Sprint's IT, efficiency push critical amid heavy promo war

Sprint is hoping to thread the needle between cutting costs, adding customers and keeping a decent balance sheet so it can compete against wealthier rivals such as Verizon and AT&T as well as disruptive T-Mobile.

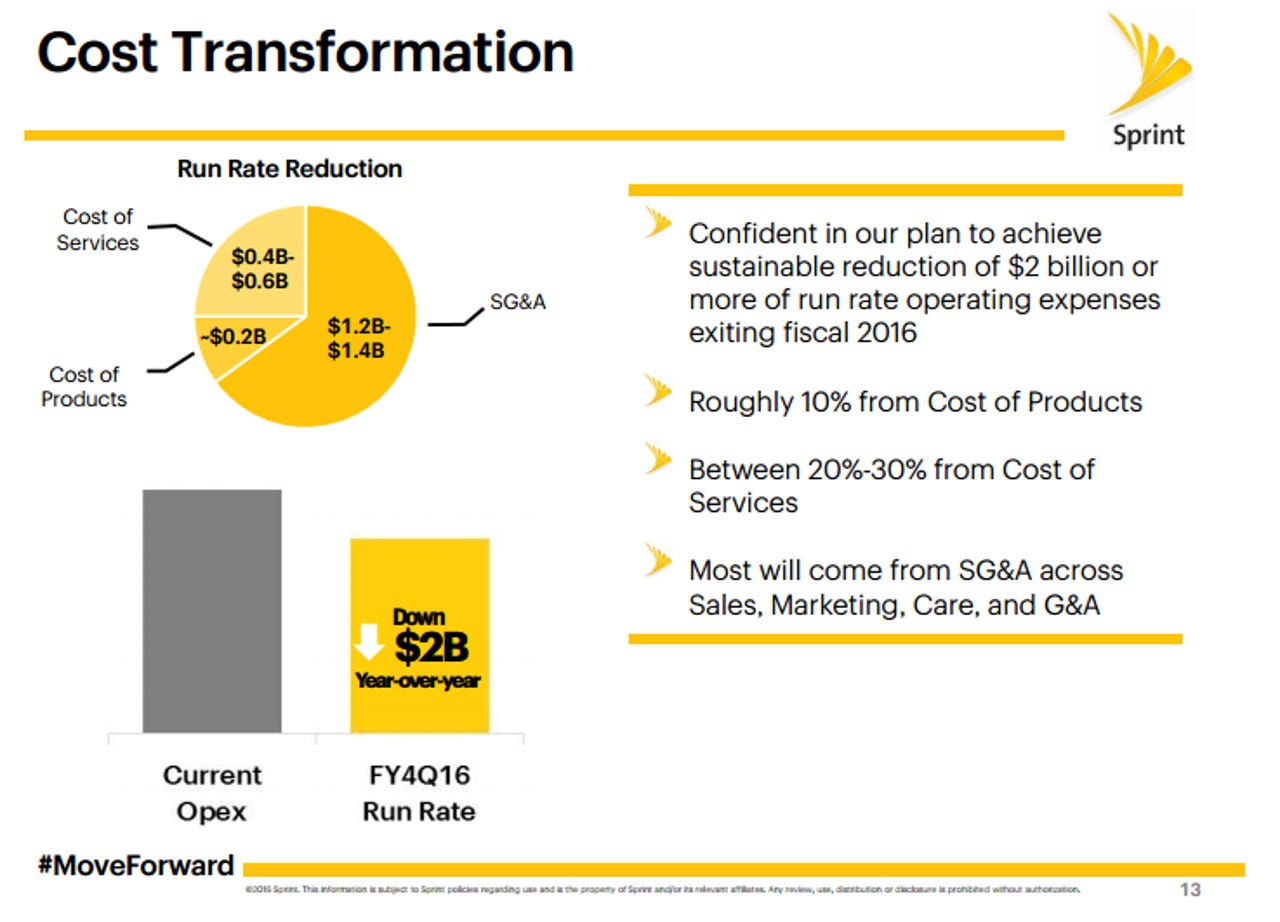

And that transformation means a good chunk of information technology heavy lifting. On a conference call, Sprint CFO Tarek Robbiati outlined how the company plans to cut its operating expenses by another $2 billion exiting the fourth quarter. These cuts are critical since Sprint doesn't have the balance sheet to improve its network and use price as a weapon to gain more subscribers. Sprint's half off promo worked well in the fiscal third quarter, but those moves aren't cheap.

Many analysts have noted that Sprint's liquidity is the most important thing for the company. While poaching customers makes for a good consumer story, Sprint has to make sure it has enough ammo to survive. Sprint ended its fiscal third quarter with cash and equivalents of $2.17 billion in cash and equivalents down from $3.45 billion a year ago. Sprint can draw on a $3 billion line of credit so has about $6 billion in liquidity. Meanwhile, long-term debt, financing and capital lease obligations were $30.43 billion, down from $32.5 billion a year ago. The current portion among those items was $3.32 billion.

Simply put, Sprint has to allay balance sheet concerns before it's a credible long-term player in the cutthroat wireless market. A big part of that equation touches IT. Robbiati said 10 percent of its 2016 cost savings will come from cost of products and logistics, 20 percent to 30 percent will derive from migrating to Internet Protocol in the wireline business and lower roaming and rent expenses. Marketing expenses will improve due to better execution. Customer care costs will fall as quality improves.

On the IT front, Robbiati said the company will "reduce hardware and software maintenance" and improve efficiency to "pave the way for significantly per reductions across all of the back-office support functions."

This efficiency push is critical since Sprint sees $5 billion in capital spending and needs to show bottom line improvement. Sprint lost $836 million, or 21 cents a share, in the third quarter on revenue of $8.1 billion, down 10 percent. Adjusting for various charges, Sprint would have lost 8 cents a share.

As for customer additions, Sprint is making progress. The company said it added 501,000 net post-paid customers and 491,000 net.