Sprint bloodletting: a lesson in the consequences of hubris

Involutary disconnection of loyal customers who asked too many questions, or roamed, too often. Lack of controls in place to prevent other relationship gasps. Failure to efficienly merge billing systems and retail operations after the acquisition of Nextel. Sticking with an out-of-touch CEO for too long.

And ignoring public protests over some of those same policies I'e just alluded to.

Hubris- from Random House Abridged Dictionary- excessive pride or self-confidence; arrogance.

And so it goes, that Friday, churn-addled Sprint announced pending layoffs of more than 5,000 employees, and closure of some 125 stores.

"In the fourth quarter, Sprint lost 109,000 subscribers overall and 683,000 postpaid customers -- larger than Wall Street analysts expected," noted Jeffry Bartash of MarketWatch. "Postpaid customer, who sign up for annual plans and pay at the end of each month, are considered the most valuable in the industry."

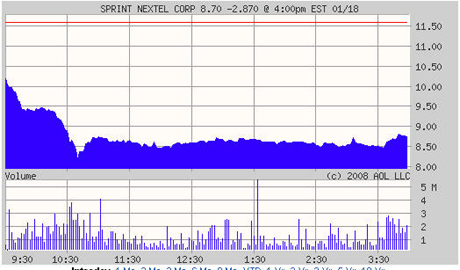

After the announcement, Sprint shares closed at $8.70 a share, down nearly 25% from the previous day's close of $11.17 a share.

And total Sprint (actually SprintNextel, but you'd never know it from the subsuming of the Nextel name) were some 230 million shares. Not sure if that's a one-day, one-company trading record, but that ultramanic level shows a lot of SprintNextel shareholders were totally freaked.

Keep in mind that as often as not, companies who announce belt-tightening measures win favor among investors.

Somehow, though, a maddening day when 229 million of your shares are traded and your stock price goes down 25% doesn't sound like the actions of a bunch of confident shareholders.