support

- Making the choice to switch from Standard to Enterprise support after 15th March automatically triggers the full 22% charge

- The KPI program, that was meant to preface justifying the introduction of cost increases is scrapped - that despite Apotheker claiming the company had proved what it set out to achieve in the first tranche of measurements

- Enterprise support cost increases are pegged for 2010

- Cost of living increases, which can be applied to standard support will be applied going forward

That would all seem to be to the good until you start crunching the numbers. Here's why:

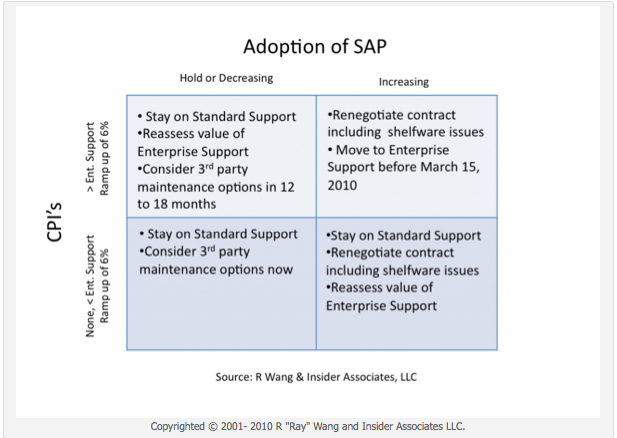

Ray Wang has produced a helpful matrix that talks to four different scenarios applying to most customers or at least those that haven't been through their contracts with a fine tooth comb. See below:

David Dobrin did the obvious thing and crunched the numbers using a hypothetical COLA (Cost Of Living Allowance) of 3%. He determined that at the 3% level, the difference between Enterprise and Standard are within 2% of each other. (See image from David's spreadsheet below) When you recrunch the numbers then Ray's 6% benchmark looks about right as the break even point at which you need to rethink carefully.

BUT - as Ray correctly points out, many contracts have a number anywhere between 0% and 5% as an additional uplift to COLA. That blows David's numbers out of the water and means that for many SAP customers, the real cost of taking Standard Support may end up above the cost for Enterprise Support. What's more, if you don't make a decision by 15th March, you automatically revert to 22% if you later decide to go with Enterprise Support. Ergo, from SAP's point of view: heads I win, tails you lose whichever decision you make.

Look back and see why I've picked out the points I regard as important. When I heard the KPIs have been dropped I couldn't immediately understand why. They were an integral part of the conditions under which SAP got its cost increase for Enterprise Support and Apotheker said the scheme had worked well. If so then why drop it? Now it makes sense. By offering a choice in the terms it is expressing and placing a one year cost moratorium, SAP no longer has to worry about KPIs. Given it has been widely rumored the next tranche of KPIs were going to be much harder for SAP to win, that's a get out of jail free card while giving customers something to assuage their angst.

Pegging the cost increase for 2010 is a good way to sugar the pill while mollifying the forward looking financial analysts. SAP can absorb any projected margin impact in 2010 by relatively small tweaks to its cost base. I'm betting that will come from R&D because SAP has already announced it will reduce that by 1% year over year through 2014. The rest will come from marketing.

The only customer cost question for those sticking with Standard will be whether SAP imposes the COLA clause. In the past, this has been an option. Recent discussions have suggested SAP tried to strong arm some customers by retrospectively applying the clause. I'm guessing that got short shrift. For me, that would be a reason to tear up the contract and start over, possibly with an eye on what third parties like Rimini can offer. However, customers are now on notice that COLA will (almost certainly) be applied by virtue of the 'going forward' addition to Apotheker's carefully crafted statement. Is this a risky strategy?

Current US inflation figures suggest that 2009 saw a deflationary trend of 0.34%. If you believe that 2010 sees a double dip then you'll likely be OK. But what about 2011 through 2016? This is the life of the current arrangements. Nobody knows for certain although there is a healthy debate suggesting that inflation will roar in the near term. If so then, COLA could end up very expensive.

Ray advises that customers should look at this issue again. He's right. While customers may well be saddled with a cost increase whether they like it or not, there is still time and room to consider what action is most appropriate. Those commentators who have said this represents a watershed and that SAP will feel further pressure may not be as right as they think although that discussion is always nuanced by a range of factors. Price pressure coming from SAAS solutions certainly filter into the equation.

By offering a choice, SAP is opening the door for customers to assess their position with a fairly clear set of alternatives in mind. That's good. Customers will be hard pressed to argue about COLA going forward but they can argue about the supplements. Whichever choice customers make I'd be surprised if many don't simply flip to Enterprise Support if for no other reason than the risks attached to figuring future likely COLA. Even so, as David correctly points out, COLA will not be evenly applied as it will be country specific and depending on where licenses are held. Whatever you decide, do NOT under any circumstances consolidate licenses because that loses you a lot of bargaining power and will almost certainly put you at a maintenance cost disadvantage. That holds true even if you are thinking of expanding your SAP solution portfolio. People in customers' CFO office will need to sharpen their pencils. David's spreadsheet is a good starting point.

SAP for its part can look at maintenance with fresh eyes and start to clarify exactly what it is that customers are getting for their Standard Support money. This is something to which David Dobrin alludes. SAP may not need exercise too much attention on this point if, as I suspect, the user base (largely) rolls over. In effectively creating a situation where you may well be better off on Enterprise Support, SAP can logically argue it is creating a simpler environment for all customers. That in turn saves money at its end. Another SAP win.

As always, the devil will be in the details of the individual negotiation, the environment in which the customer is operating, the maturity of the solution they already have and expectations going forward. But what does this mean on the ground?

SAP claims 92,000 customers. If you analyze SAP growth the last few years you'll see this has mostly come from medium sized businesses where David Dobrin's $100K ball park starting point is not unreasonable. In recent times I've met with SAP customers that bought in licenses at prices varying from $90K to $200K. The scrap of a percentage point difference here or there is an irrelevance to most of them. What matters is the practical support they receive and all are looking to Enterprise Support as their way forward. So while much of the critique has been leveled by customers using the much more expensive Business Suite, the bulk of revenue by volume will come from Business All-In-One and Business One customers.

That provides SAP with a degree of revenue insulation largely unappreciated by the market. The question for Business Suite customers is whether Solution Manager (aka SolMan) really will deliver the value customers have been sold. So far, the response has been tepid. Again, alternatives might well provide a better solution when coupled with third party maintenance, especially if your implementation is in 'steady state' or upgrades are deemed likely non-disruptive.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=63ebd03a-a7bd-4c6d-9b9d-9ea80f181808)